Get the free Importing Personal Property Into Trinidad & Tobago

Show details

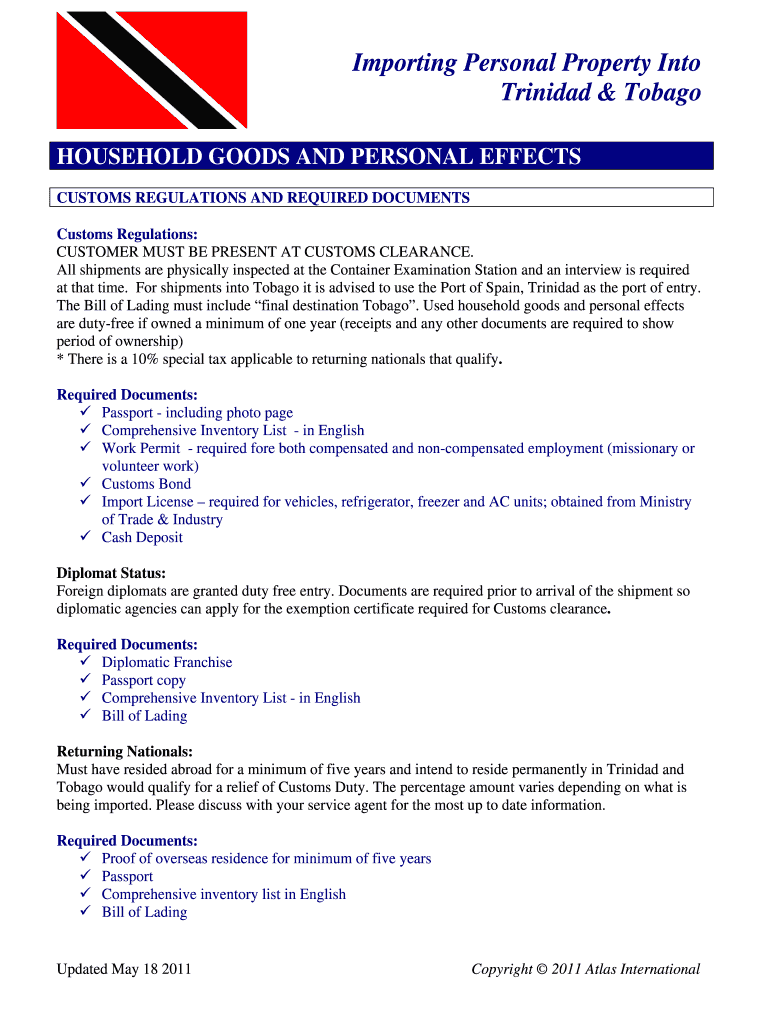

This document provides detailed information on customs regulations and required documents for importing household goods and personal effects into Trinidad and Tobago, including procedures for diplomats

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign importing personal property into

Edit your importing personal property into form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your importing personal property into form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit importing personal property into online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit importing personal property into. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out importing personal property into

How to fill out Importing Personal Property Into Trinidad & Tobago

01

Obtain the necessary import forms from the Trinidad and Tobago Customs and Excise Division.

02

Gather required documents such as proof of ownership, valid identification, and a detailed inventory of the items being imported.

03

Complete the import forms accurately, ensuring that all information matches the documents provided.

04

Submit the completed forms along with the required documents to the Customs and Excise Division for review.

05

Pay any applicable duties or taxes associated with the importation of personal property.

06

Schedule an appointment for an inspection of the items if required by Customs.

07

Receive clearance from Customs once all requirements are satisfied.

Who needs Importing Personal Property Into Trinidad & Tobago?

01

Individuals moving to Trinidad and Tobago who wish to bring their personal belongings.

02

Returning residents who are relocating back to Trinidad and Tobago after living abroad.

03

Foreigners who are relocating to Trinidad and Tobago for work or personal reasons.

Fill

form

: Try Risk Free

People Also Ask about

What items are restricted to import in Trinidad?

Perishable foodstuff. Explosives: including ammunitions, firearms, fireworks, blasting caps, igniters, fuses, flares and caps for toy firearms. Poisons including drugs and medicine, except samples of poisons and drugs and medicines in prescription quantities when packed and transmitted in the prescribed manner.

What is a prohibited import?

Prohibited Imports/Exports are goods which are, by their nature, unlawful to be imported or exported. These goods are otherwise called as “contrabands”.

How much is import duty in Trinidad and Tobago?

Calculation of duty for parcels to Trinidad and Tobago: Duty rates average between 20% and 30% and calculated on the landed cost (as explained above). Although duty rates vary by commodity and subject to change, most consumer commodities (including electronics and clothing) are subject to a 20% duty plus Vat (12.5%).

How to import goods to Trinidad?

How do I import goods? Fill out a Customs Declaration Form (C82 Form) in four copies. Submit the C82 Form with the documents listed in the section below to a Customs Officer at a Customs and Excise office. Take the C82 Form and the Assessment to the Customs' cashier and pay all outstanding taxes and duties.

Can you bring cheese to Trinidad?

Dairy products such as ice cream, milk, yogurt, cheese, and milk powder that have been legally imported from countries approved by the Ministry of Food Production*, that are free for sale in the United States, and that have not been processed in the United States may be certified for export to Trinidad and Tobago.

What are the import restrictions?

Restriction on importation refers to measures, normally adopted by governments, which restrict the ability of firms to enter foreign markets via imports. The most common restrictions are tariffs, quotas and voluntary export restraints. Tariffs serve to tax imports, thus making them expensive relative to domestic goods.

What is not allowed in Trinidad and Tobago?

Perishable foodstuff. Explosives: including ammunitions, firearms, fireworks, blasting caps, igniters, fuses, flares and caps for toy firearms. Poisons including drugs and medicine, except samples of poisons and drugs and medicines in prescription quantities when packed and transmitted in the prescribed manner.

How do I get an import permit in Trinidad?

An import licence must be obtained from the Trade Licence Unit of the Ministry of Trade and Industry, PRIOR to the shipment of any item on the import negative list to Trinidad and Tobago. Failure to do so may result in fines or forfeiture of goods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Importing Personal Property Into Trinidad & Tobago?

Importing Personal Property Into Trinidad & Tobago refers to the process of bringing personal belongings, such as household goods, vehicles, and personal effects, into the country for personal use.

Who is required to file Importing Personal Property Into Trinidad & Tobago?

Individuals relocating to Trinidad & Tobago or returning residents bringing their personal property are required to file for Importing Personal Property.

How to fill out Importing Personal Property Into Trinidad & Tobago?

To fill out the Importing Personal Property documentation, individuals must complete the required forms, listing their personal effects, including detailed descriptions and values, and submit them to the Customs and Excise Division.

What is the purpose of Importing Personal Property Into Trinidad & Tobago?

The purpose of Importing Personal Property Into Trinidad & Tobago is to allow individuals to bring their personal belongings for personal use with appropriate customs regulations and potentially exempt them from duties.

What information must be reported on Importing Personal Property Into Trinidad & Tobago?

Information that must be reported includes a detailed inventory of the items being imported, their value, the intent of use, and any applicable receipts or documents proving ownership.

Fill out your importing personal property into online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Importing Personal Property Into is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.