Get the free 403(b) Policy Loan Request

Show details

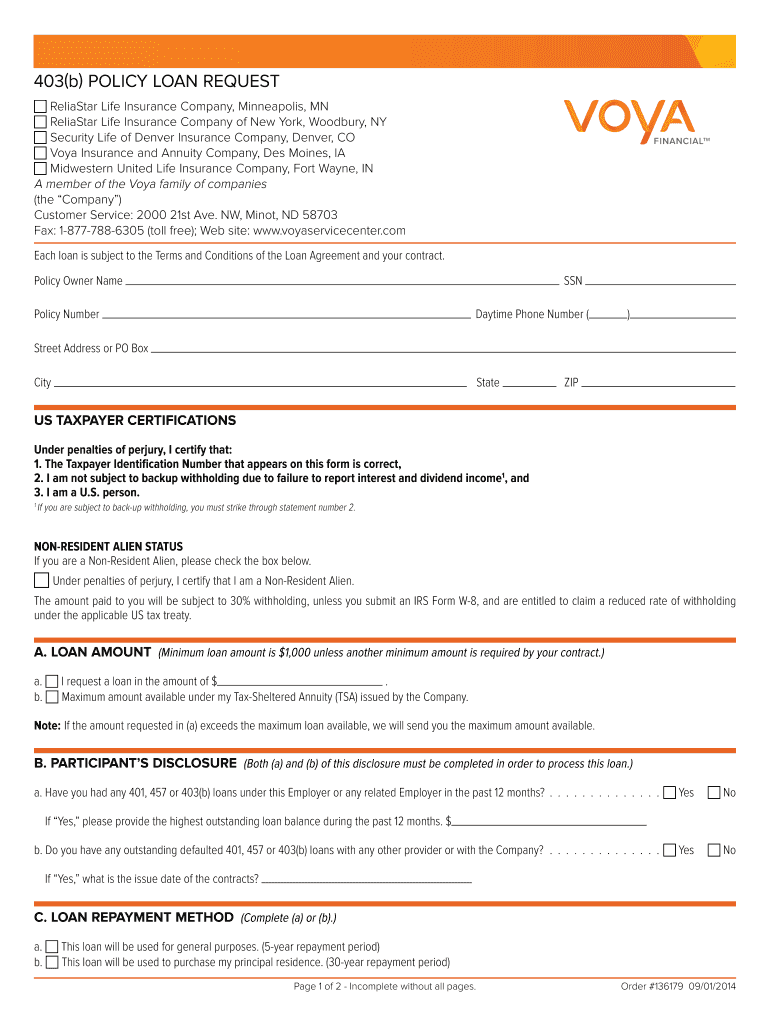

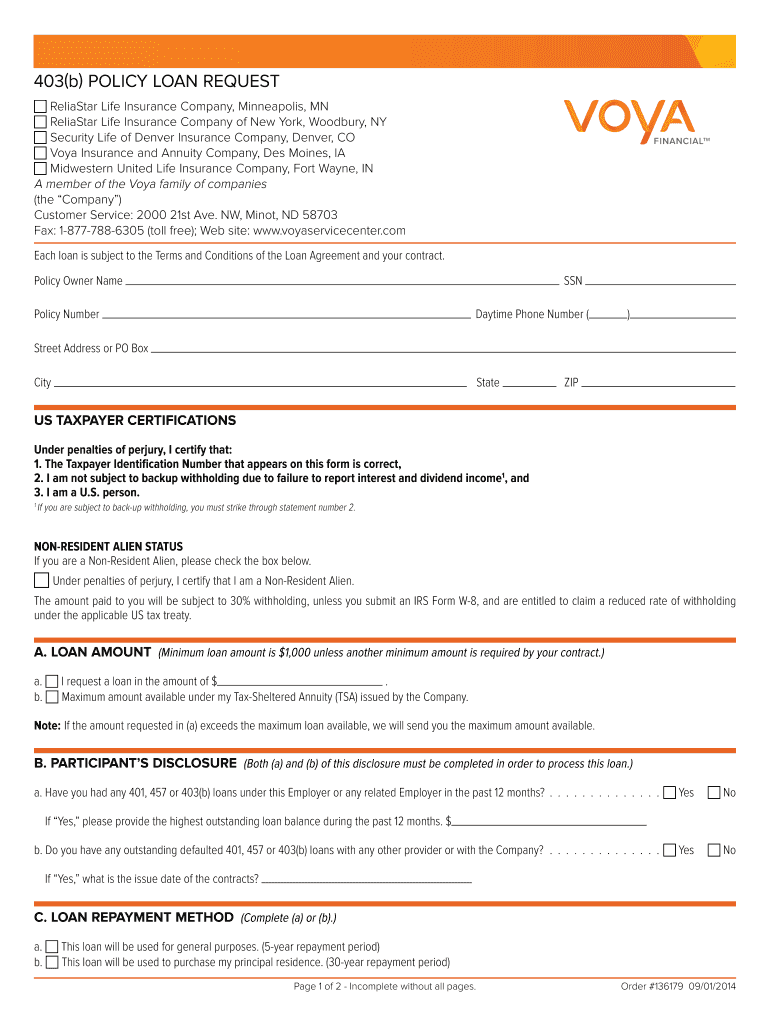

This document is a request form for a policy loan under a 403(b) plan, outlining the necessary personal information, certifications, loan amount request, repayment terms, and acknowledgments.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 403b policy loan request

