Get the free 2013 OCCUPATIONAL TAX RENEWALS

Show details

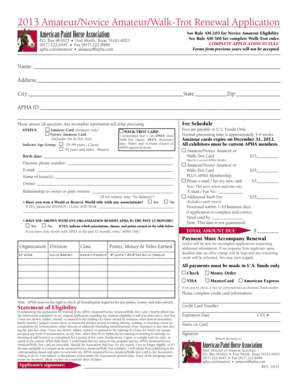

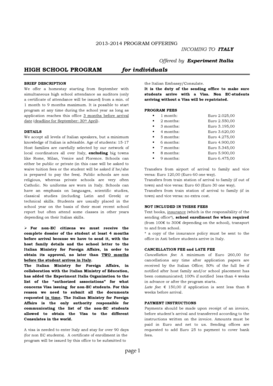

This document serves as an application for the renewal of occupational tax certificates in the City of Suwanee, outlining required information and supporting documentation for businesses operating

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2013 occupational tax renewals

Edit your 2013 occupational tax renewals form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2013 occupational tax renewals form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2013 occupational tax renewals online

Follow the steps down below to use a professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2013 occupational tax renewals. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2013 occupational tax renewals

How to fill out 2013 OCCUPATIONAL TAX RENEWALS

01

Obtain the 2013 Occupational Tax Renewal form from your local taxation office or their website.

02

Fill in your business name and address in the designated fields.

03

Provide your business license number and other identification information as required.

04

Indicate the type of business activities you engage in.

05

Calculate the total amount due based on the applicable rates for your occupation.

06

Include any supporting documents or additional information requested on the form.

07

Review the completed form for accuracy and ensure all sections are filled out.

08

Submit the completed form along with payment by the deadline specified on the form.

Who needs 2013 OCCUPATIONAL TAX RENEWALS?

01

Business owners operating within the jurisdiction that requires an Occupational Tax.

02

Self-employed individuals who generate income through their services or trades.

03

Professionals including but not limited to lawyers, accountants, and contractors who are required to renew their occupational tax annually.

Fill

form

: Try Risk Free

People Also Ask about

How do I renew my Duluth GA occupational tax?

Renewal Applications: Please note the City will no longer accept paper applications; all applications must be completed online. Use the renewal application link sent to the business owner's email. If you didn't receive the link, contact the City of Duluth business office: Call: 770-476-3434.

What is occupational tax in Georgia?

Occupational Tax is calculated on a graduated scale. The first $250,000 is taxed at 30 cents per thousand, the next $250,000 at 35 cents per thousand and so on. See example below based on a gross revenue of $1,750,000 for a business in a Tax Class 2.

What is the business occupation tax in Gwinnett?

Business Occupation Tax Certificate: Gwinnett has established six (6) tax classes, with rates ranging from $0.65 per thousand dollars of gross revenue to $1.30 per thousand dollars of gross revenue (see item #10 on the application form).

Who is required to have a business license in Georgia?

Any entity that conducts business in Georgia may be required to register with the Georgia Department of Revenue. Many factors determine whether you must register. These include — but are not limited to — businesses that employee workers, sell goods, or sell specific products such as alcohol or tobacco.

What is a Georgia tax certificate?

Georgia Tax Clearance Certificates Certificates of tax clearance are required for a variety of business activities, ranging from reinstating or dissolving an entity to applying for a loan or a tax incentive.

Do 1099 employees need a business license in Georgia?

Independent Contractors are in business for themselves and must obtain a business license prior to commencing work. Generally, if payroll taxes are not deducted from your pay, you are an Independent Contractor. Each Georgia business is only required to have an occupation tax license in one county or city.

What is an occupational tax certificate in Georgia?

An occupational tax certificate, commonly referred to as a business license, is a certificate issued by government agencies. The certificate is evidence that an individual or company has paid an occupational tax as required by the local ordinance.

Who needs an occupational tax certificate in Georgia?

Businesses located in the municipalities must obtain Business Occupational Tax Certificates from the city or town where the business is located. A separate license/certificate is required for each service or separate location of business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2013 OCCUPATIONAL TAX RENEWALS?

2013 Occupational Tax Renewals refer to the annual process by which individuals and businesses in certain jurisdictions must renew their occupational tax licenses or permits for the year 2013, ensuring their compliance with local tax regulations.

Who is required to file 2013 OCCUPATIONAL TAX RENEWALS?

Individuals and businesses that conduct activities subject to occupational tax in their local jurisdiction are required to file 2013 Occupational Tax Renewals.

How to fill out 2013 OCCUPATIONAL TAX RENEWALS?

To fill out the 2013 Occupational Tax Renewals, one must provide their business information, including business name, address, type of business, and any relevant tax identification numbers, along with the payment of the required tax fee.

What is the purpose of 2013 OCCUPATIONAL TAX RENEWALS?

The purpose of the 2013 Occupational Tax Renewals is to ensure that local governments can collect revenue from businesses operating within their jurisdiction and to regulate businesses to verify their legitimacy and compliance with local laws.

What information must be reported on 2013 OCCUPATIONAL TAX RENEWALS?

The information required to be reported on the 2013 Occupational Tax Renewals typically includes the business name, owner details, business address, nature of the business, prior year's gross receipts, and any applicable fees.

Fill out your 2013 occupational tax renewals online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2013 Occupational Tax Renewals is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.