Get the free Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochu...

Show details

This brochure provides clients with essential information about Ameriprise Financial Services and its Managed Accounts, detailing qualifications, business practices, and changes since the last update.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ameriprise managed accounts and

Edit your ameriprise managed accounts and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ameriprise managed accounts and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ameriprise managed accounts and online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ameriprise managed accounts and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

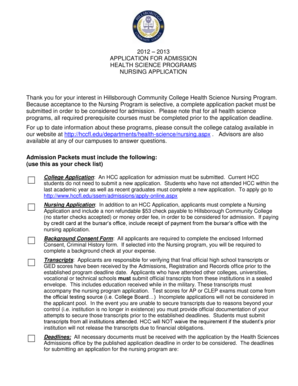

How to fill out ameriprise managed accounts and

How to fill out Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)

01

Begin by reading the introduction of the brochure to understand the purpose and services offered.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide your financial background, including income, assets, and investment experience.

04

Review the fees associated with the Ameriprise Managed Accounts and Financial Planning Service, noting any wrap fee structures.

05

Understand the investment strategy recommended by Ameriprise and how it aligns with your financial goals.

06

Sign the document to indicate your understanding and agreement to the terms outlined.

07

Keep a copy of the completed brochure for your records and future reference.

Who needs Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)?

01

Individuals seeking professional management of their investment portfolios.

02

Clients looking for comprehensive financial planning services.

03

Investors interested in understanding the fee structures of managed accounts.

04

Those who require a clear disclosure of services and potential costs associated with financial advice.

Fill

form

: Try Risk Free

People Also Ask about

What is an Ameriprise managed account?

Ameriprise Advisory Solutions (managed accounts) allow you to receive ongoing investment advice and feature an asset-based fee structure. This allows you to implement your investment strategy, generally without paying individual trading costs for each trade placed within the account.

What does "wrap fee" mean?

A wrap fee is an all-inclusive charge for the services of an investment manager or investment advisor. The wrap fee generally covers investment advice, investment research, brokerage services, and administrative fees.

What is a wrap fee brochure?

Investment firms are required to provide a wrap fee brochure detailing the services and costs that are included in the fee. Choosing a wrap fee can be a good option for investors who intend to use their broker's full line of services since it covers all the direct services the customer receives.

When must a wrap fee brochure be delivered?

You must give a wrap fee program brochure to each client of the wrap fee program before or at the time the client enters into a wrap fee program contract.

Is a 1% financial advisor fee worth it?

While 1.5% is on the higher end for financial advisor services, if that's what it takes to get the returns you want, then it's not overpaying, so to speak. Staying around 1% for your fee may be standard, but it certainly isn't the high end. You need to decide what you're willing to pay for what you're receiving.

What does Ameriprise charge for fees?

Maintenance fees for Ameriprise brokerage accounts and Ameriprise ONE Financial Accounts with UGMA/UTMA ownerships are $15 per quarter ($60 per year).

What are wrap-around fees?

Providers set their own fees for wraparound places, so prices vary, and parents pay their wraparound childcare provider directly for their child's place. Average costs are approximately £4 per session per child for breakfast clubs and £10-12 per session per child for after school clubs.

What is a fee brochure?

Fees Brochure means the Personal Account, Service and Facility Fees Brochure (as changed by us from time to time).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)?

The Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure is a document that provides clients with detailed information about the services offered through the Wrap Fee Program, including fees, investment strategies, and potential conflicts of interest.

Who is required to file Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)?

Financial advisors and firms that offer the Ameriprise® Managed Accounts and Financial Planning Service are required to file the Client Disclosure Brochure as part of regulatory compliance to inform clients about the program.

How to fill out Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)?

To fill out the Client Disclosure Brochure, financial advisors must provide accurate information regarding their services, fees, and investment strategies, ensuring that all sections are completed thoroughly and clearly for client understanding.

What is the purpose of Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)?

The purpose of the Client Disclosure Brochure is to ensure transparency and provide clients with essential information to make informed decisions regarding their investment options and to understand the costs associated with the services.

What information must be reported on Ameriprise® Managed Accounts and Financial Planning Service Client Disclosure Brochure (Wrap Fee Program)?

The information that must be reported includes the types of services offered, fee structures, investment strategies, the advisor's qualifications, potential conflicts of interest, and details on the performance of managed accounts.

Fill out your ameriprise managed accounts and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ameriprise Managed Accounts And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.