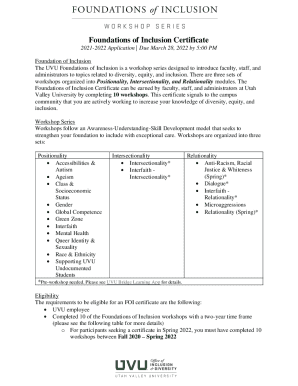

Get the free Employee Business Expenses

Show details

This form is used for employees to report ordinary, necessary, and unreimbursed business expenses incurred in connection with their employment, specifically within Springfield taxable income guidelines.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employee business expenses

Edit your employee business expenses form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee business expenses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employee business expenses online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit employee business expenses. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employee business expenses

How to fill out Employee Business Expenses

01

Gather all relevant receipts and invoices related to business expenses.

02

Fill out your personal information at the top of the form, including your name and employee ID.

03

List each expense in the designated sections by providing the date, description, amount, and category of each expense.

04

Attach scanned copies or originals of receipts to support your claims.

05

Review the completed form for accuracy.

06

Submit the form to your manager or the finance department as instructed.

Who needs Employee Business Expenses?

01

Employees who incur expenses while performing their job duties.

02

Sales personnel who travel for client meetings.

03

Employees attending conferences or training sessions.

04

Any staff member seeking reimbursement for work-related purchases.

Fill

form

: Try Risk Free

People Also Ask about

What business expenses can I write off?

As a new business, you can generally deduct up to $5,000* of start-up expenses (e.g., salaries, marketing, market analysis, etc.) and $5,000* of organizational costs (e.g., legal services, fees paid to the state to incorporate).

What business expenses can I deduct as an employee?

The amount of expenses you can deduct as an adjustment to gross income is limited to the regular federal per diem rate (for lodging, meals, and incidental expenses) and the standard mileage rate (for car expenses) plus any parking fees, ferry fees, and tolls.

How do I write off business expenses?

Sole proprietors and single-member LLCs can deduct business expenses on Schedule C of your personal Form 1040. They must be legitimate business expenses, and they must be kept separate from any personal expenses. Corporations should use the appropriate business tax form for deductions.

What is the most overlooked tax break?

The 10 Most Overlooked Tax Deductions State sales taxes. Reinvested dividends. Out-of-pocket charitable contributions. Student loan interest paid by you or someone else. Moving expenses. Child and Dependent Care Credit. Earned Income Tax Credit (EITC) State tax you paid last spring.

What expenses can you write off as an employee?

Unreimbursed Business Expenses Travel and mileage. Certain mobile phone uses. Uniforms (required by the employer that are not suitable for street wear.) Small tools. Office supplies. Professional license fees. Some moving expenses. Certain educational costs.

When did employee business expenses end?

Prior to the Tax Cuts and Jobs Act (TCJA), most individual taxpayers could claim deductions for unreimbursed employee expenses. These deductions have been suspended for taxpayers from 2018 to 2025.

What is the $2500 expense rule?

The Section 263(a) de Minimis Safe Harbor Election is an annual tax election that business owners and real estate investors can make when they file their returns. The election allows you to automatically expense any item under $2,500 on your invoice.

What is the form for employee business expenses?

Form 2106 is used to deduct unreimbursed job expenses for eligible employees. These can include tools, education, clothing, home office costs, insurance, and any dues or fees paid to professional organizations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employee Business Expenses?

Employee Business Expenses are costs incurred by an employee for business purposes, which can include travel, meals, and supplies.

Who is required to file Employee Business Expenses?

Employees who incur business-related expenses while performing their job and wish to be reimbursed by their employer or claim deductions on their taxes are required to file Employee Business Expenses.

How to fill out Employee Business Expenses?

To fill out Employee Business Expenses, gather all receipts and documentation for the incurred expenses, complete the expense report form, detailing each expense category, date, purpose, and amount, and submit it to the appropriate department.

What is the purpose of Employee Business Expenses?

The purpose of Employee Business Expenses is to enable employees to claim reimbursement for costs incurred while performing their job duties, ensuring that they are not personally out-of-pocket for expenses related to their employment.

What information must be reported on Employee Business Expenses?

The information that must be reported on Employee Business Expenses typically includes the date of the expense, the amount spent, the purpose of the expense, the category of the expense, and any accompanying documentation, such as receipts.

Fill out your employee business expenses online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employee Business Expenses is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.