Get the free Florida Office of Insurance Regulation - Accident & Health Rate Change Summary

Show details

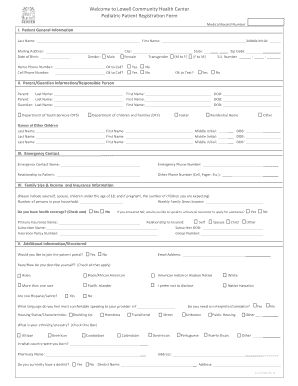

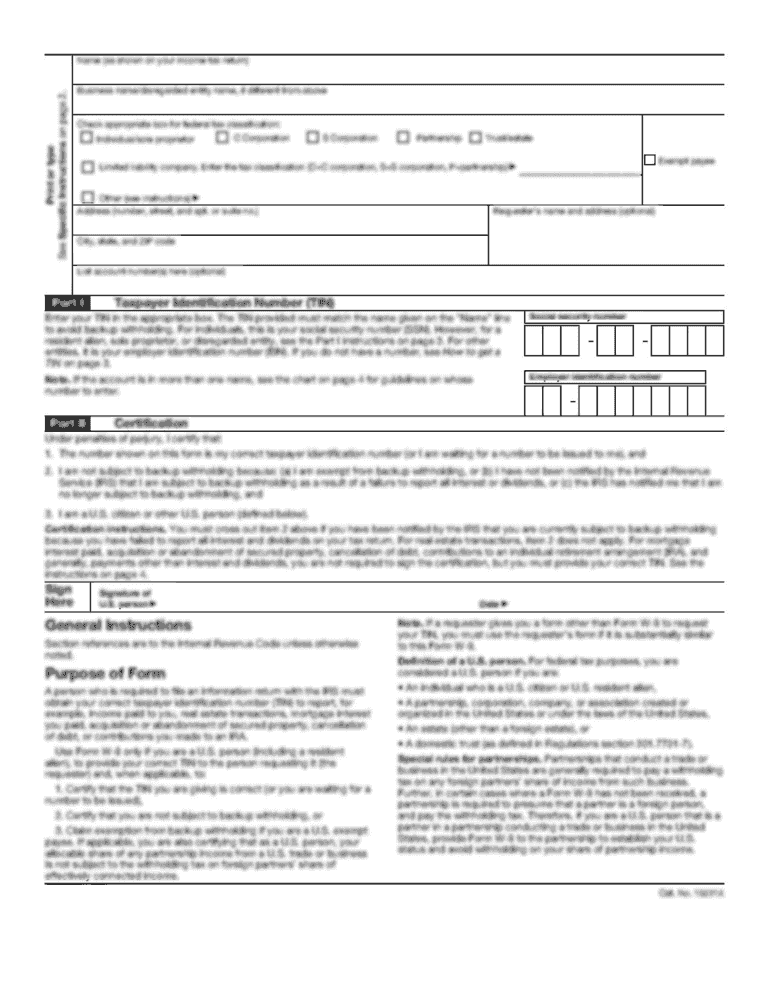

This document summarizes the approved accident and health rate changes for various health insurance plans in Florida for the calendar year 2009, including the percentage change allowed and average

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign florida office of insurance

Edit your florida office of insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your florida office of insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing florida office of insurance online

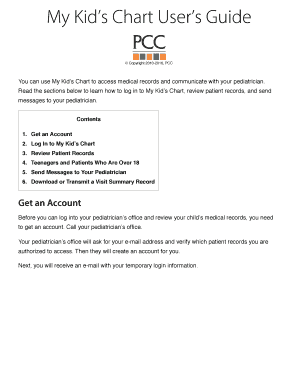

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit florida office of insurance. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out florida office of insurance

How to fill out Florida Office of Insurance Regulation - Accident & Health Rate Change Summary

01

Begin by downloading the Florida Office of Insurance Regulation - Accident & Health Rate Change Summary form from the official website.

