Get the free 2012 fall and 2013 Winter Instructional Hitting Leagues and Baseball Classes Session...

Show details

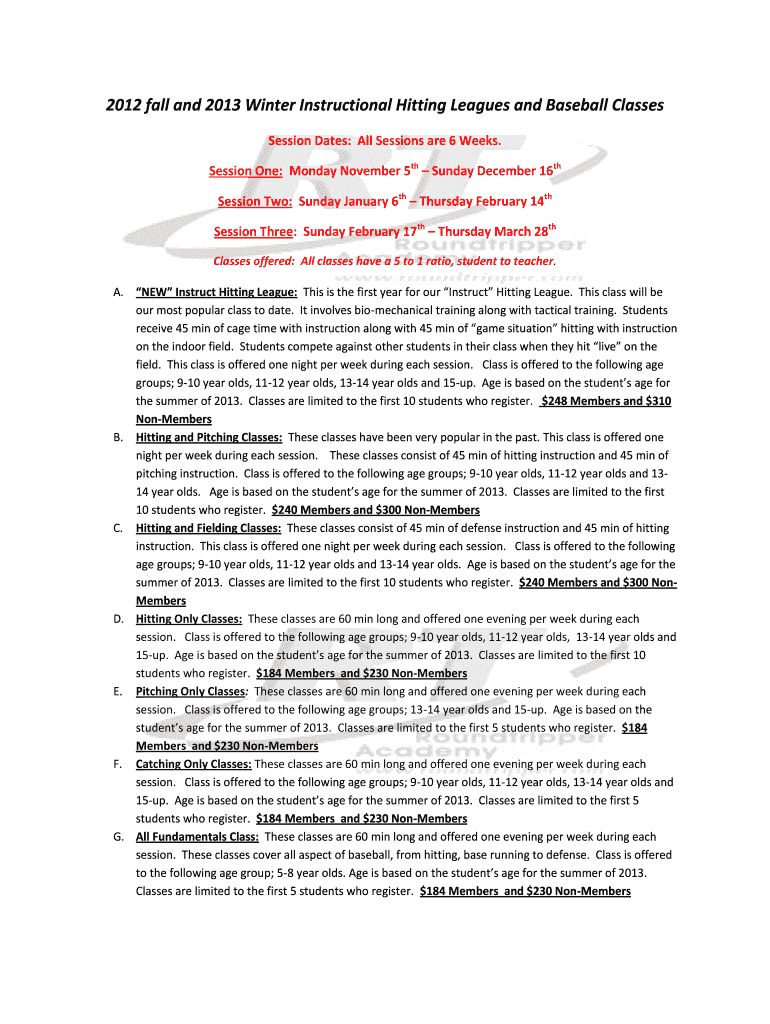

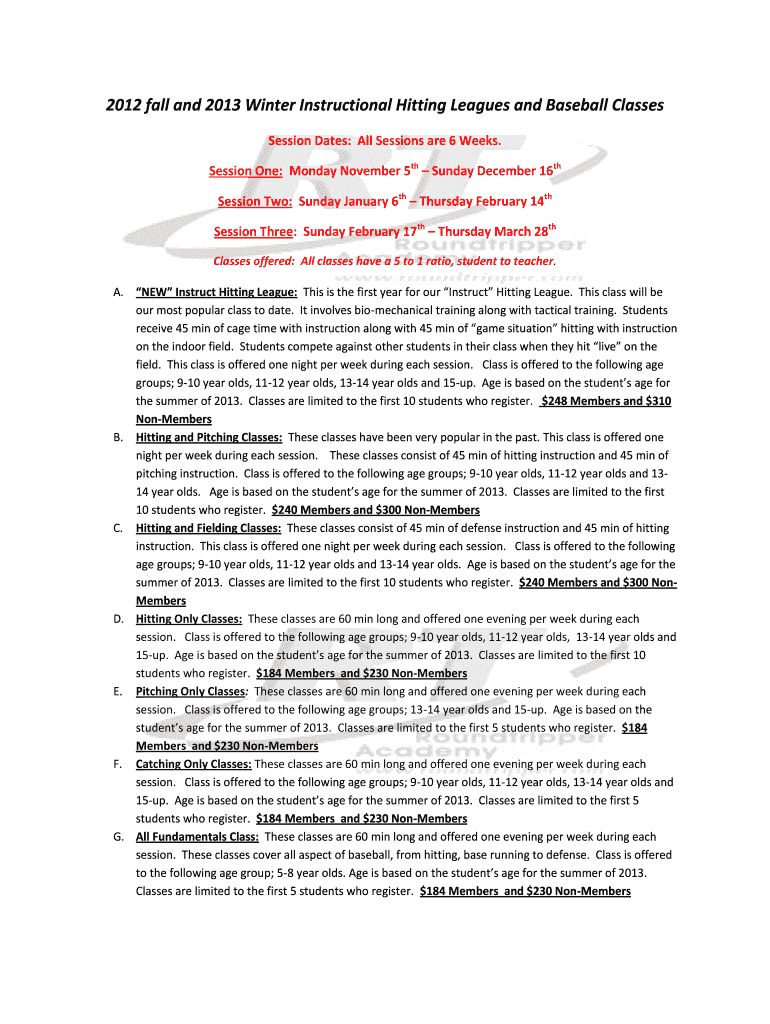

2012 fall and 2013 Winter Instructional Hitting Leagues and Baseball Classes Session Dates: All Sessions are 6 Weeks. Session One: Monday, November 5th Sunday, December 16th Session Two: Sunday, January

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 fall and 2013

Edit your 2012 fall and 2013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 fall and 2013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 fall and 2013 online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2012 fall and 2013. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 fall and 2013

How to fill out 2012 fall and 2013:

01

Gather all necessary documents and information. Make sure you have any relevant tax forms, financial statements, and personal identification documents required for the filing process.

02

Start by filling out the personal information section. Provide your full name, social security number, address, and any other required details accurately.

03

Proceed to the income section. Declare all sources of income for the specified period, including wages, salaries, rental income, business profits, and any other relevant earnings. Ensure you report all income accurately to avoid any potential issues.

04

If applicable, provide information about any deductions or credits you may be eligible for. This could include student loan interest deductions, education credits, childcare expenses, or other tax breaks. Consult the relevant IRS publications or seek professional advice if you are unsure about which deductions or credits may apply to you.

05

Double-check all the information you have entered before submitting. Pay attention to numerical accuracy and ensure all figures are reported correctly.

06

If filing electronically, review the submission process and follow the instructions provided. If filing by mail, ensure you have included all necessary attachments and that the forms are signed and dated accordingly.

07

Keep copies of all filed documents for your records, including all forms and supporting documents. These may be required for reference or in the event of an audit.

Who needs 2012 fall and 2013:

01

Individuals who earned income during the specified period and are required to file a tax return with the government.

02

Small business owners or self-employed individuals who need to report their business income and expenses for the specified years.

03

Individuals who had any specific tax situations or events in 2012 fall and 2013 that require reporting, such as having significant investment gains or losses, receiving a large inheritance, or going through a major life event like marriage, divorce, or the birth of a child.

