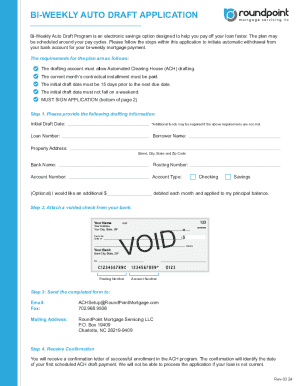

Get the free Mortgage Repayment Cover

Show details

This document outlines the details of the Mortgage Repayment Cover policy, including eligibility, benefits, claims procedures, and important information regarding the coverage for disability and involuntary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage repayment cover

Edit your mortgage repayment cover form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage repayment cover form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage repayment cover online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mortgage repayment cover. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage repayment cover

How to fill out Mortgage Repayment Cover

01

Gather all necessary personal and financial documents, including proof of income, expenses, and any existing debt.

02

Obtain the Mortgage Repayment Cover application form from your insurance provider or financial advisor.

03

Fill in your personal details accurately, including your full name, address, and contact information.

04

Provide information about your mortgage, such as the amount borrowed, interest rate, and repayment term.

05

Complete the section detailing your income sources, including salary, bonuses, and any other income streams.

06

Disclose any existing insurance cover you may have and any other financial obligations.

07

Review all provided information for accuracy and completeness.

08

Submit the application form along with any required documents to your insurance provider.

Who needs Mortgage Repayment Cover?

01

Homeowners who have taken out a mortgage and want to ensure their mortgage payments are covered in case of unforeseen circumstances.

02

Individuals who are the primary earners in their household and want to protect their family from financial stress in case of their death or disability.

03

Anyone who is concerned about job security and wants additional peace of mind regarding their mortgage repayment obligations.

Fill

form

: Try Risk Free

People Also Ask about

How much is a $500,000 mortgage payment for 30 years?

The monthly cost of a $500,000 mortgage is $3,360, assuming a 30-year loan term and a 7.10% interest rate. Over the course of a year, you would pay $40,320 in combined principal and interest payments.

How are mortgage repayments worked out?

We divide the mortgage amount and the total interest you'd pay by the number of months you want to repay the money over. We use the unrounded repayment to work out the amount of interest you'd pay over the mortgage term. We use the rate to calculate the total interest you'd pay over the mortgage term.

What's the difference between life insurance and mortgage protection?

This type of 'mortgage protection' is a life insurance policy that's designed to cover a repayment mortgage. Unlike Mortgage protection payment insurance, it pays out upon death rather than illness or injury, and only pays out once.

How does a mortgage repayment work?

Repayment mortgages mean you pay off both the capital that was lent to you and the interest accrued, in a series of monthly payments over an agreed term. Interest-only repayments are exactly what they sound like, the repayments you make each month cover only the interest accrued on the amount lent.

What happens if I pay an extra $100 a month on my 30-year mortgage?

For example, let's say you've got a 30-year mortgage of $400,000 with an interest rate of 7%. Adding an extra $100 per month could allow you to shave more than three years off your loan term, saving over $73,000 in interest.

How much is mortgage insurance?

Private mortgage insurance rates vary by credit score and other factors and typically range from 0.58% to 1.86% of the original loan amount. The total amount of PMI you'll pay until you reach 20% equity.

Do you still need mortgage insurance?

If you take out a conventional home loan with less than a 20 percent down payment, lenders often require that you purchase private mortgage insurance (PMI) as a condition of qualifying for the loan.

How much would repayments be on a $70,000 mortgage?

At the time of writing (August 2025), the average monthly repayments on a £70,000 mortgage are £409. This is based on current interest rates being around 5%, a typical mortgage term of 25 years, and opting for a capital repayment mortgage. Based on this, you would repay £122,764 by the end of your mortgage term.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Mortgage Repayment Cover?

Mortgage Repayment Cover is an insurance product designed to help borrowers cover their mortgage payments in case they experience financial difficulties, such as job loss or illness.

Who is required to file Mortgage Repayment Cover?

Typically, borrowers who have a mortgage and wish to secure additional protection against unforeseen circumstances are encouraged to file for Mortgage Repayment Cover, although it is not legally required.

How to fill out Mortgage Repayment Cover?

To fill out Mortgage Repayment Cover, borrowers should follow the instructions provided by the insurance provider, which usually includes providing personal information, mortgage details, and selecting coverage options.

What is the purpose of Mortgage Repayment Cover?

The purpose of Mortgage Repayment Cover is to provide financial security for homeowners by ensuring that their mortgage payments can be met even during difficult financial times, thereby preventing foreclosure.

What information must be reported on Mortgage Repayment Cover?

Required information typically includes personal identification, mortgage account details, income information, and any pre-existing conditions that may affect eligibility for coverage.

Fill out your mortgage repayment cover online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage Repayment Cover is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.