Edit your 403b policy loan request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 403b policy loan request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 403b policy loan request online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 403b policy loan request. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 403b policy loan request

How to fill out 403(b) Policy Loan Request

01

Obtain the 403(b) Policy Loan Request form from your plan administrator or the financial institution managing your 403(b) account.

02

Fill out your personal information including your name, address, and account number on the form.

03

Specify the loan amount you wish to borrow, ensuring it does not exceed the maximum limit set by the plan.

04

Indicate the purpose of the loan, if required by the form.

05

Sign and date the form to acknowledge your request for a policy loan.

06

Submit the completed form to your plan administrator or the financial institution as instructed.

Who needs 403(b) Policy Loan Request?

01

Individuals who have a 403(b) retirement plan and seek to borrow against their investment.

02

Employees or educators looking for financial assistance or liquidity in times of need.

03

Participants in a 403(b) plan who are facing unexpected expenses and want to access funds without cashing out their retirement savings.

Fill

form

: Try Risk Free

People Also Ask about

How do I withdraw money from my 403b?

Current IRS regulations allow withdrawals of 403(b) monies, without penalties, when you: Reach age 59½, Retire or separate from service during the year in which you reach age 55 or later,*** Take substantially equal periodic payments, Birth or Adoption eligibility, Die or become disabled, or.

What happens if I pull out my 403b?

If you withdraw money from your 403(b) plan before age 59½, you will need to pay a 10% early withdrawal penalty in addition to the income tax you'll pay on the withdrawal.

Can I borrow from my Fidelity 403 B?

Can I borrow money from my retirement plan? A loan from a retirement plan (such as 401(k), 403(b), etc.) lets you borrow money and pay it back to yourself over time, with interest — the loan payments and interest go back into your account. Your plan rules can tell you how much you can borrow and how to pay it back.

Can I pull money out of my 403b?

403(b) account holders can withdraw funds at 59 1/2, job severance, disability, or financial hardship. Early 403(b) withdrawals may face a 10% penalty unless taken after 55 or under rule 72(t) conditions. Rollovers from a 403(b) to another retirement account avoid penalties and expand investment options.

Can I take a hardship withdrawal from my 403 B?

Some retirement plans, such as 401(k) and 403(b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, but these withdrawals must follow IRS guidelines.

Can I take money out of my 403b to pay off debt?

While using your 403(b) to pay off debt may offer short-term relief, it often comes with significant long-term consequences. The penalties, taxes and loss of compounding growth may jeopardize your future financial security.

Why can't I withdraw money from my 403b?

This conversation is a little simpler than you thought: you're probably not eligible to withdraw the money. You're not allowed to withdraw from a 403b when you're active and under 59.5, except for specific ``hardship withdrawal'' provisions. And general home maintenance/ improvement does not qualify.

What is the maximum loan amount for a 403b?

Borrowing From a 403(b) Many 403(b) plans contain a loan option governed by specific rules that allow you to borrow funds from your 403(b) plan and pay the money back over time. The loan amount can be as much as 50% of your vested account balance, or $50,000, whichever is less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 403(b) Policy Loan Request?

A 403(b) Policy Loan Request is a formal application made by a participant in a 403(b) retirement plan to borrow money against their retirement savings.

Who is required to file 403(b) Policy Loan Request?

Participants in a 403(b) retirement plan who wish to take out a loan against their account balance are required to file a 403(b) Policy Loan Request.

How to fill out 403(b) Policy Loan Request?

To fill out a 403(b) Policy Loan Request, participants typically need to provide personal information, loan amount requested, purpose of the loan, and any required signatures, sometimes along with supporting documentation.

What is the purpose of 403(b) Policy Loan Request?

The purpose of a 403(b) Policy Loan Request is to allow participants to access their retirement funds for personal use while still keeping the funds within the retirement plan.

What information must be reported on 403(b) Policy Loan Request?

The information that must be reported typically includes the participant's name, account number, loan amount requested, repayment terms, and the purpose of the loan.

Fill out your 403b policy loan request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

403b Policy Loan Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.