Get the free 2007 Rates

Show details

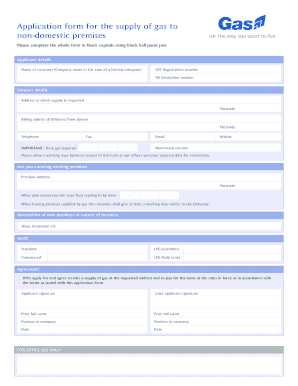

This document provides detailed shipping rates and guidelines for UPS services applicable to domestic, export, and import shipments for customers located in Alaska and Hawaii, effective from January

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2007 rates

Edit your 2007 rates form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 rates form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2007 rates online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2007 rates. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2007 rates

How to fill out 2007 Rates

01

Gather all necessary financial documents from the year 2007.

02

Obtain the 2007 Rates form from the relevant tax authority or website.

03

Start with your personal information: name, address, Social Security Number (SSN) or Tax Identification Number (TIN).

04

Locate sections for income, expenses, and deductions relevant to the year 2007.

05

Accurately enter your total income from all sources for that year.

06

Include any applicable deductions you can claim based on your eligibility.

07

If applicable, fill out sections regarding credits that may apply to your situation.

08

Review all entries for accuracy and completeness.

09

Sign and date the form, then submit it as directed, whether electronically or via mail.

Who needs 2007 Rates?

01

Individuals who earned income in the year 2007.

02

Taxpayers who are required to file a tax return for that year.

03

Those who need to report deductions or credits for 2007.

04

Tax professionals assisting clients with past-year tax returns.

05

Anyone looking to amend a previous year's tax return.

Fill

form

: Try Risk Free

People Also Ask about

Why was CAD worth more than USD in 2007?

The Canadian dollar's value against the US dollar rose sharply in 2007 because of the continued strength of the Canadian economy and the US currency's weakness on world markets. During trading on September 20, 2007, it met the US dollar at parity for the first time since November 25, 1976.

What was the Canadian exchange rate in 2007?

USD/CAD (CAD=X) DateOpenHigh Dec 1, 2007 1.0004 1.0243 Nov 1, 2007 0.9467 1.0011 Oct 1, 2007 0.9928 1.0014 Sep 1, 2007 1.0561 1.057832 more rows

Why was the Canadian dollar so strong in 2007?

On September 20, 2007, the Canadian dollar reached parity with the US dollar for the first time in close to 31 years, with a 62% rise in less than six years driven in part by record high prices for oil and other commodities.

What is the average FX rate from GBP to USD?

British pound sterling to US dollars exchange rate history 1 GBP to USDLast 7 days High 1.3556 Low 1.3427 Average 1.3516 Change -0.76%

Why is CAD more than USD?

Since Canada's effective purchasing power is higher, this movement is usually reflected in a higher exchange rate. The opposite also holds: weaker commodity prices can translate into a weaker Canadian dollar. Inflation rates: Inflation is the rate at which general price levels rise over time.

Why did the Canadian dollar get stronger?

Recent Canadian dollar strength has been underpinned by a sharp depreciation of the US dollar. US tariffs' impact on the Canadian dollar is waning, and Fed rate cuts could boost the currency. A range-bound Canadian dollar is seen as likely in the second half of 2025.

What was the pound rate in 2009?

The value of the pound fell sharply during the crisis, and the GBP to INR rate reached a record low of 74.56 in 2009.

What is exchange rate history?

Historical currency exchange rates are foreign exchange rates which give traders a historical reference of how a currency pair has traded in the past. Historical exchange rates help many forex traders to discern the direction of a given currency pair.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2007 Rates?

2007 Rates refer to the tax rates and filing requirements established for the tax year 2007, which are used to determine the amount of taxes owed or refunded to individuals and businesses.

Who is required to file 2007 Rates?

Individuals and businesses that had taxable income in the year 2007 or met certain income thresholds, claimed tax credits, or were required to report specific financial information are required to file 2007 Rates.

How to fill out 2007 Rates?

To fill out the 2007 Rates, taxpayers should gather necessary documents, complete the appropriate tax forms using their financial information for 2007, and ensure that all calculations are accurate before submitting to the relevant tax authority.

What is the purpose of 2007 Rates?

The purpose of 2007 Rates is to provide a framework for determining tax liabilities for the tax year, ensuring that taxpayers fulfill their obligations and that the government collects revenue to fund public services.

What information must be reported on 2007 Rates?

The information that must be reported on 2007 Rates includes total income, deductions, credits, and any other pertinent financial data that affects the tax calculation for the year 2007.

Fill out your 2007 rates online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2007 Rates is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.