02

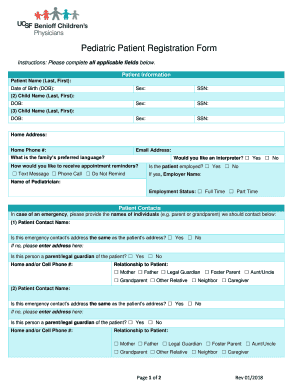

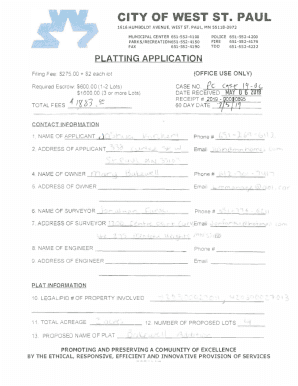

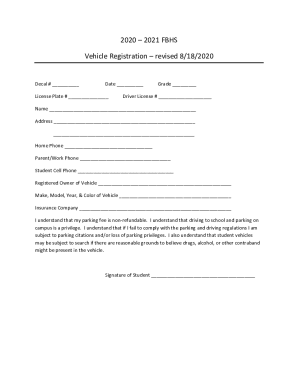

Fill in the general information section, including the insurer's name, address, and contact details.

03

Provide the relevant policy types for which the rate change is being requested.

04

Clearly state the proposed rate change percentage and provide effective dates.

05

Include a detailed explanation for the rate change, including any actuarial data or supporting documentation.

06

Review all entries for accuracy and completeness.

07

Submit the completed form along with any required attachments to the Florida Office of Insurance Regulation.

Who needs Florida Office of Insurance Regulation - Accident & Health Rate Change Summary?

01

Insurance companies operating in Florida that are seeking to change rates for accident and health insurance products.

02

Actuaries and financial analysts responsible for preparing and submitting rate change proposals.

03

Regulatory compliance officers within insurance companies who ensure adherence to Florida laws and regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the role of insurance regulatory?

IRDAI or Insurance Regulatory and Development Authority of India is the apex body that supervises and regulates the insurance sector in India. The primary purpose of IRDAI is to safeguard the interest of the policyholders and ensure the growth of insurance in the country.

What does the Florida Department of insurance do?

The state insurance department receives, researches, investigates, and resolves individual consumer complaints against insurance companies, agents and brokers.

Are car insurance rates going down in Florida?

The Florida Insurance Commissioner says auto insurance rates among the state's top insurers have dropped. State leaders say legislative reform helped drive insurance rates down. Insurance experts expect auto insurance rates to continue to decrease.

What are the duties of the Florida Office of insurance regulatory?

From licensing companies, reviewing forms and rates, monitoring insurers' financial condition, enforcing compliance, analyzing market data, and attracting insurance-related jobs and capital, OIR offers a dynamic workplace with professional development opportunities while serving Florida insurance consumers.

Who approves insurance rate increases in Florida?

Florida's Office of Insurance Regulation this week approved an average 31.5% increase in homeowner rates for Trusted Resource Underwriters Exchange – one of the largest Florida rate hikes in two years – despite questions about irregularities by the company and potential savings produced by legislative reforms.

Is homeowners insurance in Florida going down in 2025?

The projected annual cost of homeowners insurance will hit $15,460 in 2025, nearly five times the national average. Despite the high cost, Florida home insurance premiums decreased by about an average of 3% last year. In 2024, weather catastrophes were responsible for 97% of insured losses worldwide.

What does the Florida Office of insurance regulatory do?

The Florida Office of Insurance Regulation (OIR) is responsible for all activities concerning insurers and other risk bearing entities, including licensing, rates, policy forms, market conduct, claims, issuance of certificates of authority, solvency, viatical settlements, premium financing, and administrative

What is the role of the Florida Office of insurance Regulating?

