Get the free SELF AUDIT

Show details

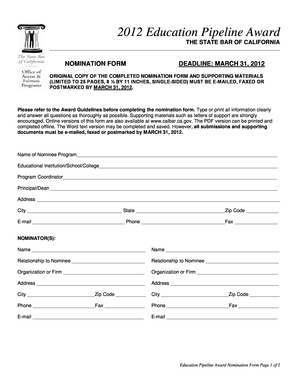

This document serves as a self-audit form for reporting gross wages, allowances, overtime wages, and other compensatory details required by FHM Insurance Company for workers' compensation audits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign self audit

Edit your self audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your self audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing self audit online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit self audit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out self audit

How to fill out SELF AUDIT

01

Gather relevant financial documents and records.

02

Identify the purpose of the self-audit.

03

Create a checklist of items to review based on the audit objectives.

04

Review income statements, balance sheets, and cash flow statements.

05

Check for discrepancies or errors in your records.

06

Evaluate internal controls and processes.

07

Document findings and observations.

08

Prepare a summary report of the self-audit.

09

Take corrective actions if necessary.

10

Maintain records of the audit process for future reference.

Who needs SELF AUDIT?

01

Individuals managing personal finances.

02

Small business owners assessing their financial health.

03

Non-profit organizations ensuring compliance with regulations.

04

Anyone preparing for an external audit.

05

Individuals seeking to improve financial literacy and management.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of audit in English?

Examples of audit in a Sentence You will need all your records if you are selected for audit by the IRS. Verb They audit the company books every year. The Internal Revenue Service audited him twice in 10 years. I audited an English literature class last semester.

What are the 4 types of audit?

The four types of audits are financial audits, internal audits, compliance audits, and performance audits. Financial audits examine the accuracy of financial statements and records. Internal audits evaluate an organization's internal controls and risk management processes.

What is the purpose of a self-audit?

The main objectives of a self-audit are to conduct an honest assessment of your current state and capabilities, identify gaps in your knowledge or skill set and create a strategy essential for further personal development.

How do you conduct a self-audit?

Step One–Identify the Risks. Regardless of the method, a risk assessment seeks measureable answers to two key questions: Step Two–Audit the Risks: Review Standards and Procedures. Step Three–Audit the Risks: Review Claims. Step Four–Document, Document, Document the Audit. Step Five–Review, Act on, and Measure the Results.

What is a self-audit?

A self-audit is an audit, examination, review, or other inspection performed both by and within a given health care practice. or business. Self-audits generally focus on assessing, correcting, and maintaining controls to promote compliance with. applicable laws, rules, and regulations.

What is a self-audit checklist?

The self-audit checklist is intended solely as a compliance assistance tool. The audit checklist is intended to be used in conjunction with the compliance guidance, which explains the practical requirements of the regulations.

How to make a self-audit?

As you self-audit, maintain unconditional positive regard for yourself. That means offering compassion to yourself even if you feel you've done wrong or could have handled something better this past year. Look at yourself with curiosity, not contempt. Judgment and shame only elicit defensiveness.

What is the meaning of self-audit?

Self-audit means an analysis conducted internally by any official not involved in the daily transactions of the entity or by an independent party, with the assistance of the entity, and certified by an officer, to verify the correctness of transaction recording and to provide.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SELF AUDIT?

A self audit is a process where individuals or organizations evaluate their own financial reporting, internal controls, and compliance with laws and regulations to ensure accuracy and transparency.

Who is required to file SELF AUDIT?

Typically, businesses and individuals that meet certain criteria set by tax authorities or regulatory bodies are required to file a self audit, including those with significant income, complex transactions, or specific industry requirements.

How to fill out SELF AUDIT?

To fill out a self audit, one must gather relevant financial documents, assess compliance with applicable regulations, verify the accuracy of financial statements, and complete the necessary audit forms as required by governing authorities.

What is the purpose of SELF AUDIT?

The purpose of a self audit is to identify discrepancies, improve compliance, enhance internal controls, and provide assurance to stakeholders about the integrity of financial records.

What information must be reported on SELF AUDIT?

Information that must be reported on a self audit typically includes financial statements, compliance details, disclosures regarding internal controls, and any discrepancies or corrective actions taken.

Fill out your self audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Self Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.