Get the free (1) Reinvestment of dividend paid on shares held in the Director's Deferred Compensa...

Show details

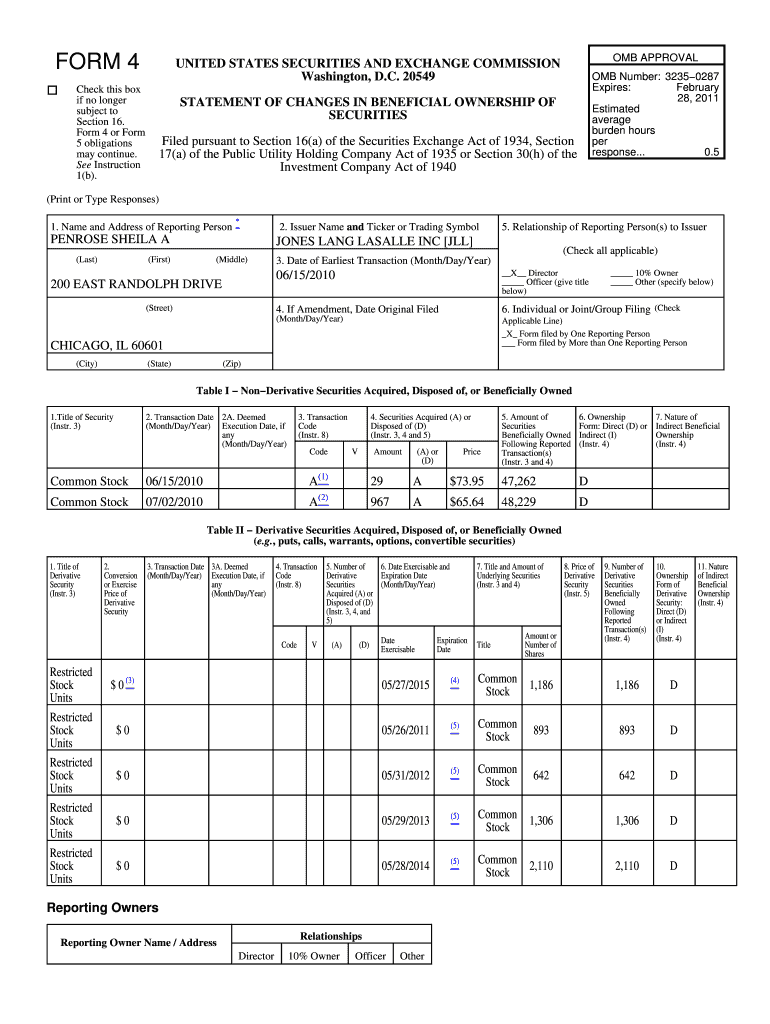

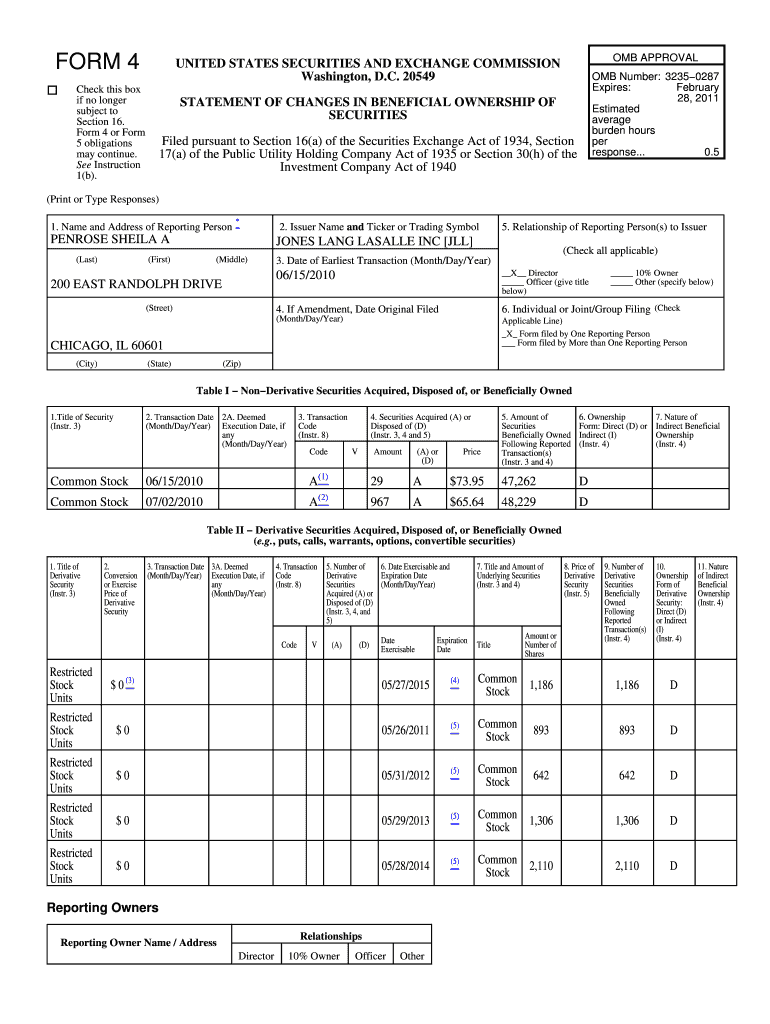

FORM 4 OMB APPROVAL UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 1 reinvestment of dividend

Edit your 1 reinvestment of dividend form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 reinvestment of dividend form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 1 reinvestment of dividend online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 1 reinvestment of dividend. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 1 reinvestment of dividend

How to fill out 1 reinvestment of dividend:

01

Determine eligibility: Check if the investment or brokerage firm offers a reinvestment program for dividends. Not all companies provide this option, so make sure it is available before proceeding.

02

Review the terms: Understand the specific rules and terms of the reinvestment program. This may include details about the minimum dividend amount required for reinvestment, any fees or charges associated with the program, and the frequency of reinvestment.

03

Complete the enrollment process: If you meet the eligibility criteria and agree to the terms, you will need to fill out an enrollment form. This form typically requires your personal information, account details, and consent to participate in the reinvestment program.

04

Specify investment preferences: In the enrollment form, you may have the opportunity to specify your investment preferences. This could include selecting specific stocks or funds in which you want to reinvest your dividends or choosing to automatically reinvest dividends across your entire investment portfolio.

05

Sign and submit the form: Once you have provided all the necessary information, review the form for accuracy, sign it, and submit it according to the instructions provided by the investment or brokerage firm.

Who needs 1 reinvestment of dividend:

01

Investors looking for long-term growth: 1 reinvestment of dividend is beneficial for investors who aim to grow their investment portfolios over time. By reinvesting dividends, they can potentially increase the number of shares or units they own, which can lead to higher capital gains in the future.

02

