Get the free Invoice - 810

Show details

This document outlines the guidelines and structure for generating an Invoice Transaction Set (810) for use within EDI environments, detailing the required and optional segments and fields necessary

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invoice - 810

Edit your invoice - 810 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invoice - 810 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invoice - 810 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit invoice - 810. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

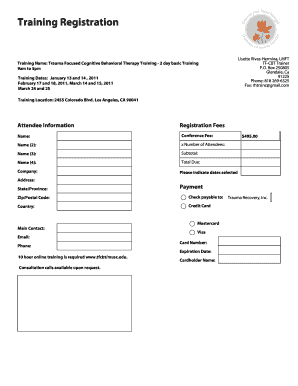

How to fill out invoice - 810

How to fill out Invoice - 810

01

Start by filling out the header with your company's name, address, and contact information.

02

Include the invoice number for tracking purposes.

03

Write the date of the invoice.

04

Enter the customer's name and address in the designated section.

05

Specify the description of the goods or services provided.

06

List the quantity and unit price of each item.

07

Calculate the total amount due, including any applicable taxes or discounts.

08

Provide payment terms, including due dates and payment methods.

09

Include any additional information or notes relevant to the invoice.

Who needs Invoice - 810?

01

Businesses and freelancers providing goods or services that require formal billing.

02

Companies that need to maintain proper accounting records.

03

Clients who are receiving goods or services and require documentation for payment.

Fill

form

: Try Risk Free

People Also Ask about

What is 810 file type?

EDI 810: EDI Invoice Transactions The EDI 810 Invoice transaction set is the electronic version of the paper-based invoice document. It is typically sent in response to an EDI 850 Purchase Order as a request for payment once the goods have shipped or services are provided.

What is the difference between 810 and 210 EDI?

EDI 810 is for general invoices, while EDI 210 is for motor carrier freight details and invoices. Standard invoice details are included in the EDI 810 e-transaction types, including: Invoice number. Date.

What is EDI 810 and 850?

Two of the most common types of EDI transactions are the EDI 810 Invoice and the EDI 850 Purchase Order (PO). These documents are used primarily in business to business transactions, and both documents can go in either direction – inbound or outbound.

What is the difference between EDI 810 and 850?

An EDI 810 is usually sent out in response to the Purchase Order (EDI 850) or after the order is fulfilled and an Advance Shipping Notice (EDI 856) is sent out. This is an electronic version of the Cash Receipt that is typically issued by a buyer after the receipt of an 810 document (Invoice).

What is a 810 invoice?

What is EDI 810? An EDI 810 Invoice is sent by a seller to a buyer, to indicate the charges due, and request payment according to agreed-upon terms. This EDI transaction can be used instead of sending a paper, email, or PDF invoice.

What is the invoice number in English?

An invoice number is a unique, sequential code that is systematically assigned to invoices. Invoice numbers are one of the most important aspects of invoicing as they ensure that income is properly documented for tax and accounting purposes.

What is an EDI 810 invoice?

What is EDI 810? An EDI 810 Invoice is sent by a seller to a buyer, to indicate the charges due, and request payment according to agreed-upon terms. This EDI transaction can be used instead of sending a paper, email, or PDF invoice.

How to read an EDI 810?

EDI 810 Format IN is the invoice number segment. BIG is the starting point segment which includes date, purchase order and release number. TDS is the total amount due segment. IT1 is the item identification segment, repeated for each item. CAD is the carrier detail segment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Invoice - 810?

Invoice - 810 is a standardized electronic document used in business-to-business transactions to request payment for goods or services provided.

Who is required to file Invoice - 810?

Businesses that engage in electronic data interchange (EDI) transactions and have agreements with their trading partners are typically required to file Invoice - 810.

How to fill out Invoice - 810?

To fill out Invoice - 810, ensure all required fields are completed, including invoice number, date, buyer and seller information, item descriptions, quantities, prices, and payment terms.

What is the purpose of Invoice - 810?

The purpose of Invoice - 810 is to facilitate the electronic exchange of invoice information between trading partners, streamlining the billing process and improving accuracy in accounts payable.

What information must be reported on Invoice - 810?

The information that must be reported on Invoice - 810 includes the seller's information, buyer's information, invoice date, invoice number, item line details (descriptions, quantities, prices), payment terms, and total amount due.

Fill out your invoice - 810 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invoice - 810 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.