Get the free Importing Personal Property Into Singapore

Show details

This document outlines the customs regulations and required documents for importing household goods and personal effects into Singapore, including specifics on duty exemptions, restrictions on certain

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign importing personal property into

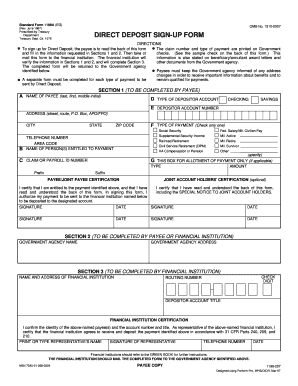

Edit your importing personal property into form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your importing personal property into form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit importing personal property into online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit importing personal property into. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out importing personal property into

How to fill out Importing Personal Property Into Singapore

01

Determine which personal items you want to import.

02

Check if the items are allowed for import into Singapore with the relevant authorities.

03

Prepare a detailed inventory list of all items being imported.

04

Ensure that all items are decluttered, clean, and in good condition.

05

Obtain necessary permits if required for items like vehicles or specific controlled goods.

06

Arrange for transportation and choose a reliable shipping company experienced in international moves.

07

Complete the Customs Declaration Form (Form C) and submit it along with your inventory list to Singapore Customs.

08

Pay any applicable duties and taxes on the imported items based on their declared value.

09

Provide additional documentation if needed, such as receipts or proof of ownership.

10

Wait for customs clearance and follow up with the shipping company to receive your items.

Who needs Importing Personal Property Into Singapore?

01

Individuals relocating to Singapore for work or personal reasons.

02

Non-residents moving to Singapore for an extended stay.

03

Returning Singapore citizens or permanent residents bringing back personal belongings.

04

Students studying in Singapore who wish to bring their personal items.

Fill

form

: Try Risk Free

People Also Ask about

What needs to be declared through customs?

Gifts and Merchandise: If you purchased items intended as gifts or merchandise, these must be declared. If you exceed the duty-free allowance, you may be required to pay a customs duty. Jewelry and High-Value Items: Items like jewelry, artwork, and collectibles must be declared and may be subject to duties.

What is not allowed to bring into Singapore?

Explosives, grenades, bombs, switchblades, butterfly knives, balisongs, and daggers are also prohibited. Under the Singapore Copyright Act, you cannot import any counterfeit goods including, designer items, electronics, software, DVDs, music, or any other items that infringe copyright rules.

How much can I import without paying duty in Singapore?

GST on imported goods However, GST need not be paid for goods (except for dutiable products) at the point of importation with CIF value of not more than $400. Where the CIF value is more than $400, the entire sum will be subject to GST.

What items need to be declared at customs in Singapore?

Dutiable Goods and GST Taxable Goods Intoxicating liquors, including spirits, wine, , ale, stout and porter. Tobacco products, including cigarettes and cigars. Motor vehicles, including motorised bicycles. Motor fuel, including motor spirits, diesel products and compressed natural gas (CNG)

How to import items into Singapore?

Quick Guide for Importers Imports. How to Import Your Goods? Step 1: Register for UEN and Activate Customs Account. Step 2: Check if Your Goods are Controlled. Step 3: Apply for Inter-Bank GIRO. Step 4: Furnish Security. Step 5: Obtain Customs Import Permit. Step 6: Prepare Documents for Cargo Clearance.

What happens if you don't declare at customs in Singapore?

The penalty for a customs offence is a composition sum of up to S$5000, or prosecution in court, depending on the severity of the offence.

Do I need an import license in Singapore?

Goods that do not require an import permit in Singapore Non-controlled or Unprohibited goods with total Cost, Insurance and Freight (CIF) value of under 400 SGD. Goods imported for personal use (excluding intoxicating liquors or tobacco), not intended for sale or trade. Goods brought into a free trade zone (FTZ)

What are taxable items in Singapore?

Dutiable Goods and GST Taxable Goods Intoxicating liquors, including spirits, wine, , ale, stout and porter. Tobacco products, including cigarettes and cigars. Motor vehicles, including motorised bicycles. Motor fuel, including motor spirits, diesel products and compressed natural gas (CNG)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Importing Personal Property Into Singapore?

Importing Personal Property into Singapore refers to the process of bringing personal belongings, such as household items and personal effects, into the country for personal use, often when relocating or moving.

Who is required to file Importing Personal Property Into Singapore?

Individuals relocating to Singapore, expatriates, and returning Singapore citizens who are bringing personal property into the country are typically required to file for importing personal property.

How to fill out Importing Personal Property Into Singapore?

To fill out Importing Personal Property documents, individuals must provide detailed information about their personal goods, including descriptions, values, and the purpose of importation, along with any necessary supporting documentation such as receipts or inventory lists.

What is the purpose of Importing Personal Property Into Singapore?

The purpose of importing personal property into Singapore is to ensure that individuals can bring their essential belongings for personal use when relocating, while also complying with local customs regulations.

What information must be reported on Importing Personal Property Into Singapore?

Information that must be reported includes a detailed inventory of the items being imported, their values, the reason for importation, the timeframe of the move, and identification details of the importer, such as passport or identification number.

Fill out your importing personal property into online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Importing Personal Property Into is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.