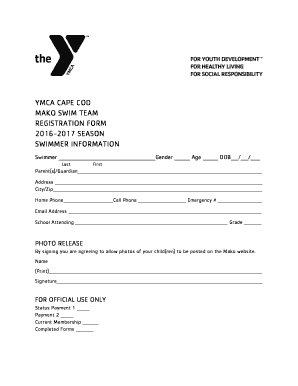

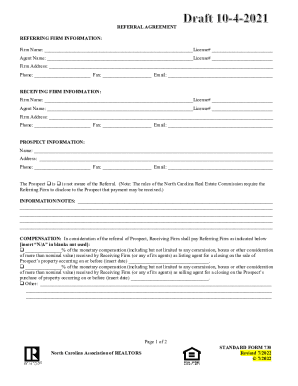

This is a Notice of Dishonored Check (Civil). A “dishonoreChehe” k” (also known as a “bounced check”“or “bad Che” k”) is a check which the bank will not pay because there is no such checking account, or there are insufficient funds in the account to pay the check. In order to attempt the greatest possible recovery on a dishonored check, the business owner, or any other person given a dishonored check, may be required by state law to notify the debtor that the check was dishonored.

Get the free NOTICE OF DISHONORED CHECK

Show details

This document serves as a formal notification regarding a dishonored check, detailing the check specifics, the consequences of non-payment, and the legal framework under which this notice is issued.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of dishonored check

Edit your notice of dishonored check form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of dishonored check form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out notice of dishonored check

How to fill out NOTICE OF DISHONORED CHECK

01

Obtain the NOTICE OF DISHONORED CHECK form from your state’s legal or financial office.

02

Fill in the date the check was issued.

03

Provide the name and contact information of the check writer.

04

Enter the amount of the check.

05

Specify the reason for dishonor (e.g., insufficient funds).

06

Include any relevant account or check details.

07

Sign and date the notice.

08

Send the notice to the check writer via certified mail.

Who needs NOTICE OF DISHONORED CHECK?

01

Creditors who have received a bounced check.

02

Business owners accepting checks as payment.

03

Individuals who have been issued a dishonored check.

Fill

form

: Try Risk Free

People Also Ask about

What is Dishonoured Cheque in English?

When a bank refuses to process a cheque you have submitted, it is known as a dishonour of cheque. This rejection can occur for reasons such as insufficient balance in an account, a signature mismatch, or a post-dated cheque.

What is a notice of Dishonour?

OF NOTICE OF DISHONOUR. Dishonour by non-acceptance. 91. A bill of exchange is said to be dishonoured by non-acceptance when the drawee, or one of several drawees not being partners, makes default in acceptance upon being duly required to accept the bill, or where presentment is excused and the bill is not accepted.

What is a notice of dishonored payment?

The Dishonored Check or Other Form of Payment Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.

What is a notice of dishonor of a cheque?

Notice of dishonour may be given to a duly authorised agent of the person to whom it is required to be given, or, where he has died, to his legal representative, or, where he has been declared an insolvent, to his assignee; may be oral or written; may, if written, be sent by post; and may be in any form; but it must

What happens if your IRS payment is returned?

If a payment is returned by your financial institution (e.g., due to insufficient funds, incorrect account information, closed account, etc.) the IRS will mail a Letter 4870 to the address we have on file for you, explaining why the payment could not be processed, and providing alternate payment options.

How do you write a dishonored check on a check stub?

1. Write Dishonored check $105.00 on the line under the heading “Other.” 2. Write the total of the dishonored check in the amount column.

What happens when a payment is dishonoured?

A direct debit dishonour means that a customer couldn't make a scheduled payment at the prearranged time. These payment failures are far less common than with other payment methods like credit cards, but there are some circumstances when a direct debit doesn't go through.

What does a dishonored payment mean?

The Dishonored Check or Other Form of Payment Penalty applies if you don't have enough money in your bank account to cover the payment you made for the tax you owe. Your bank dishonors and returns your bad check or electronic payment and declares the amount unpaid.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NOTICE OF DISHONORED CHECK?

A NOTICE OF DISHONORED CHECK is a formal notification that a check has been returned due to insufficient funds or other issues preventing it from being processed.

Who is required to file NOTICE OF DISHONORED CHECK?

The payee or the individual/business that received the check is typically required to file a NOTICE OF DISHONORED CHECK with the appropriate authorities or financial institutions.

How to fill out NOTICE OF DISHONORED CHECK?

To fill out a NOTICE OF DISHONORED CHECK, include the check details such as the check number, date, amount, payor's name, and the reason for dishonor. Sign and date the document before submitting it.

What is the purpose of NOTICE OF DISHONORED CHECK?

The purpose of a NOTICE OF DISHONORED CHECK is to formally communicate the non-payment of a check, allowing the payee to take necessary actions to recover funds or address the issue.

What information must be reported on NOTICE OF DISHONORED CHECK?

The information that must be reported includes the check number, date of issuance, amount of the check, the reason for dishonor, and the contact details of the payee and payor.

Fill out your notice of dishonored check online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Dishonored Check is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.