Get the free APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS - sba

Show details

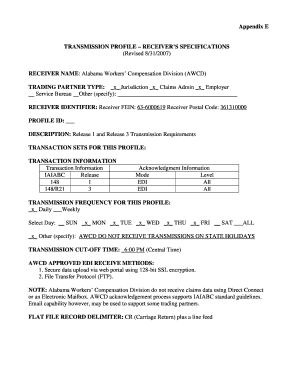

APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS Report Number Date Issued October 21 2009 10-03 of hazard insurance recoveries paid by Louisiana Citizens Property Insurance Corporation* We interviewed Office of Disaster Assistance ODA loan officers and case managersobtain Disaster Loan Processing and Disbursement that was used at Texastotoloanthean understanding loan disbursement. Where Center in Fort Worth of the insurance offset process prior approval and during insuranceof...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application of insurance offsets

Edit your application of insurance offsets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application of insurance offsets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application of insurance offsets online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application of insurance offsets. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application of insurance offsets

How to fill out APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS

01

Gather necessary documents: Collect all relevant insurance policies and documentation related to damages caused by the disaster.

02

Obtain a copy of the APPLICATION OF INSURANCE OFFSETS form: Download the application from the official website or request a physical copy.

03

Fill out personal information: Enter your name, contact information, and any other required personal details in the specified fields.

04

Describe the disaster: Provide a brief description of the disaster event and the impact it has had on your property.

05

Itemize damages: List all damages that occurred as a result of the disaster, including property types and estimated repair costs.

06

Insurance policy details: Include information about your insurance coverage, claim numbers, and the amount already received from insurance claims.

07

Review the application: Double-check all entries for accuracy and completeness to ensure it meets all requirements.

08

Submit the application: Send your completed application to the designated agency or office as instructed on the form.

Who needs APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS?

01

Individuals or businesses who have suffered losses due to disasters in the Gulf Coast region and have insurance coverage that may offset claimed damages.

02

Homeowners or property owners seeking financial assistance for repairs after receiving insurance settlements.

03

Non-profit organizations or community-focused entities that are trying to recover and rebuild from disaster-related losses.

Fill

form

: Try Risk Free

People Also Ask about

Can I spend my SBA loan on anything?

SBA 7(a) loans are to be used solely for working capital, business expansion, equipment purchases, and debt refinancing. There are additional SBA 7(a) loans specific to commercial real estate. Any use cases outside these areas are generally not allowed.

Can an SBA disaster loan be used for anything?

You may have been referred to SBA after applying for FEMA disaster assistance. If you still have unmet needs, loans may help with home repair or replacement, personal property, vehicles, mitigation, business losses, and working capital for small business and most private nonprofits.

Do you have to pay back a disaster loan?

Economic Injury Disaster Advance Grants Do You Need To Repay It?: No! This loan advance does not need to be repaid.

What can disaster loans be used for?

You may have been referred to SBA after applying for FEMA disaster assistance. If you still have unmet needs, loans may help with home repair or replacement, personal property, vehicles, mitigation, business losses, and working capital for small business and most private nonprofits.

What can a FEMA loan be used for?

FEMA assistance that may be available if you submit the SBA loan application includes disaster-related car repairs, essential household items and other disaster-related expenses. You do not have to accept the loan, and it is free to apply.

What insurance is needed for an SBA disaster loan?

A: Hazard insurance is a type of coverage required for an SBA loan. Hazard insurance protects your business property from fire, natural disasters, and other covered causes of loss.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS?

The APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS is a form used by individuals or businesses affected by disasters in the Gulf Coast region to report insurance proceeds and offsets related to disaster recovery loans.

Who is required to file APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS?

Individuals, businesses, and organizations that have received disaster loans as part of recovery efforts in the Gulf Coast region are required to file this application if they have received insurance payouts related to the disaster.

How to fill out APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS?

To fill out the application, you need to provide detailed information about the disaster loan, the insurance claims filed, any proceeds received, and how those funds will impact the disaster loan repayment. Specific sections must be completed accurately to ensure proper processing.

What is the purpose of APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS?

The purpose of this application is to ensure that any insurance proceeds are accounted for and appropriately offset against the disaster loans provided, preventing over-compensation and ensuring proper use of federal funds.

What information must be reported on APPLICATION OF INSURANCE OFFSETS FOR GULF COAST DISASTER LOANS?

Report any insurance payouts received, the nature of the damages covered, details of the disaster loan, and how the insurance proceeds will be used in relation to the disaster recovery efforts.

Fill out your application of insurance offsets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application Of Insurance Offsets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.