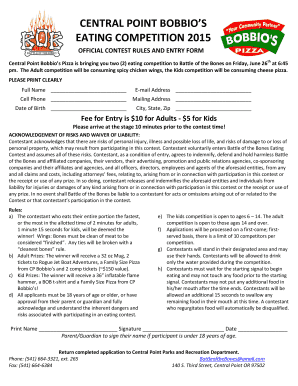

Get the free PARTIAL EXEMPTION CERTIFICATE

Show details

This document certifies that the buyer is engaged in agricultural business and is eligible for partial exemption from the state general fund portion of sales and use tax for qualified sales and purchases

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign partial exemption certificate

Edit your partial exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your partial exemption certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit partial exemption certificate online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit partial exemption certificate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out partial exemption certificate

How to fill out PARTIAL EXEMPTION CERTIFICATE

01

Obtain the Partial Exemption Certificate form from the relevant authority or website.

02

Fill out the basic information section, including your name, address, and contact information.

03

Indicate the type of exemption you are applying for from the available options.

04

Provide any necessary identification or documentation required to support your application.

05

Complete any additional sections that pertain to your specific situation or the exemption type.

06

Review the form for accuracy and completeness.

07

Sign and date the certificate where required.

08

Submit the completed certificate to the designated office or online portal.

Who needs PARTIAL EXEMPTION CERTIFICATE?

01

Individuals or businesses that qualify for a specific tax exemption or reduction.

02

Property owners who utilize the property for qualified purposes.

03

Organizations that meet the criteria set by the tax authority for partial exemption.

Fill

form

: Try Risk Free

People Also Ask about

What is partial exemption?

If a business makes both taxable and exempt supplies it is called 'partially exempt'. Consequence of partial exemption. A business that is partially exempt cannot recover input tax on purchases, costs and overheads relating to the exempt sales.

What does partially exempted mean?

Partial exemption means an exemption of part of the value of taxable property.

What is the definition of partially exempt?

Some income is partially exempt – this means it is counted at part of its value and may affect your AISH monthly living allowance. These are examples of non-exempt and partially exempt incomes: employment income such as a wages paid by an employer, a training allowance or severance pay.

How do I get a VAT exemption certificate?

How to apply Contact HMRC by telephone to request form VAT1. We'll ask you why you need the form. Tell us that you want to apply for exception from registering for VAT . We'll send you form VAT1 and form VAT5EXC. You'll need to complete both these forms and return them to us to apply for exception.

What is a partial exemption?

A business that incurs expenditure on taxable and exempt business activities is partially exempt for VAT purposes. This means that the business is required to make an apportionment between the activities using a 'partial exemption method' in order to calculate how much input tax is recoverable.

How to account for partial exemption VAT?

If your business is partly exempt and you buy goods or services that you use partly for business and partly for non-business purposes you must split the VAT accordingly. You then use your partial exemption method in paragraph 3.9 of VAT Notice 706 to work out how much of the business VAT you can reclaim.

What is the meaning of partial exemption?

A business that incurs expenditure on taxable and exempt business activities is partially exempt for VAT purposes. This means that the business is required to make an apportionment between the activities using a 'partial exemption method' in order to calculate how much input tax is recoverable.

What is an example of a partial exemption special method?

One practical example of a PESM can be demonstrated through the supplies provided by a . The provision of gaming supplies are exempt from VAT, so the VAT on the cost of any equipment that is needed to provide these supplies is irrecoverable, as these costs relate directly to the 's exempt income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PARTIAL EXEMPTION CERTIFICATE?

A Partial Exemption Certificate is a document that allows certain purchasers to buy goods or services without paying the full sales tax on their purchase, indicating that only a portion of the transaction is exempt from taxation.

Who is required to file PARTIAL EXEMPTION CERTIFICATE?

Businesses or individuals who engage in transactions that qualify for a partial sales tax exemption must file a Partial Exemption Certificate.

How to fill out PARTIAL EXEMPTION CERTIFICATE?

To fill out a Partial Exemption Certificate, you typically need to provide the purchaser's name, address, and tax identification number, along with details about the goods or services being purchased and the specific reason for the partial exemption.

What is the purpose of PARTIAL EXEMPTION CERTIFICATE?

The purpose of a Partial Exemption Certificate is to legally document the exemption status for certain portions of a sale, allowing businesses to comply with tax regulations while ensuring that they are not overcharged for tax on exempt items.

What information must be reported on PARTIAL EXEMPTION CERTIFICATE?

The information that must be reported includes the purchaser's name and address, the nature of the exempt transaction, the specific exempt items or services, the applicable exemption percentage, and the signature of the purchaser or their authorized representative.

Fill out your partial exemption certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Partial Exemption Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.