Get the free Accounts Payable and Payroll Coordinator Accounts Payable

Show details

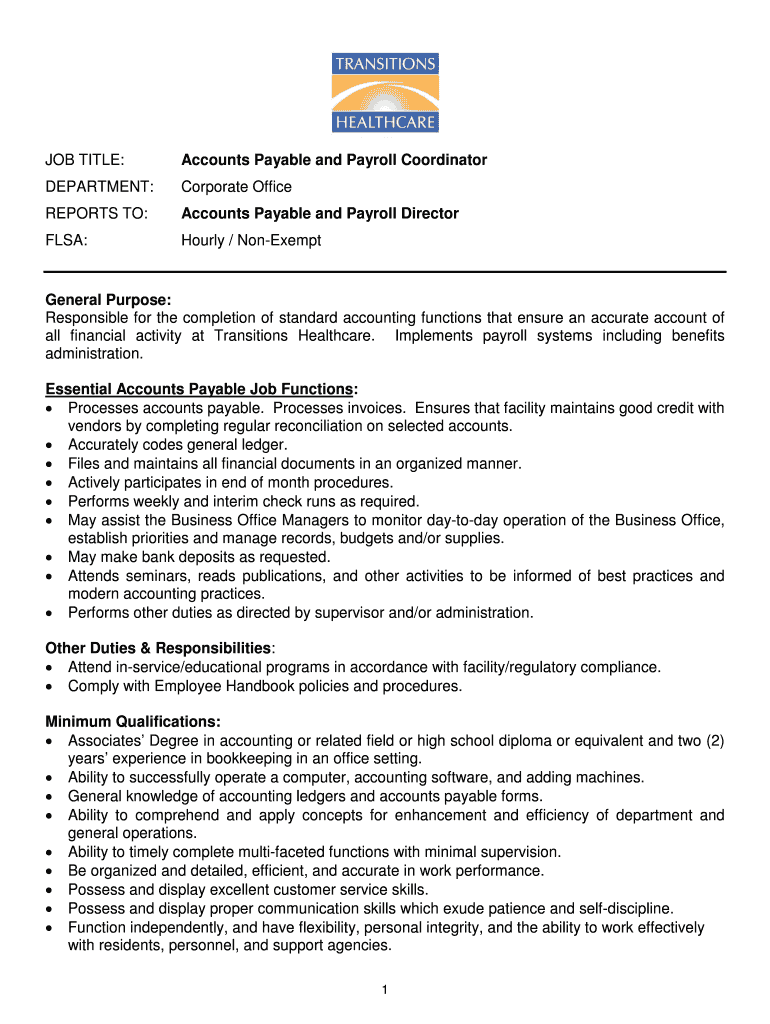

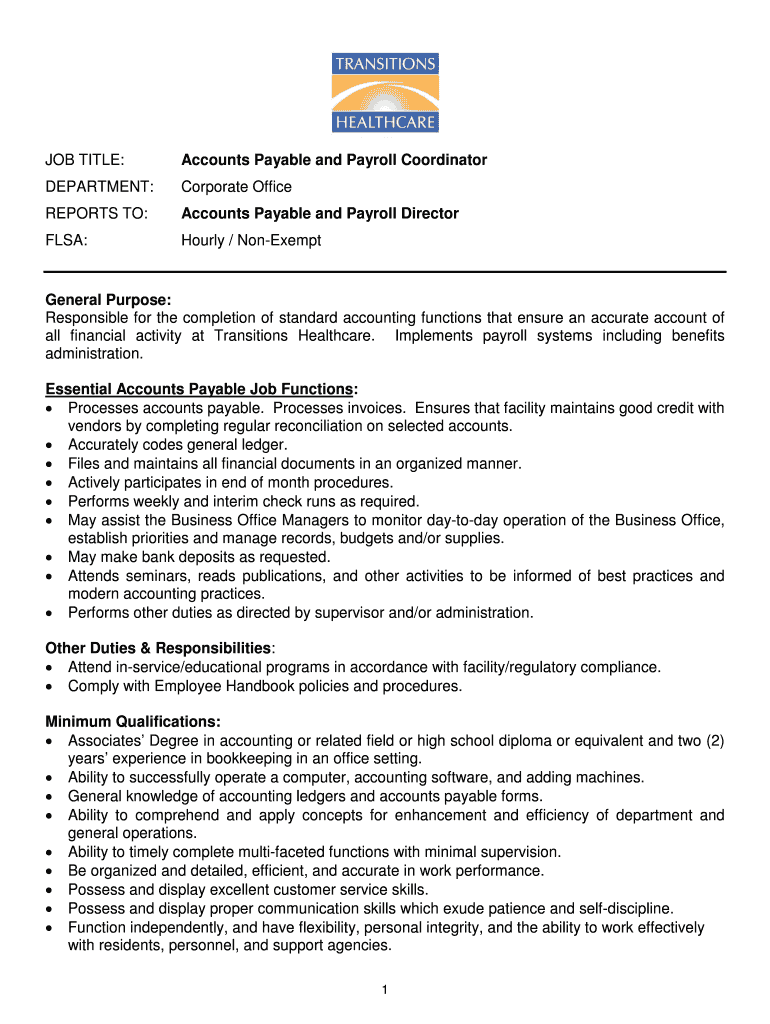

JOB TITLE: Accounts Payable and Payroll Coordinator DEPARTMENT: Corporate Office REPORTS TO: Accounts Payable and Payroll Director FLEA: Hourly / Nonexempt General Purpose: Responsible for the completion

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts payable and payroll

Edit your accounts payable and payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts payable and payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounts payable and payroll online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accounts payable and payroll. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts payable and payroll

How to fill out accounts payable and payroll:

01

Gather all relevant documentation: This includes invoices, receipts, and records of employee wages and hours worked. Make sure you have all the necessary paperwork before starting the process.

02

Record all expenses and payments: Enter all invoices and bills into your accounts payable system. This may involve creating entries in a spreadsheet or using accounting software. Be sure to include important details such as the vendor name, invoice number, amount due, and due date.

03

Review and reconcile: Regularly review your accounts payable records to ensure accuracy. Reconcile the payments made with the invoices received, making sure that all expenses are properly accounted for. This step helps prevent discrepancies in your financial records.

04

Process payroll: Gather employee timesheets or attendance records, and calculate the hours worked for each employee. Calculate any overtime or commissions due. Apply the appropriate tax withholdings, deductions, and benefits. Once everything is calculated, generate paychecks or process direct deposits for your employees.

05

Submit tax payments and filing: Ensure that you comply with payroll tax requirements by submitting the necessary payments and filings to the appropriate authorities. This includes payroll taxes, unemployment taxes, and any other required withholdings.

Who needs accounts payable and payroll:

01

Businesses: Whether small or large, businesses of all sizes need accounts payable and payroll systems. It helps them manage and track expenses, pay their vendors on time, and process accurate paychecks for their employees.

02

