Get the free MATCHING GIFT FORM

Show details

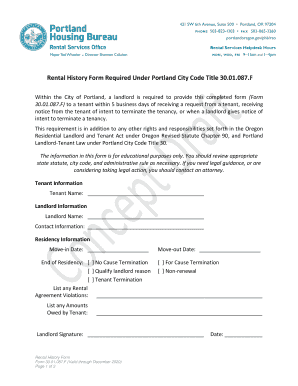

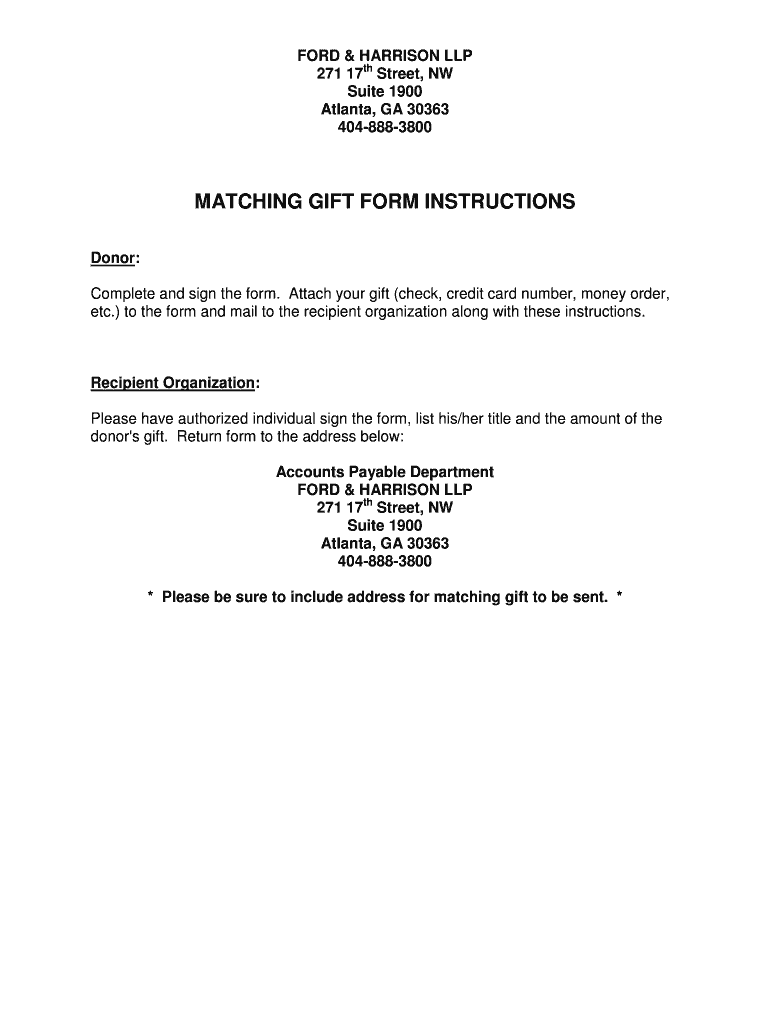

This document provides instructions for making a matching gift donation through Ford & Harrison LLP, detailing the necessary steps for donors and the recipient organization.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign matching gift form

Edit your matching gift form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your matching gift form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing matching gift form online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit matching gift form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out matching gift form

How to fill out MATCHING GIFT FORM

01

Obtain the matching gift form from your employer or the organization's website.

02

Fill in your personal information, including your name, address, and email.

03

Provide details about the donation you made, including the amount and the date of the donation.

04

Enter the name of the organization you donated to, ensuring it matches with the organization's official name.

05

Submit the completed form to your employer's HR or matching gift coordinator.

Who needs MATCHING GIFT FORM?

01

Employees of companies that offer matching gift programs.

02

Donors who want their charitable donations to have double the impact.

03

Nonprofit organizations seeking additional funding through matched donations.

Fill

form

: Try Risk Free

People Also Ask about

How to set up a matching gift program?

We'll dive into the ten essential steps involved in starting a matching gift program, which include the following: Set minimum and maximum donation amounts. Choose a matching gift ratio. Designate qualifying employee types. Determine qualifying nonprofit causes. Establish a submission request deadline.

What does gift matching mean?

What Is Donation Matching? Donation matching is a corporate giving initiative in which an employer matches their employee's contribution to a specific cause, increasing the gift. For example, if a Kindful employee donates $50 to a local organization, the matching gift would be Kindful's additional donation of $50.

What is a matching gift?

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. When an employee makes a donation, they'll request a matching gift from their employer.

What is an example of matched giving?

Matched Giving is when a partner, sponsor or charity itself, decides to match donors' donations by a set multiplier. For example, if I donated $10 to a fundraiser's page, it would be matched with another $10 donation. Therefore, the fundraiser receives $20 in donations to their page.

How to ask for a matching gift?

To find out if your employer has a matching gift policy, simply ask your HR department. It looks like my company has a matching program — how do I get my gift matched? Simply contact a Human Resources representative within your organization/company about matching. My employer doesn't have a matching gift program.

How do I announce a matching gift?

In this type of matching gift letter, you should: Confirm that you're aware of the donor's matching gift request. Highlight what your nonprofit will be able to accomplish with the matched funds. Let the donor know that you'll stay in touch until the request is complete.

What is an example of a matching challenge?

The sponsor will set a specific time frame or promise to match up to a predetermined fundraising goal. For example, the donor may pledge to match every dollar donated up to $5,000 or every dollar contributed during a 48-hour window. Either way, they're promising to double the impact of every contribution.

What is the difference between matching gift and challenge gift?

The copy for matching gift vs challenge gift used ECFA's definitions: The ECFA defines a matching gift as one that represents a gift that is contingent on the gifts of other donors to receive it, while a challenge gift represents a noncontingent gift that becomes a "challenge" for other donors to also support the same

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MATCHING GIFT FORM?

The MATCHING GIFT FORM is a document used by companies to facilitate the matching of charitable donations made by their employees to eligible nonprofit organizations.

Who is required to file MATCHING GIFT FORM?

Employees who wish to have their charitable donations matched by their employer are required to file the MATCHING GIFT FORM.

How to fill out MATCHING GIFT FORM?

To fill out the MATCHING GIFT FORM, employees typically need to provide their personal information, donation details, and the organization receiving the donation, sometimes along with a copy of the donation receipt.

What is the purpose of MATCHING GIFT FORM?

The purpose of the MATCHING GIFT FORM is to enable employers to process and verify employee donations for matching gifts, thereby encouraging philanthropic contributions.

What information must be reported on MATCHING GIFT FORM?

The MATCHING GIFT FORM generally requires information such as the employee's name, the donation amount, the recipient organization, and date of the donation.

Fill out your matching gift form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Matching Gift Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.