Get the free ROLLOVER IN REQUEST

Show details

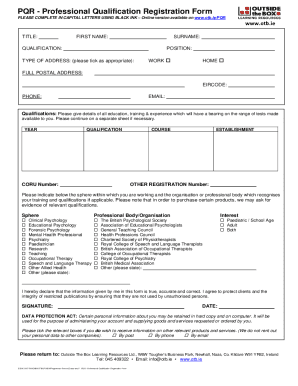

This document is intended for individuals wishing to initiate a rollover or transfer of pre-tax funds into the Deferred Compensation Program (DCP). It includes instructions for the completion of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rollover in request

Edit your rollover in request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rollover in request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rollover in request online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rollover in request. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rollover in request

How to fill out ROLLOVER IN REQUEST

01

Start by gathering necessary information such as account details and the amount to roll over.

02

Open the ROLLOVER IN REQUEST form.

03

Fill in your personal information, including your name and contact details.

04

Provide details of the account from which you are rolling over funds.

05

Indicate the type of account to which the funds will be rolled over.

06

Specify the exact amount to be rolled over.

07

Review all the information filled in for accuracy.

08

Sign and date the request form.

09

Submit the form to the appropriate financial institution or department.

Who needs ROLLOVER IN REQUEST?

01

Individuals with retirement accounts wishing to transfer funds without tax penalties.

02

Employees changing jobs and needing to roll over their 401(k) plans.

03

Investors looking to consolidate retirement accounts.

Fill

form

: Try Risk Free

People Also Ask about

What is the purpose of a rollover?

The basics As you switch jobs or retire, an IRA rollover allows you to keep potential tax benefits and move funds to an account that can offer more investment options and flexibility than many employer-sponsored retirement plans.

What is rollover in English?

a : the act of delaying the payment of a debt. b : the act of placing invested money in a new investment of the same kind — see also roll over at 1roll. 2. chiefly US : an accident in which a car, truck, etc., turns over. He was injured in a rollover (accident) on the highway.

What is a rollover request?

Most pre-retirement payments you receive from a retirement plan or IRA can be “rolled over” by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

What does rollover mean?

A rollover is the process of keeping a position open beyond its expiry. The term is commonly used in forex, where it is used to explain the possible interest that may be earned or incurred for holding a position over night. However, rollover has a variety of meanings in finance.

What is the difference between a transfer and a rollover?

What is the difference between a transfer and a rollover? A transfer is used to move funds from one institution to another without changing the account type. A direct rollover is used to move funds from an employer plan to another account type like an IRA, without having to pay taxes.

What does rollover mean in banking?

In other words, a rollover is borrowing under the same facility to repay existing debt that is coming due.

What does it mean to request a rollover?

A rollover is when you move funds from one eligible retirement plan to another, such as from a 401(k) to a Traditional IRA or Roth IRA. Rollover distributions are reported to the IRS and may be subject to federal income tax withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ROLLOVER IN REQUEST?

A ROLLOVER IN REQUEST is a formal application submitted to transfer funds from one retirement account to another without incurring tax penalties.

Who is required to file ROLLOVER IN REQUEST?

Individuals who wish to transfer their retirement savings from one account to another, such as from a 401(k) to an IRA, are required to file a ROLLOVER IN REQUEST.

How to fill out ROLLOVER IN REQUEST?

To fill out a ROLLOVER IN REQUEST, provide your personal information, details of the accounts involved, and specify the amount to be rolled over. Ensure all required fields are filled and submit it to the appropriate financial institution.

What is the purpose of ROLLOVER IN REQUEST?

The purpose of a ROLLOVER IN REQUEST is to enable individuals to transfer their retirement assets while maintaining the tax-advantaged status of their funds.

What information must be reported on ROLLOVER IN REQUEST?

The ROLLOVER IN REQUEST must report personal details such as name, address, Social Security number, account numbers of both the old and new accounts, and the amount being rolled over.

Fill out your rollover in request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rollover In Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.