Get the free Importing Personal Property Into Bahamas

Show details

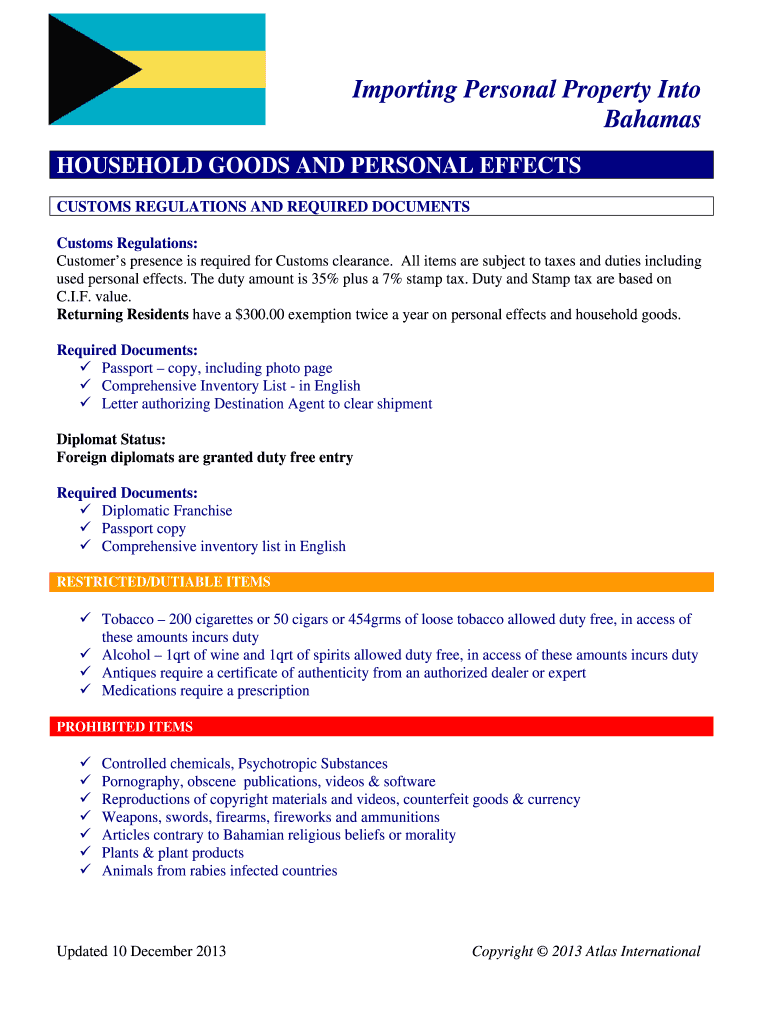

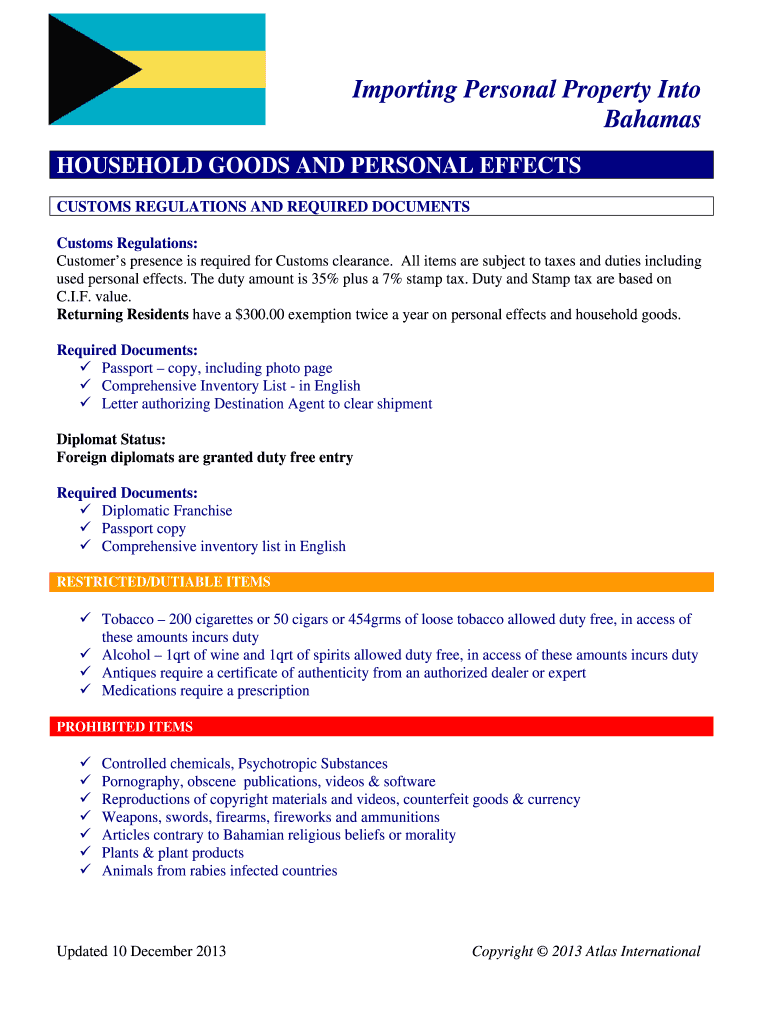

This document outlines the customs regulations, required documents, and restrictions for importing personal property, vehicles, and pets into the Bahamas.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign importing personal property into

Edit your importing personal property into form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your importing personal property into form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit importing personal property into online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit importing personal property into. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out importing personal property into

How to fill out Importing Personal Property Into Bahamas

01

Gather all necessary documentation, including proof of ownership, invoices, and personal identification.

02

Complete the Bahamian Customs Declaration Form (C-13) for importing personal property.

03

Ensure items are eligible for duty exemption, such as household goods and personal effects.

04

List all items accurately, including descriptions, quantities, and values.

05

Submit the completed forms and documentation to the customs office upon arrival in The Bahamas.

06

Pay any applicable duties and fees, if required.

07

Schedule and conduct a customs inspection if necessary.

Who needs Importing Personal Property Into Bahamas?

01

Individuals relocating to The Bahamas.

02

People returning to The Bahamas with personal effects.

03

Residents who wish to bring in non-commercial personal property.

Fill

form

: Try Risk Free

People Also Ask about

What are the car import rules in The Bahamas?

Bahamas Immigration requires the following: PERMITS & FEES - $150 per vessel 30' and under; $300 per vessel 31' and above includes clearance, cruising permit and fishing fee for up to three people; $25 per additional person. Fees are valid for two entries within a 90-day period.

What is the minimum amount for Customs?

If your goods have an intrinsic value (the value of the goods alone excluding transport, insurance and handling charges) of less than €150, you will not have to pay Customs Duty.

How much does it cost to clear customs in The Bahamas?

The primary requirements of importing into or exporting from the Bahamas are proof of authorization for processing, proof of value of the goods (Invoices or receipts)and proof of freight charges (Bill of Lading or Freight Invoice) along with the relevant Customs documentations for declarations, depending on the purpose

How is Customs duty calculated in The Bahamas?