Non-profit organizations: Non-profits also require accounts payable and payroll systems to handle their financial obligations. They need to manage their expenses and process payroll while adhering to any specific regulations applicable to their sector.

03

Government entities: Government agencies at various levels also rely on accounts payable and payroll systems to handle their financial transactions. They need to accurately track expenses and process payments for vendors and employees.

In conclusion, accounts payable and payroll are essential processes for businesses, non-profits, and government entities. Properly filling out these documents ensures accurate financial records and ensures that vendors are paid and employees receive their wages in a timely manner.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I edit accounts payable and payroll on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share accounts payable and payroll from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I complete accounts payable and payroll on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your accounts payable and payroll, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I edit accounts payable and payroll on an Android device?

The pdfFiller app for Android allows you to edit PDF files like accounts payable and payroll. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is accounts payable and payroll?

Accounts payable is the amount of money a company owes to its vendors for goods and services received. Payroll is the total amount of compensation a company pays to its employees.

Who is required to file accounts payable and payroll?

All businesses are required to file accounts payable and payroll in order to accurately track and report their financial obligations and employee compensation.

How to fill out accounts payable and payroll?

Accounts payable and payroll can be filled out using accounting software or manually by recording all invoices, expenses, and employee compensation accurately.

What is the purpose of accounts payable and payroll?

The purpose of accounts payable is to track and manage a company's outstanding debts to vendors. The purpose of payroll is to accurately compensate employees for their work.

What information must be reported on accounts payable and payroll?

Information such as vendor names, invoice numbers, payment due dates, employee names, hours worked, and compensation rates must be reported on accounts payable and payroll.

Fill out your accounts payable and payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Payable And Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.