Get the free Tax Proration Agreement

Show details

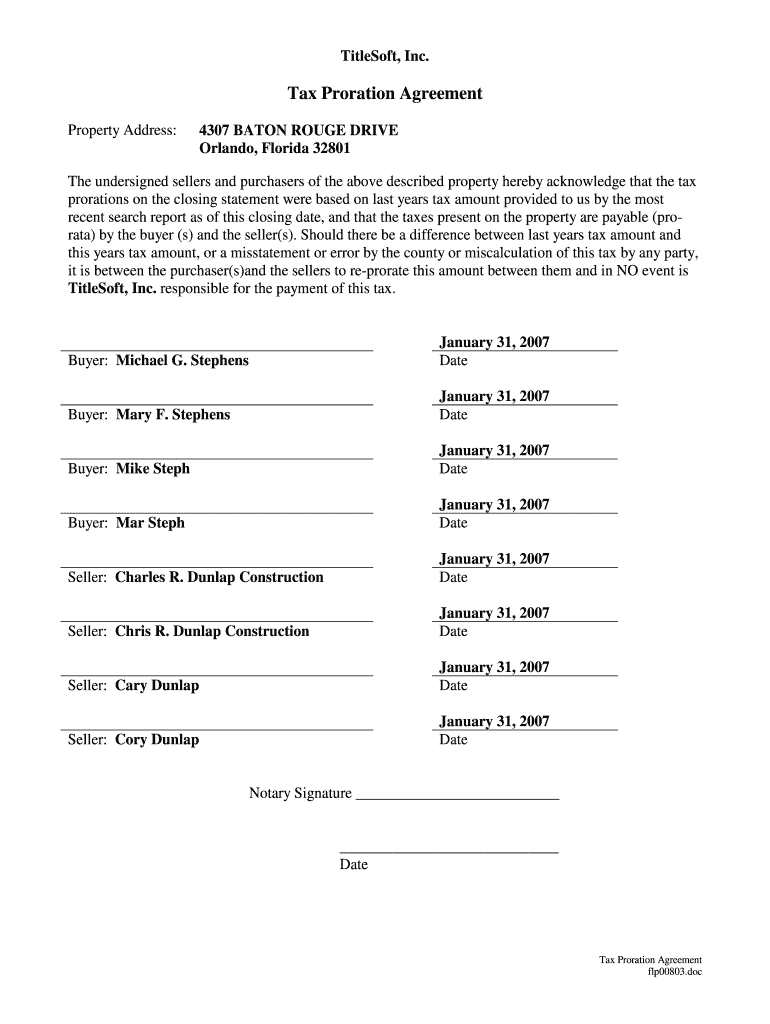

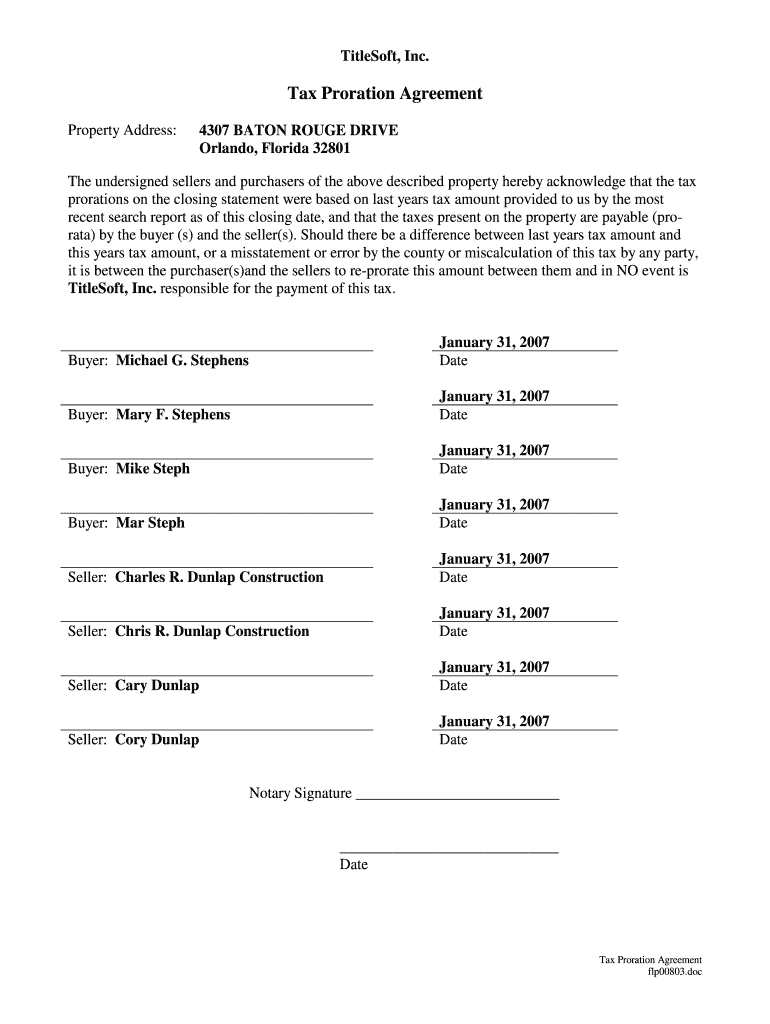

Title Soft, Inc. Tax Proration Agreement Property Address: 4307 BATON ROUGE DRIVE Orlando, Florida 32801 The undersigned sellers and purchasers of the above described property hereby acknowledge that

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax proration agreement

Edit your tax proration agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax proration agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax proration agreement online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax proration agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax proration agreement

How to fill out tax proration agreement:

01

Obtain a copy of the tax proration agreement form: Start by obtaining a copy of the tax proration agreement form, which can usually be found online or obtained from a real estate attorney or agent.

02

Fill in the basic details: Start by filling in the basic details on the form, such as the names and contact information of the parties involved, the property address, and the date of the agreement.

03

Include the proration calculation: The tax proration agreement typically involves determining how property taxes will be allocated between the buyer and the seller. Calculate the property tax proration based on the number of days each party will own or occupy the property during the tax period.

04

Specify the closing date and proration period: Indicate the closing date of the property sale and the specific proration period for which the taxes will be prorated. This period is usually from the start of the taxing year until the closing date.

05

Include any exemptions or special conditions: If there are any exemptions or special conditions that could affect the tax proration, such as a homestead exemption or an agreement to cover past-due taxes, include these provisions in the agreement.

06

Sign and date the agreement: Both the buyer and the seller should carefully read through the completed tax proration agreement. Once everyone is satisfied with the terms, sign and date the document.

Who needs tax proration agreement:

01

Homebuyers and sellers: Anyone involved in buying or selling a property would benefit from having a tax proration agreement. This agreement ensures that property taxes are allocated appropriately between the buyer and the seller, preventing any disputes or misunderstandings.

02

Real estate agents and brokers: Real estate agents and brokers often assist clients in preparing and reviewing documents related to property transactions. Having a tax proration agreement is essential for these professionals to ensure accurate and fair distribution of property taxes.

