Get the free dcb bank kyc update online form

Show details

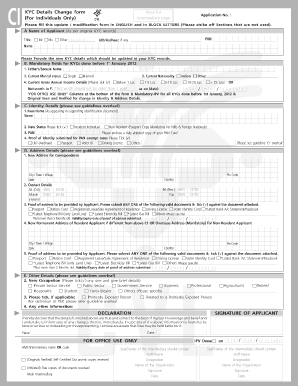

Freedom Prepaid Card KYC Come Application Form Know Your Customer (KYC) Form For Upgrading Card Freedom Prepaid Card KYC Application Form Name of Applicant Card No.: Mr/Mrs/Ms : Surname : The document

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your dcb bank kyc update form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dcb bank kyc update form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dcb bank kyc update online online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dcb kyc application form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out dcb bank kyc update

How to fill out DCB Bank KYC form?

01

Start by carefully reading the instructions provided on the form. Make sure you have all the necessary documents and information required for filling out the form.

02

Begin by providing your personal details such as full name, date of birth, gender, and contact information in the respective sections of the form.

03

Next, fill in your residential address details, including your current address and any previous addresses if applicable. Provide accurate information to ensure smooth processing of your KYC application.

04

The form will also require you to provide your identification details. Fill in your PAN (Permanent Account Number) or Aadhaar Card number, as per the requirements mentioned in the form.

05

Provide details of any other valid identification documents you possess, such as passport, driving license, or voter ID card.

06

If you are filling out the KYC form as a joint account holder or as a representative of a company or firm, ensure you provide the relevant details and documents required for such cases.

07

Make sure to carefully review all the information filled in the form before submitting it. Cross-check for any errors or missing information and correct them as necessary.

08

Once you have filled out the form accurately, affix your signature at the designated space to confirm the authenticity of the information provided.

09

Submit the filled-out KYC form along with the required supporting documents to the designated branch or as per the instructions mentioned in the form itself.

Who needs DCB Bank KYC form?

01

Individuals who wish to open a new bank account with DCB Bank are required to fill out the KYC form.

02

Existing account holders may also need to update their KYC details periodically as per the guidelines issued by the bank.

03

Any person or entity who wishes to avail various banking services and products offered by DCB Bank, such as loans, credit cards, or investment options, will need to complete the KYC process by submitting the form.

Fill dcb kyc app : Try Risk Free

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is dcb bank kyc form?

DCB Bank KYC Form is a form used for Know Your Customer (KYC) compliance by DCB Bank, India. The form is used to collect customer information and verify the identity of individuals and organizations. The form includes details such as customer name, address, PAN number, photograph, and other identity documents. The form is required for opening new accounts with the bank as well as for availing certain services.

When is the deadline to file dcb bank kyc form in 2023?

The deadline to file DCB Bank KYC forms in 2023 has not yet been announced.

What information must be reported on dcb bank kyc form?

The information required for a DCB Bank KYC form includes:

1. Name

2. Address

3. Date of Birth

4. Gender

5. Occupation

6. Phone Number

7. PAN (Permanent Account Number)

8. Email

9. Signature

10. Proof of Identity (Aadhar Card, Passport, PAN Card, Driving License, Voter ID, etc.)

11. Proof of Address (Aadhar Card, Passport, Electricity Bill, Telephone Bill, Bank Statement, etc.)

Who is required to file dcb bank kyc form?

Any individual or entity, such as a resident Indian, non-resident Indian (NRI), person of Indian origin (PIO), foreign nationals, partnership firms, companies, trusts, associations, societies, etc., who wish to open an account or perform certain transactions with DCB Bank, are required to file their KYC (Know Your Customer) form.

How to fill out dcb bank kyc form?

To fill out the DCB Bank KYC (Know Your Customer) form, follow the steps below:

1. Obtain the KYC form: Visit the official website of DCB Bank or visit a branch to collect the KYC form. Alternatively, some banks also provide an online KYC form that can be downloaded from their website.

2. Fill in personal information: Start by filling in your personal details such as your full name, date of birth, gender, and marital status. Provide accurate information and ensure it matches your official identification documents.

3. Fill in contact details: Fill in your current residential address, email address, and phone number. Make sure to provide correct and functioning contact details for future communication.

4. Provide identification proof: Choose the type of identification document you will be submitting (e.g., Aadhaar Card, Passport, PAN Card) and fill in the relevant details such as the document number, issuing authority, and date of issue. Attach a self-attested photocopy of the ID document.

5. Fill in financial details: Provide information regarding your annual income, occupation, and the sources of income. If you are self-employed, provide details about your business or profession.

6. Fill in reference details: Provide details of two references, such as friends or family members. These references should not be living with you or related to you.

7. Provide other details: Answer questions related to your political affiliations, tax residency status, and involvement in any criminal cases or investigations.

8. Declarations: Read through the declarations section carefully and sign where required. By signing, you declare that all the information provided is accurate and you agree to abide by the bank's KYC norms.

9. Attach necessary documents: Ensure you attach self-attested photocopies of the required identification documents along with the KYC form.

10. Submit the form: Once you have completed filling out the form and attached the necessary documents, visit your nearest DCB Bank branch and submit the form to a bank representative or drop it in the designated KYC dropbox.

It is recommended to carry original copies of your identification documents for verification purposes. Additionally, it's advisable to contact the bank or refer to their official website for any specific instructions or additional requirements they may have for KYC compliance.

What is the purpose of dcb bank kyc form?

The purpose of the DCB Bank KYC (Know Your Customer) form is to collect necessary information about an individual or entity to verify their identity and understand their financial transactions. It is a requirement by regulatory authorities and financial institutions to prevent money laundering, identity theft, and other fraudulent activities. The form helps the bank to evaluate and monitor the customer's risk profile, ensure compliance with legal obligations, and establish a relationship with the customer.

What is the penalty for the late filing of dcb bank kyc form?

The penalty for the late filing of DCB Bank KYC (Know Your Customer) form may vary depending on the regulations and policies of the specific bank and jurisdiction. Typically, banks impose a penalty fee or may restrict certain services until the KYC form is submitted. It is advisable to check with DCB Bank directly or refer to their KYC policy to understand the specific penalties for late filing.

How do I modify my dcb bank kyc update online in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your dcb kyc application form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find dcb bank video kyc?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the dcb kyc application app download. Open it immediately and start altering it with sophisticated capabilities.

How do I make changes in dcb bank kyc form?

With pdfFiller, it's easy to make changes. Open your dcb bank kyc app form in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

Fill out your dcb bank kyc update online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dcb Bank Video Kyc is not the form you're looking for?Search for another form here.

Keywords relevant to dcb bank kyc portal form

Related to dcb kyc portal

If you believe that this page should be taken down, please follow our DMCA take down process

here

.