The Florida Office of Insurance Regulation (OIR) is responsible for all activities concerning insurers and other risk bearing entities, including licensing, rates, policy forms, market conduct, claims, issuance of certificates of authority, solvency, viatical settlements, premium financing, and administrative

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

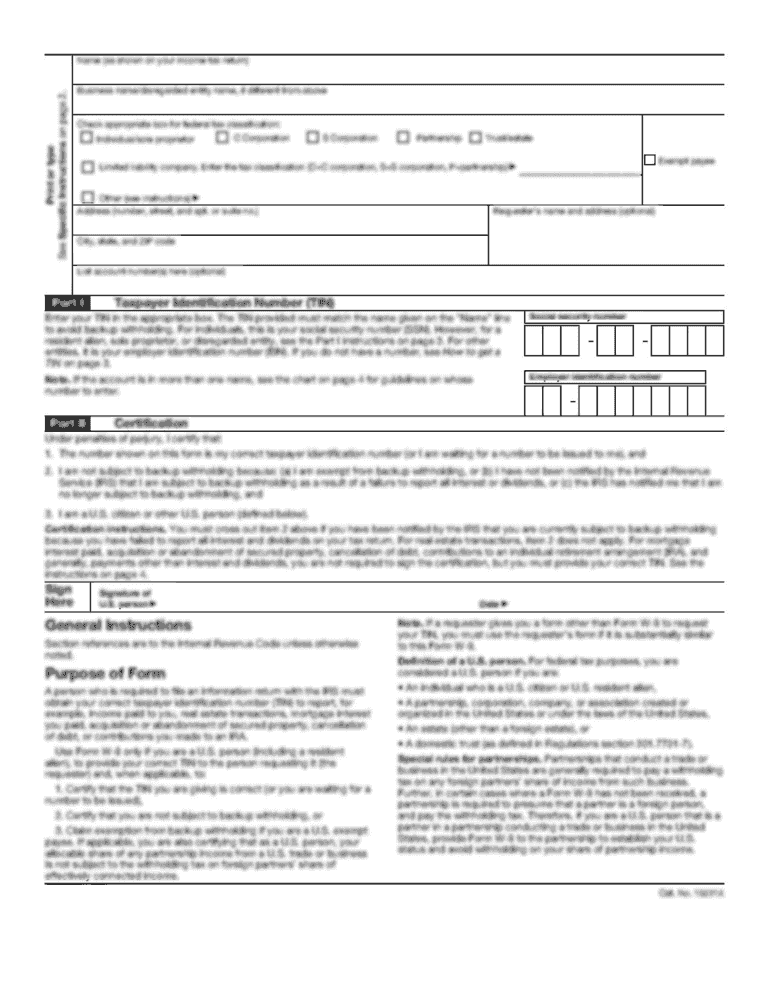

What is Florida Office of Insurance Regulation - Accident & Health Rate Change Summary?

The Florida Office of Insurance Regulation - Accident & Health Rate Change Summary is a document used by insurance companies to report proposed changes to rates for accident and health insurance plans. It provides a summary of the reasons for the rate changes and the expected impact on consumers.

Who is required to file Florida Office of Insurance Regulation - Accident & Health Rate Change Summary?

Insurance companies and health insurers that offer accident and health coverage in Florida are required to file the Florida Office of Insurance Regulation - Accident & Health Rate Change Summary when they propose to change their rates.

How to fill out Florida Office of Insurance Regulation - Accident & Health Rate Change Summary?

To fill out the Florida Office of Insurance Regulation - Accident & Health Rate Change Summary, insurers need to provide detailed information about the proposed rate changes, including the current and proposed rates, actuarial justification, information on the impact to policyholders, and supporting documentation as required by the Florida Office of Insurance Regulation.

What is the purpose of Florida Office of Insurance Regulation - Accident & Health Rate Change Summary?

The purpose of the Florida Office of Insurance Regulation - Accident & Health Rate Change Summary is to ensure transparency and accountability in the insurance rate-setting process. It allows regulators to review and evaluate the justification for rate changes, protecting consumers from excessive or unjustified premium increases.

What information must be reported on Florida Office of Insurance Regulation - Accident & Health Rate Change Summary?

The information that must be reported on the Florida Office of Insurance Regulation - Accident & Health Rate Change Summary includes the current and proposed rates, the rationale for the rate change, the expected impact on policyholders, historical data on claims and expenses, and any other supporting information required by regulatory guidelines.

Fill out your florida office of insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Florida Office Of Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.