04

Students or parents of students who need to claim education-related tax benefits for the specified period, such as the American Opportunity Credit or the Lifetime Learning Credit.

05

Individuals or families who may be eligible for certain deductions, credits, or exemptions that apply to the 2012 fall and 2013 tax years, such as the Earned Income Tax Credit or the Child Tax Credit.

06

Non-U.S. citizens or residents who earned income from a U.S. source during the specified period, and potentially need to file a U.S. tax return based on their specific tax treaty or immigration status.

It is important to note that this response provides general information and guidance. Individual circumstances may vary, and it is always advisable to consult with a tax professional or refer to the official IRS guidelines to ensure accurate and proper completion of tax forms for 2012 fall and 2013.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2012 fall and 2013 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including 2012 fall and 2013, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send 2012 fall and 2013 for eSignature?

Once your 2012 fall and 2013 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in 2012 fall and 2013?

With pdfFiller, the editing process is straightforward. Open your 2012 fall and 2013 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is fall and winter instructional?

Fall and winter instructional refers to the courses and educational activities that take place during the fall and winter seasons in an academic year.

Who is required to file fall and winter instructional?

Educational institutions and organizations that offer courses or educational programs during the fall and winter seasons are required to file fall and winter instructional reports.

How to fill out fall and winter instructional?

Fall and winter instructional reports can usually be filled out online through the educational institution's reporting system. The specific steps may vary depending on the institution's requirements.

What is the purpose of fall and winter instructional?

The purpose of fall and winter instructional reports is to track and document the educational activities and courses offered during the fall and winter seasons, ensuring compliance with academic standards and regulations.

What information must be reported on fall and winter instructional?

Information such as course names, enrollment numbers, instructor names, class schedules, and any other relevant details about the educational activities during the fall and winter seasons must be reported.

Fill out your 2012 fall and 2013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Fall And 2013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.