Get the free CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM

Show details

This document outlines the guidelines and qualifications for Greeley residents to apply for the 2007 Food Tax Rebate Program following the repeal of the exemption from sales tax on food for home consumption.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign city of greeley sales

Edit your city of greeley sales form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city of greeley sales form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing city of greeley sales online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit city of greeley sales. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out city of greeley sales

How to fill out CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM

01

Obtain the CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM application form from the official website or local government office.

02

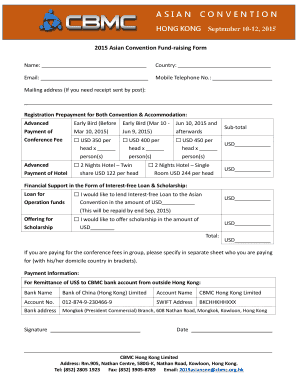

Fill in your personal information, including your name, address, and contact details.

03

Provide proof of residency in Greeley, such as a utility bill or lease agreement.

04

Indicate your household size and any dependents you may have.

05

Gather necessary documentation of your food purchases to support your application.

06

Calculate the sales tax paid on food purchases using the provided guidelines.

07

Complete any additional sections required by the application, such as income verification.

08

Review your application for accuracy and completeness.

09

Submit your application either online or by mailing it to the designated office.

Who needs CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM?

01

Residents of Greeley who have incurred sales tax on food purchases and meet the income eligibility criteria.

02

Families or individuals facing financial hardship who need assistance with food-related expenses.

Fill

form

: Try Risk Free

People Also Ask about

What is the city of Greeley rebate?

The LIFT UP programs offer rebates to help low- income families offset costs associated with food and utility bills. The maximum LIFT rebate is $100 per qualified applicants each year. In addition, the City of Greeley increased the onetime Utility Program credit to a $150 credit toward your water bill.

What is the food tax rebate in Greeley CO?

— Greeley residents can apply for a $100 reimbursement per person for taxes paid on food purchases made in 2023 and a $100 per household credit to their utility account. Residents only need to complete one application to benefit from both programs. The City's Food Tax Rebate Program has been running since 1990.

What is the sales tax for Greeley, Colorado?

Greeley is located in Weld County, Colorado. The combined sales tax rate is 7.01%. The total sales tax rate in Greeley comprises the state tax. The city also imposes an additional sales tax of 4.11%.

What is the sales tax on food in Colorado?

Under Colorado sales tax law, food is exempt from sales tax. For this purpose, “food” means “food for domestic home consumption” as defined under the federal food stamp program.

What is the food tax in Colorado?

In Colorado, grocery items are exempt from state tax, though local areas can levy a tax.

How much is sales tax in Greeley, Colorado?

Greeley is located in Weld County, Colorado. The combined sales tax rate is 7.01%. The total sales tax rate in Greeley comprises the state tax. The city also imposes an additional sales tax of 4.11%.

Who is eligible for the Greeley food tax rebate?

Applicants must have resided in Greeley for at least ten months in 2023 and be residents at the time of application.

What is the phone number for the city of Greeley?

Quick Guide to City Services ConditionDepartmentContact Meeting dates, times, public input City Clerk's Office 970-350-9740 Couches, Furniture Outside, not on an enclosed porch Community Development 970-350-9833 Outside, in alleys, public right-of-way Public Works 970-350-9336110 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM?

The City of Greeley Sales Tax on Food Rebate Program is a financial initiative designed to provide rebates to eligible residents on the sales tax paid for food purchases.

Who is required to file CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM?

Residents of Greeley who have purchased food within the city and meet certain income qualifications are required to file for the rebate.

How to fill out CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM?

To fill out the application, residents should complete the designated form available on the City of Greeley's website, providing necessary personal and financial information.

What is the purpose of CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM?

The purpose of the program is to alleviate the financial burden of sales tax on food, thereby helping low to moderate-income residents afford their groceries.

What information must be reported on CITY OF GREELEY SALES TAX ON FOOD REBATE PROGRAM?

Applicants must report personal identification details, income information, and the total amount of sales tax paid on food purchases during the specified period.

Fill out your city of greeley sales online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Greeley Sales is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.