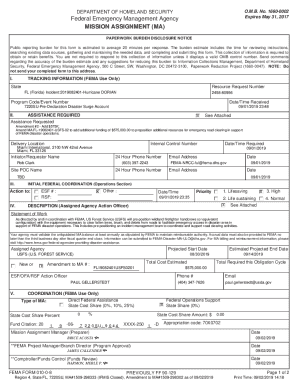

Get the free Annual Filing Requirements Summary

Show details

This document provides a summary of the annual filing requirements for charitable organizations required to register with the Charities Bureau, including filing instructions and applicable fees.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual filing requirements summary

Edit your annual filing requirements summary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual filing requirements summary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing annual filing requirements summary online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit annual filing requirements summary. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual filing requirements summary

How to fill out Annual Filing Requirements Summary

01

Gather all necessary financial documents, including income statements and expense reports.

02

Identify the specific forms required for your annual filing based on your business entity type and location.

03

Fill out the Annual Filing Requirements Summary form completely, ensuring all information is accurate.

04

Include any supporting documents or schedules that are required with the summary.

05

Review the completed summary for any errors or omissions before submission.

06

Submit the Annual Filing Requirements Summary to the appropriate governmental agency by the deadline.

Who needs Annual Filing Requirements Summary?

01

Individuals operating a business, including sole proprietors, partnerships, corporations, and LLCs.

02

Tax professionals and accountants assisting clients with their annual filings.

03

Non-profit organizations that are required to file annual reports to maintain their tax-exempt status.

04

Anyone needing to comply with state or local business regulations pertaining to annual filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of annual filing?

Annual Filing means any annual filing of financial information and operating data required to be filed pursuant to the Rule Undertakings and any other information which the City may elect to include in any such annual filing.

What is an annual summary?

A summary annual report is a condensed version of a company's full annual report. It provides an overview of the company's financial performance and key developments over the past year.

What is the annual filing called?

Annual reports (also called a form 10K by the SEC) typically include the following: A letter from the Chairman of the Board to the shareholders. Financial statements including sales, stock, and marketing data. Information about products and subsidiaries. A list of directors and officers of the company.

What does "annual summary" mean?

An annual summary is a document highlighting any charges, interest or refunds that have been applied to your current account(s) during a 12 month period.

What is required for an annual report?

Typically, however, the annual report must include, at a minimum: The company's legal name. In the case of a foreign company, the fictitious name it qualified under, if any. The principal office address in the state, if any.

What is an annual interest summary?

The Bank automatically sends out an Annual Interest Summary at the end of each tax year, which details the interest credited and any tax paid. You can use this to complete your tax return and you do not need a certificate of interest for this purpose.

How to write a summary annual report?

Tips for Writing Summary Annual Report Emails Lead with the good stuff. Don't make them hunt for the highlights. Make data beautiful. A wall of numbers can be a snooze. Add a human touch. Reports can feel impersonal. Tell them what to do next. Be direct with your call to action.

What is a summary of an annual report?

An annual report summary is what it sounds like: a summation of the key data in an annual report outside the confines of the report itself. Done right, an annual report summary also attracts an audience to the annual report itself by sharing key insights that invite further exploration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Filing Requirements Summary?

The Annual Filing Requirements Summary is a document that provides an overview of the various filing requirements that a business or individual must adhere to on an annual basis, including deadlines and relevant forms.

Who is required to file Annual Filing Requirements Summary?

Typically, all corporations, partnerships, and certain nonprofit organizations are required to file an Annual Filing Requirements Summary to comply with state and federal regulations.

How to fill out Annual Filing Requirements Summary?

To fill out the Annual Filing Requirements Summary, one must gather necessary financial and legal information, complete the required sections accurately, and submit the form before the specified deadlines, often accompanied by any additional documentation needed.

What is the purpose of Annual Filing Requirements Summary?

The purpose of the Annual Filing Requirements Summary is to ensure compliance with legal obligations and to provide relevant authorities with essential information regarding a business's operational status and financial health.

What information must be reported on Annual Filing Requirements Summary?

The information that must be reported includes business identification details, income statements, balance sheets, tax information, hours worked, and any other relevant financial data as specified by regulatory requirements.

Fill out your annual filing requirements summary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Filing Requirements Summary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.