Individuals seeking to compound returns: Reinvesting dividends allows for the power of compounding returns. By reinvesting dividends and earning additional dividends on those reinvested amounts, investors have the opportunity to generate compounded returns and potentially accelerate the growth of their investments.

03

Investors with a dividend-focused strategy: Some investors prefer to focus on generating a steady income stream from their investments. For those pursuing a dividend-focused strategy, reinvesting dividends can be an effective way to achieve this goal, as it allows them to continuously reinvest the income generated by their investments, potentially increasing their dividend income over time.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find 1 reinvestment of dividend?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific 1 reinvestment of dividend and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make edits in 1 reinvestment of dividend without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing 1 reinvestment of dividend and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I complete 1 reinvestment of dividend on an Android device?

Use the pdfFiller mobile app and complete your 1 reinvestment of dividend and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is 1 reinvestment of dividend?

1 reinvestment of dividend is when dividends received from an investment are reinvested back into the same investment rather than being received as cash.

Who is required to file 1 reinvestment of dividend?

Investors who receive dividends and choose to reinvest them back into the same investment are required to file 1 reinvestment of dividend.

How to fill out 1 reinvestment of dividend?

To fill out 1 reinvestment of dividend, investors must report the amount of dividends received and reinvested on their tax return.

What is the purpose of 1 reinvestment of dividend?

The purpose of 1 reinvestment of dividend is to accurately report and track the reinvestment of dividends for tax purposes.

What information must be reported on 1 reinvestment of dividend?

Investors must report the amount of dividends received and reinvested, the name of the investment, and any associated tax information.

Fill out your 1 reinvestment of dividend online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

1 Reinvestment Of Dividend is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.