Calculating Duty In The Bahamas Calculating the duty specifically for an item is straight-forward. You take the value of the item and multiply it by the duty rate. For example, if you're importing a TV valued at $500. Using the current duty rate for TVs of 35%, the duty would be $500 x 35% which equals $175.

How much is customs exemption in The Bahamas for Bahamians?

Residents are allowed an exemption of $500.00 exemption, twice in each calendar year on any dutiable article. This exemption is not cumulative and is not transferable to any other person on items brought into the country that is not intended for sale or business purposes. This does not relate to goods shipped as cargo.

How much is Customs exemption in The Bahamas?

INTERNATIONAL VISITORS All valid receipts for declared items are required. All visitors to the Bahamas are entitled to an exemption of $100.00 on any dutiable article being brought into the Bahamas. Any value in excess of this, the necessary custom duties and taxes will be applicable.

How much does it cost to clear Customs in The Bahamas?

Bahamas Immigration requires the following: PERMITS & FEES - $150 per vessel 30' and under; $300 per vessel 31' and above includes clearance, cruising permit and fishing fee for up to three people; $25 per additional person. Fees are valid for two entries within a 90-day period.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Importing Personal Property Into Bahamas?

Importing Personal Property Into Bahamas refers to the process of bringing personal belongings, such as household goods and personal items, into the Bahamas from another country for personal use.

Who is required to file Importing Personal Property Into Bahamas?

Individuals who are relocating to the Bahamas or bringing personal items for long-term use are required to file for Importing Personal Property.

How to fill out Importing Personal Property Into Bahamas?

To fill out the Importing Personal Property form, individuals must provide accurate details regarding their personal items, value, and the purpose of the import, typically through the customs declaration form provided by the Bahamian customs authorities.

What is the purpose of Importing Personal Property Into Bahamas?

The purpose of importing personal property into the Bahamas is to allow individuals to bring their necessary belongings for personal use as they move or travel to the country.

What information must be reported on Importing Personal Property Into Bahamas?

Information that must be reported includes a detailed inventory of the personal items, their estimated value, the purpose of importation, and any other relevant customs information as required by Bahamian authorities.

Fill out your importing personal property into online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Importing Personal Property Into is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.