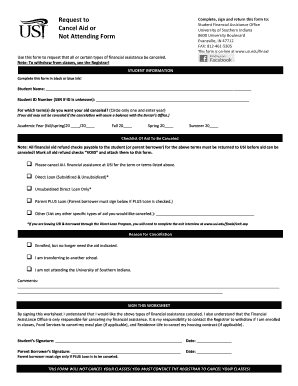

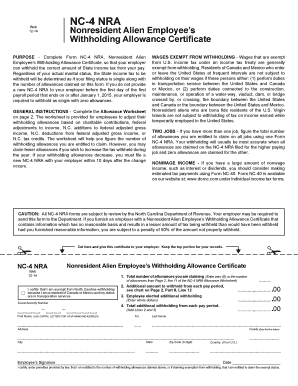

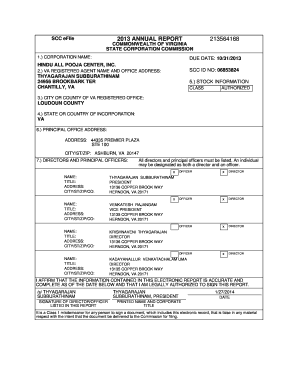

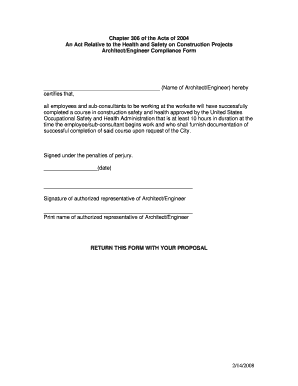

Get the free Coverdell Education Savings Account Disclosure Statement and Custodial Agreement

Show details

This document is a comprehensive guide and disclosure statement for Coverdell Education Savings Accounts, explaining their purpose, contribution limits, investment options, and management responsibilities

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign coverdell education savings account

Edit your coverdell education savings account form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your coverdell education savings account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing coverdell education savings account online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit coverdell education savings account. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out coverdell education savings account

How to fill out Coverdell Education Savings Account Disclosure Statement and Custodial Agreement

01

Gather necessary personal information for the account holder and the beneficiary.

02

Read the Coverdell Education Savings Account Disclosure Statement to understand the account features and benefits.

03

Fill out the account holder's information, including name, address, and Social Security number.

04

Complete the beneficiary's information, ensuring to specify the relationship to the account holder.

05

Review the contribution limits and ensure that your intended contributions are within the annual limits.

06

Provide information regarding the investment options chosen for the account.

07

Sign and date the Custodial Agreement to acknowledge acceptance of terms.

08

Submit the completed forms to the financial institution managing the account.

Who needs Coverdell Education Savings Account Disclosure Statement and Custodial Agreement?

01

Parents or guardians who wish to save for their child's education expenses.

02

Individuals aiming to fund qualified educational expenses such as tuition, fees, books, and supplies for K-12 and post-secondary education.

03

Those looking for a tax-advantaged way to invest in education for a designated beneficiary.

Fill

form

: Try Risk Free

People Also Ask about

Can Coverdell be converted to Roth IRA?

Coverdell Education Savings Accounts can be rolled over to 529 plans. Can they, too, be rolled over to a Roth IRA? No.

Can you cash out a Coverdell?

The beneficiary of a Coverdell education savings account can take out money tax-free. There are no limits to the amount of money you can withdraw from a Coverdell education savings account, but there are limits to the amount of money you can put in, which is up to $2,000 per year per child.

Why would you use a Coverdell?

In general, the designated beneficiary of a Coverdell ESA can receive tax-free distributions to pay qualified education expenses. The distributions are tax-free to the extent the amount of the distributions doesn't exceed the beneficiary's qualified education expenses.

What is the difference between a Coverdell and an IRA?

Education IRAs are also referred to as "Coverdell accounts" or simply "ESAs." Despite their "IRA" moniker, they are for educational expenses, not retirement savings, though they work in a similar way.

What is the maximum contribution to a Coverdell education savings account?

Contribution limits The annual Coverdell contribution limit is $2,000 per year, whereas the 529 plans do not have an annual contribution limit. (But with a 529 plan, you will need to consider the gift tax consequences for large gifts). The lifetime limit for a 529 plan varies by state from $235,000 to $500,000.

When can I withdraw from Coverdell?

Beneficiaries must withdraw funds by age 30 or face taxation and penalties; unused funds can be transferred to family members.

Who is the account owner of Coverdell ESA?

The Coverdell ESA is structured as a trust or custodial account for a beneficiary. The funds invested must be administered and distributed for the benefit of the beneficiary. Because the beneficiary is usually a minor, a "responsible individual," almost invariably a parent or guardian, must administer the account.

What is a Coverdell education savings?

A Coverdell education savings account (Coverdell ESA) is a trust or custodial account set up in the United States solely for paying qualified education expenses for the designated beneficiary of the account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Coverdell Education Savings Account Disclosure Statement and Custodial Agreement?

The Coverdell Education Savings Account (ESA) Disclosure Statement and Custodial Agreement is a legal document that outlines the terms and conditions of a Coverdell ESA. It details the rights and responsibilities of the account holder and the custodian, including how the funds can be used for educational expenses.

Who is required to file Coverdell Education Savings Account Disclosure Statement and Custodial Agreement?

The account holder of the Coverdell Education Savings Account must complete the Disclosure Statement and Custodial Agreement as part of establishing the account. The custodian who manages the account may also need to retain this documentation for compliance purposes.

How to fill out Coverdell Education Savings Account Disclosure Statement and Custodial Agreement?

To fill out the Coverdell ESA Disclosure Statement and Custodial Agreement, the account holder should provide personal information such as name, address, Social Security number, and details regarding the beneficiary. It is important to review the instructions provided with the form to ensure all required fields are completed accurately.

What is the purpose of Coverdell Education Savings Account Disclosure Statement and Custodial Agreement?

The purpose of the Coverdell Education Savings Account Disclosure Statement and Custodial Agreement is to inform the account holder of the rules governing the account, establish the custodian's responsibilities, and outline the investment options and tax implications associated with the account.

What information must be reported on Coverdell Education Savings Account Disclosure Statement and Custodial Agreement?

The information that must be reported includes the account holder's and beneficiary's personal details, the amount contributed to the account, investment choices, any distributions made, and the overall purpose of the funds in relation to qualified educational expenses.

Fill out your coverdell education savings account online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Coverdell Education Savings Account is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.