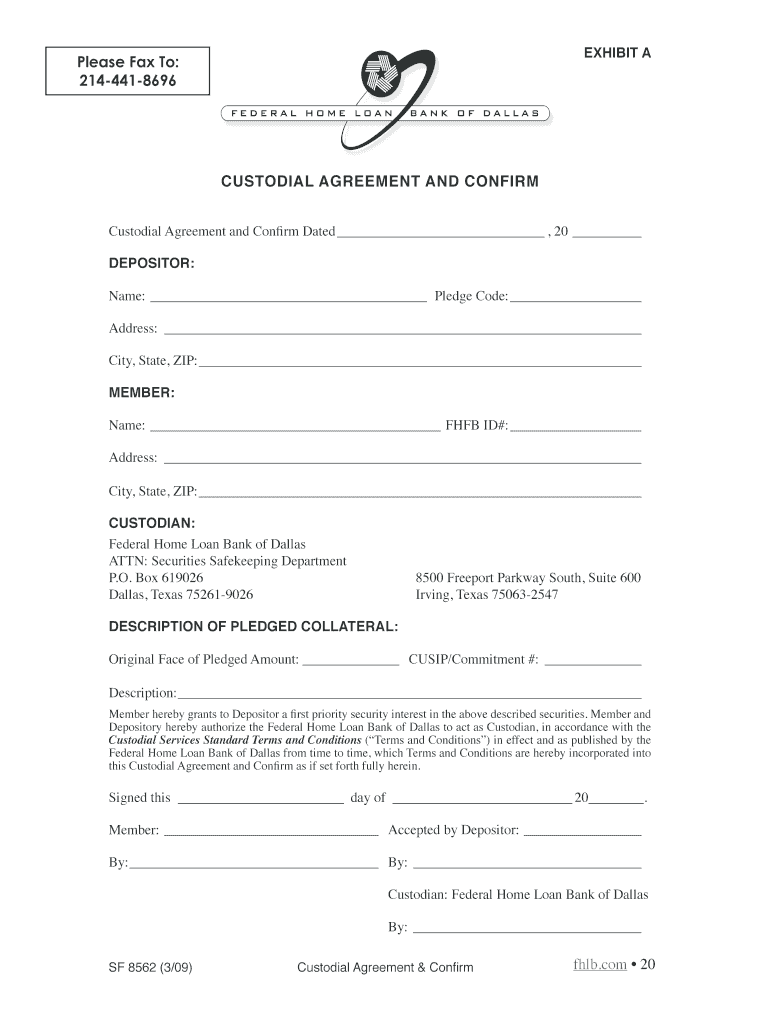

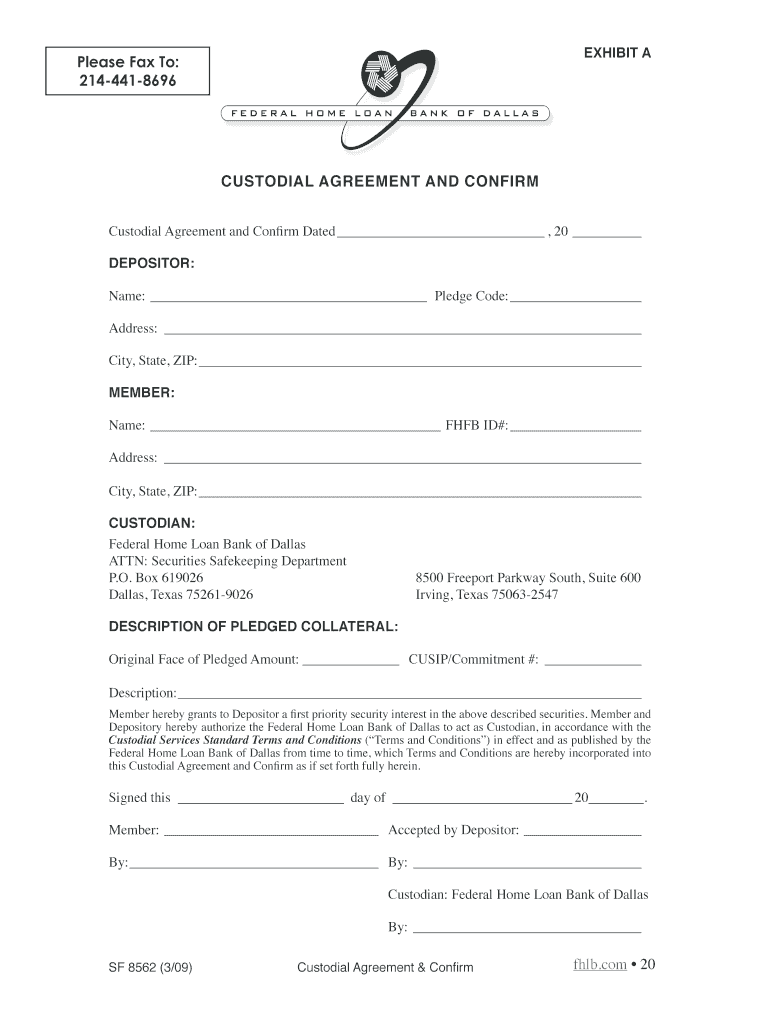

Get the free FEDERAL HOME LOAN Securities Safekeeping Guide

Show details

This document serves as a comprehensive guide on securities safekeeping services provided by the Federal Home Loan Bank of Dallas, outlining their mission, services, procedures, benefits, and relevant

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal home loan securities

Edit your federal home loan securities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal home loan securities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit federal home loan securities online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit federal home loan securities. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal home loan securities

How to fill out FEDERAL HOME LOAN Securities Safekeeping Guide

01

Obtain the FEDERAL HOME LOAN Securities Safekeeping Guide from the appropriate authority.

02

Read the introduction section to understand the purpose of the guide.

03

Review the sections on eligibility criteria for securities safekeeping.

04

Gather necessary documents and information required for filling out the application.

05

Complete the application form carefully, ensuring all fields are filled out accurately.

06

Provide any additional documentation or forms as specified in the guide.

07

Review the completed application for any errors or missing information.

08

Submit the application to the designated address mentioned in the guide.

Who needs FEDERAL HOME LOAN Securities Safekeeping Guide?

01

Financial institutions that intend to manage FEDERAL HOME LOAN Securities.

02

Investors seeking safe custody for their FEDERAL HOME LOAN Securities.

03

Entities required to comply with regulations regarding securities safekeeping.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of safekeeping?

Safekeeping, also known as safe keep, is the storage of assets or other items of value in a protected area. Many individuals choose to place financial assets in safekeeping. To do so, individuals may use self-directed methods of safekeeping or the services of a bank or brokerage firm.

What is securities safekeeping?

The safekeeping function involves the electronic storage of securities records in custody accounts, and the transfer and settlement function involves the transfer of securities between parties.

What is safekeeping a stock mean?

