Get the free Application for Special Assessment as Legal Residence

Show details

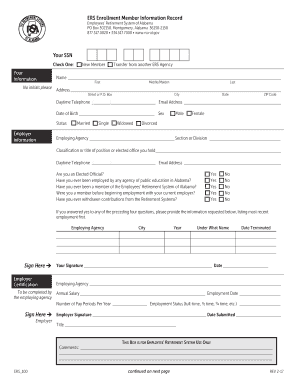

This document is intended for property owners in Richland County to apply for a special assessment as their legal residence, including the necessary information and certifications required for eligibility.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for special assessment

Edit your application for special assessment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for special assessment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for special assessment online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for special assessment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for special assessment

How to fill out Application for Special Assessment as Legal Residence

01

Obtain the Application for Special Assessment as Legal Residence form from your local tax assessor's office or their website.

02

Read the instructions carefully to understand the eligibility requirements.

03

Fill out your personal information, including your name, address, and contact details in the designated sections.

04

Confirm your residency status by providing proof of legal residence, such as a lease or utility bill.

05

Complete any additional sections that may require information about your property.

06

Review your application to ensure all information is accurate and complete.

07

Sign and date the application to validate it.

08

Submit the application to the appropriate office either in person or by mail before the deadline.

Who needs Application for Special Assessment as Legal Residence?

01

Homeowners who are applying for property tax relief due to their legal residence status.

02

Individuals who have recently moved to a new legal residence and want to establish their tax benefits.

03

Landlords or property owners who are seeking special assessment based on residency qualifications.

Fill

form

: Try Risk Free

People Also Ask about

What all do I need for a legal residence application in South Carolina?

Required Documents SC Driver's License/Identification card for all owner-occupants and spouse. SC Motor Vehicle Registration showing current address for all owner occupants and spouse. Social Security Card (both spouses). Tax Returns: Redacted copy of your most recently filed Federal Income tax returns.

What qualifies as a primary residence in South Carolina?

Definition of Legal Residence For tax purposes the term Legal Residence shall mean the permanent home or dwelling place owned by a person and occupied by the owner thereof as their primary residence. It shall be the place where he intends to remain permanently for an indefinite time.

What is the special assessment for legal residence in SC?

These residences are taxed on an assessment equal to 4% of the fair market value of the property. To this value, a local rate is applied to determine taxes due. In addition to the special assessment ratio of 4%, the legal residence is also exempt from payment of taxes for school operating purposes.

What determines legal residence in South Carolina?

Under most circumstances, a person must live in South Carolina for 12 consecutive months to establish residency. What kind of documents establish intent to become a SC resident? Licensing for professional practice (if applicable) in South Carolina.

What is the 4 legal residence exemption in SC?

Legal Residence is a statewide special tax assessment rate for those who own and live in a home full-time in South Carolina. South Carolina law provides the 4% assessment ratio on primary residential properties. The alternative is 6%. This exemption only applies to primary residences, not second/vacation homes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Special Assessment as Legal Residence?

The Application for Special Assessment as Legal Residence is a form that homeowners must complete to qualify for tax assessment benefits based on their primary residence status.

Who is required to file Application for Special Assessment as Legal Residence?

Homeowners who wish to receive special property tax assessments based on their primary residency are required to file this application.

How to fill out Application for Special Assessment as Legal Residence?

To fill out the application, homeowners need to provide accurate details about their property, including ownership information, residency status, and any relevant identification numbers.

What is the purpose of Application for Special Assessment as Legal Residence?

The purpose of the application is to determine eligibility for lower property tax rates for homeowners who use their property as a primary residence.

What information must be reported on Application for Special Assessment as Legal Residence?

The application must report information such as the homeowner's name, address, property details, and proof of residency, along with any applicable identification numbers.

Fill out your application for special assessment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Special Assessment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.