Get the free Vendor’s Lien Release

Show details

This document serves as a legal release of a vendor's lien, upon the full payment of a related note. It involves parties of the first and second parts and includes notary certification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign vendors lien release

Edit your vendors lien release form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your vendors lien release form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit vendors lien release online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit vendors lien release. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out vendors lien release

How to fill out Vendor’s Lien Release

01

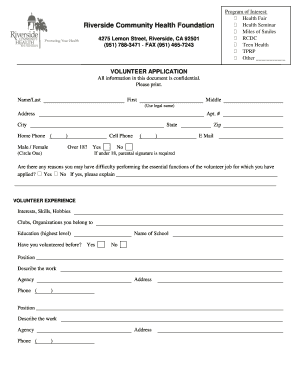

Begin by obtaining the Vendor's Lien Release form from your local county clerk's office or online.

02

Fill in the name and address of the lienholder (the vendor) in the appropriate section of the form.

03

Provide the name and address of the property owner who is releasing the lien.

04

Include a description of the property associated with the lien, such as the address and legal description.

05

State the date the original lien was recorded in the appropriate section.

06

Sign and date the form in the presence of a notary public to ensure authenticity.

07

Submit the completed and notarized form to the county recorder's office where the original lien was filed to officially release it.

Who needs Vendor’s Lien Release?

01

Property sellers who have previously placed a lien on their property.

02

Buyers who may need proof that a vendor's lien has been removed before purchasing a property.

03

Real estate professionals involved in transactions requiring a clear title.

Fill

form

: Try Risk Free

People Also Ask about

What is the process called release of the lien?

In comparison, a lien release (also known as release of lien, cancellation of lien, or a lien cancellation) would come into play after the filing of a lien. The subcontractor would utilize a lien release, resulting in the cancellation of any lien claims, after he or she receives payment.

How to get lien amount released?

Clear Outstanding Dues – If the lien is due to unpaid EMIs, credit card dues, or overdraft issues, settle the pending amount. Submit Required Documents – If the lien is for tax or legal reasons, provide the necessary clearance certificates.

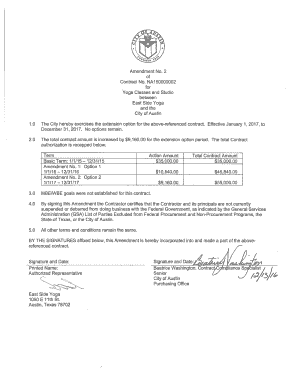

What is the purpose of a vendor's lien in Texas?

The lien that is reserved by the Seller is known as a “Vendor's Lien.” A Warranty Deed with Vendor's Lien transfers title to the real estate property but the property is subjected to a lien for the unpaid purchase price. Again, it is part of a seller finance package of documents.

Who signs a release of lien in Texas?

The document is usually called a Release of Lien, Lien Release, or a Deed of Reconveyance. It can be prepared by the owner or the Lien Claimant, but it must be signed by the Lien Claimant in front of a notary public and filed in the property records in the county where the property is located.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Vendor’s Lien Release?

A Vendor's Lien Release is a legal document that confirms the release of a vendor's lien on a property, indicating that the debt has been satisfied.

Who is required to file Vendor’s Lien Release?

The seller or vendor who originally placed the lien on the property is typically required to file the Vendor's Lien Release.

How to fill out Vendor’s Lien Release?

To fill out a Vendor's Lien Release, include the property details, the amount of the lien paid, the parties involved, and signatures of the vendor and any witnesses as required by state law.

What is the purpose of Vendor’s Lien Release?

The purpose of a Vendor's Lien Release is to officially document that the vendor's claim on the property has been cleared, allowing for the transfer of clear title to the buyer.

What information must be reported on Vendor’s Lien Release?

Key information that must be reported on a Vendor's Lien Release includes the names of the involved parties, the legal description of the property, the original lien amount, payment confirmation, and the date of the release.

Fill out your vendors lien release online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Vendors Lien Release is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.