Definition: Safekeeping refers to the act of protecting something that is in one's custody. It can also refer to the holding of a security on behalf of the investor or broker that has paid for it, as defined by the Securities Investors Protection Act.

What is safekeeping in securities?

The safekeeping function involves the electronic storage of securities records in custody accounts, and the transfer and settlement function involves the transfer of securities between parties.

How to use securities as collateral?

Set up as a revolving line of credit, an SBLOC allows you to borrow money using securities held in your investment accounts as collateral. An SBLOC requires you to make monthly, interest-only payments, and the loan remains outstanding until you repay it.

What does safekeeping mean?

/ˌˈseɪfˌˈkipɪŋ/ Safekeeping means protecting or guarding an object. You might put a batch of cupcakes on top of the refrigerator for safekeeping, hoping to keep them safe from your hungry roommates until after dinner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FEDERAL HOME LOAN Securities Safekeeping Guide?

The FEDERAL HOME LOAN Securities Safekeeping Guide is a document that provides instructions and guidelines for the safekeeping, reporting, and management of Federal Home Loan Bank securities.

Who is required to file FEDERAL HOME LOAN Securities Safekeeping Guide?

Entities that hold Federal Home Loan Bank securities, including financial institutions and other qualified organizations, are required to file the FEDERAL HOME LOAN Securities Safekeeping Guide.

How to fill out FEDERAL HOME LOAN Securities Safekeeping Guide?

To fill out the FEDERAL HOME LOAN Securities Safekeeping Guide, individuals or institutions must provide accurate information regarding the securities held, including details such as security identification numbers, amounts, and custody information.

What is the purpose of FEDERAL HOME LOAN Securities Safekeeping Guide?

The purpose of the FEDERAL HOME LOAN Securities Safekeeping Guide is to ensure that securities are properly safeguarded, facilitate reporting compliance, and promote transparency in the handling of these financial instruments.

What information must be reported on FEDERAL HOME LOAN Securities Safekeeping Guide?

The information that must be reported on the FEDERAL HOME LOAN Securities Safekeeping Guide includes details of the securities held, including type, quantity, unique identifiers, and any changes in status or ownership.

Fill out your federal home loan securities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Home Loan Securities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.