Get the free SAMPLE STANDBY LETTER OF CREDIT

Show details

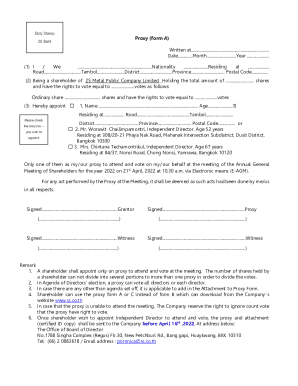

This document serves as a template for an Irrevocable Standby Letter of Credit that can be issued by a bank to benefit a county department for specific permits related to erosion control or stormwater

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sample standby letter of

Edit your sample standby letter of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample standby letter of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sample standby letter of online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sample standby letter of. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sample standby letter of

How to fill out SAMPLE STANDBY LETTER OF CREDIT

01

Start with the heading: 'Standby Letter of Credit'.

02

Include the issuing bank's name and address.

03

State the date of issuance.

04

Identify the beneficiary (the party receiving the credit).

05

Specify the amount of credit being issued.

06

Outline the conditions under which the credit can be drawn.

07

Include the validity period of the letter of credit.

08

Provide instructions for how the beneficiary can present a claim against the letter of credit.

09

Include any additional terms or conditions specific to the transaction.

10

Incorporate the signatures of authorized bank officials.

Who needs SAMPLE STANDBY LETTER OF CREDIT?

01

Businesses or individuals engaging in transactions that require a guarantee of payment.

02

Importers and exporters who need assurance that payment will be made.

03

Contractors who need to secure performance guarantees.

04

Parties involved in real estate transactions requiring financial commitment.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a SBLC?

Financial SBLC For example, if a crude oil company ships oil to a foreign buyer with an expectation that the buyer will pay within 30 days from the date of shipment, and the payment is not made by the required date, the crude oil seller can collect the payment for goods delivered from the buyer's bank.

What is a standby LC example?

An SBLC helps ensure that the buyer will receive the goods or service that's outlined in the document. For example, if a contract calls for the construction of a building and the builder fails to deliver, the client presents the SLOC to the bank to be made whole.

How to issue a standby letter of credit?

The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report.

Which is better, SBLc or LC?

LC: It is used as the main way to make payments in transactions. It's the primary method for paying for goods or services. SBLC: It is used as a backup. It only comes into play if the buyer doesn't pay as agreed.

What is the SBLc format?

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. It is a payment of last resort from the bank, and ideally, is never meant to be used.

What is the difference between standby LC and LC?

LC: The goal is to make sure the payment is made according to the agreement. It helps complete the transaction smoothly. SBLC: Its goal is to make sure that if the buyer doesn't pay, the bank will step in to pay the seller.

What is an example of a standby LC?

Example: If an edible dye manufacturer sends a shipment to a soft drink company against a financial SBLC, and the company is unable to pay for it, the issuing bank will step in and pay the manufacturer for the dye. Later on, the soft drink company would have to pay the full amount and interest to the issuing bank.

What is a standby letter of credit?

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SAMPLE STANDBY LETTER OF CREDIT?

A SAMPLE STANDBY LETTER OF CREDIT is a financial document issued by a bank on behalf of a client, guaranteeing payment to a third party if certain conditions are met. It serves as a safety net for transactions, providing assurance that funds will be available.

Who is required to file SAMPLE STANDBY LETTER OF CREDIT?

Entities that seek to back up their commitments—such as contractors, companies involved in international trade, or parties engaged in loan agreements—are generally required to file a SAMPLE STANDBY LETTER OF CREDIT.

How to fill out SAMPLE STANDBY LETTER OF CREDIT?

To fill out a SAMPLE STANDBY LETTER OF CREDIT, you need to provide the name and address of the applicant, the beneficiary, the amount of the credit, the terms under which it will be drawn, and the expiration date. It is crucial to ensure that all information is accurate and complies with any relevant regulations.

What is the purpose of SAMPLE STANDBY LETTER OF CREDIT?

The purpose of a SAMPLE STANDBY LETTER OF CREDIT is to provide financial security to the beneficiary, ensuring that they will be compensated in case the applicant fails to fulfill their contractual obligations. It acts as a form of collateral.

What information must be reported on SAMPLE STANDBY LETTER OF CREDIT?

The information that must be reported on a SAMPLE STANDBY LETTER OF CREDIT includes the names and addresses of the parties involved, the amount of credit, the conditions for enforcement, expiration date, and any applicable fees. Detailed instructions for drawing on the credit may also be included.

Fill out your sample standby letter of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Standby Letter Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.