03

Attorneys and legal professionals: Attorneys and legal professionals who specialize in real estate law regularly draft and review tax proration agreements for their clients. They ensure that the agreement complies with relevant laws and protects their clients' interests.

04

Lenders and financial institutions: Lenders and financial institutions may request a tax proration agreement to understand how property taxes will be prorated during the sale of a property. This information helps them assess the financial viability of the transaction.

In summary, filling out a tax proration agreement involves obtaining the form, providing basic details, calculating the proration, specifying the closing date and proration period, including any exemptions or special conditions, and finally, signing and dating the agreement. This agreement is essential for home buyers, sellers, real estate agents, attorneys, and lenders to ensure a fair distribution of property taxes during a property transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in tax proration agreement?

The editing procedure is simple with pdfFiller. Open your tax proration agreement in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my tax proration agreement in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tax proration agreement right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit tax proration agreement on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as tax proration agreement. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is tax proration agreement?

A tax proration agreement is a legal document that specifies how property taxes will be divided between the buyer and seller of real estate at the time of sale.

Who is required to file tax proration agreement?

Both the buyer and seller of real estate are typically required to file a tax proration agreement.

How to fill out tax proration agreement?

To fill out a tax proration agreement, both parties must provide information about the property, details of the sale, and agree on how property taxes will be split.

What is the purpose of tax proration agreement?

The purpose of a tax proration agreement is to ensure that property taxes are fairly divided between the buyer and seller at the time of sale.

What information must be reported on tax proration agreement?

Information such as property address, sale price, closing date, and details of how property taxes will be prorated must be reported on a tax proration agreement.

Fill out your tax proration agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Proration Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.