Get the free Business Credit Application - 360 Digital Imaging Solutions

Show details

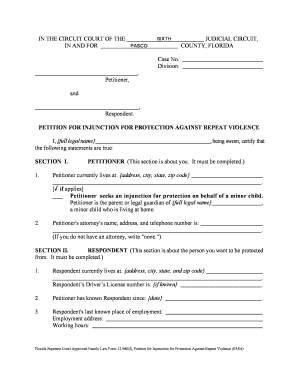

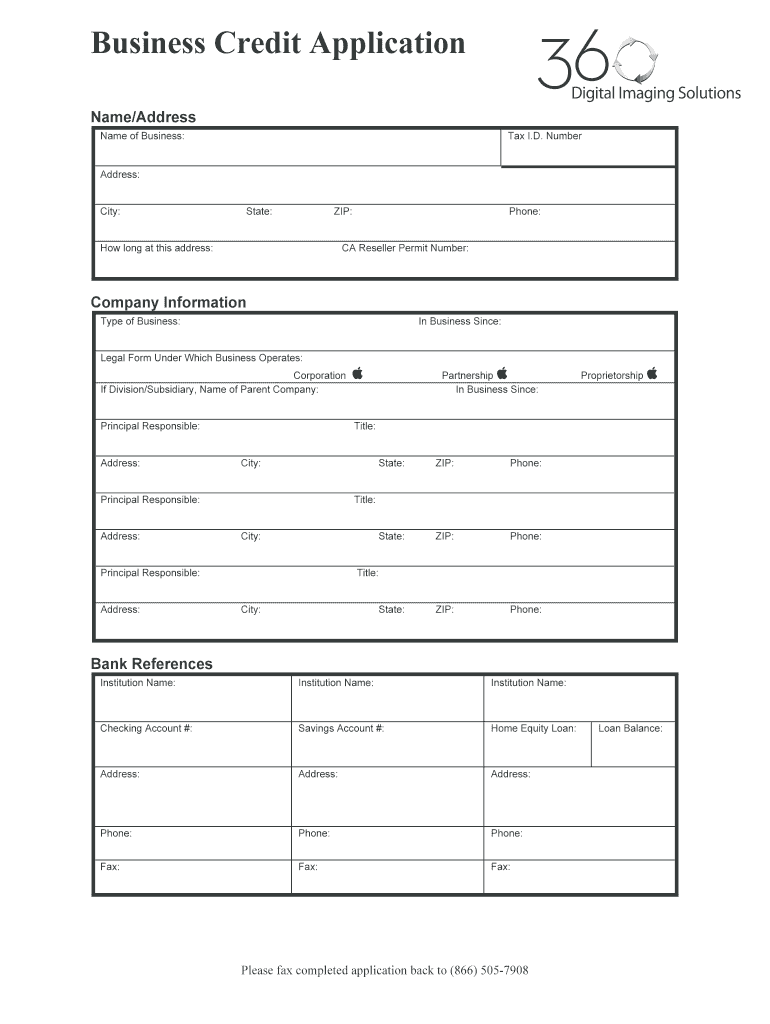

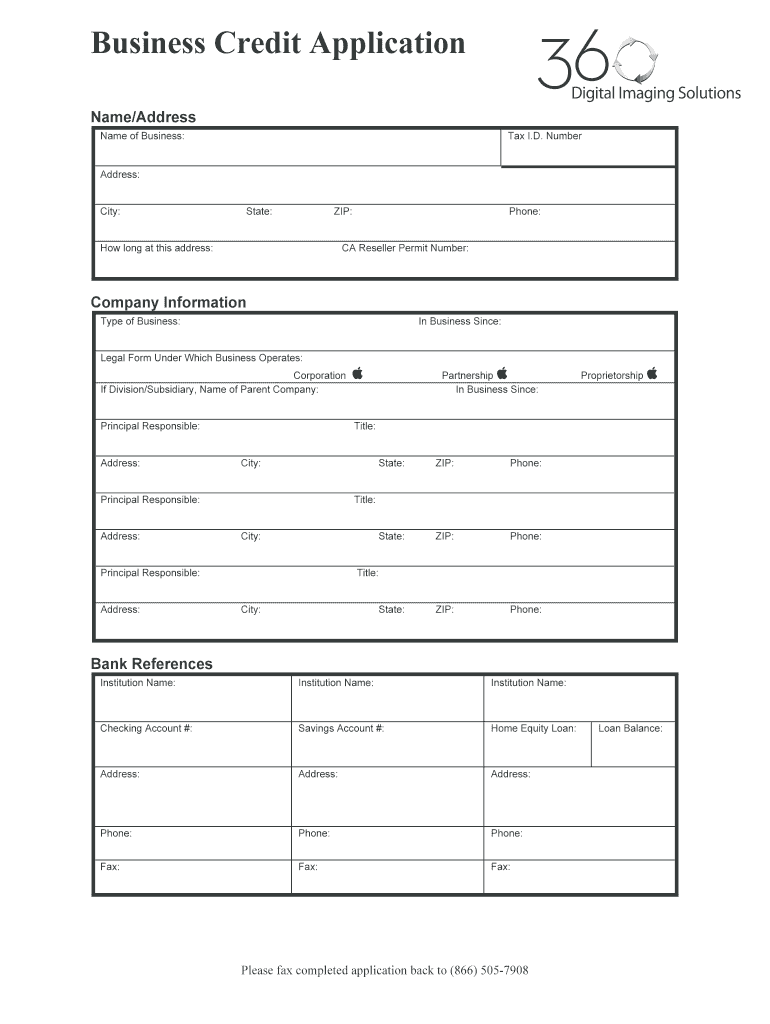

Business Credit Application Name×Address Name of Business: Tax I.D. Number Address: City: State: ZIP: How long at this address: Phone: CA Reseller Permit Number: Company Information Type of Business:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business credit application

Edit your business credit application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business credit application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

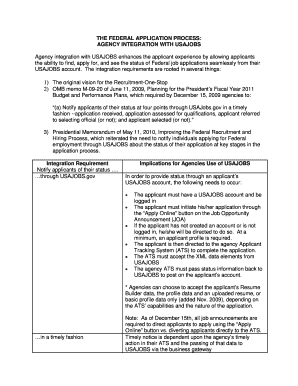

Editing business credit application online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business credit application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business credit application

How to fill out a business credit application:

01

Gather all necessary documentation: Before starting the application, make sure you have all the required documents such as identification, business licenses, financial statements, and tax returns. Having these ready will save you time and ensure accuracy during the application process.

02

Provide accurate business information: Start by entering your business name, address, phone number, and other contact details. Double-check the information before submitting to ensure accuracy.

03

Describe your business: In this section, you will be asked to provide detailed information about your business. Include relevant details such as the nature of your business, the industry you operate in, and the number of years you have been in operation.

04

Financial information: This section usually requires you to provide your business's financial information, including annual revenues, monthly expenses, and any outstanding debts. Be thorough and accurate in disclosing this information as it plays a crucial role in the credit decision process.

05

Personal information: As the owner or authorized representative of the business, you will need to provide personal information, such as your name, social security number, and contact details. This is necessary for the lender to evaluate your creditworthiness.

06

References: Some business credit applications may require you to provide references. These can be suppliers, customers, or other businesses that can vouch for your creditworthiness and ability to fulfill financial obligations.

07

Review and submit: Take the time to review all the information you have entered to ensure accuracy and completeness. Once you are confident everything is correct, submit the application to the lender. Keep a copy for your records.

Who needs a business credit application?

01

Startups and new businesses: If you are a startup or a new business with limited financial history, a business credit application can help you establish creditworthiness and access financing opportunities.

02

Established businesses: Even if your business has been operating for a while, having a business credit application on hand is beneficial for potential future financing needs. It allows you to apply for loans, credit lines, or credit cards easily when the need arises.

03

Business owners seeking partnerships or vendor relationships: Some partnerships or vendor agreements may require a credit application for evaluation purposes. Having a business credit application readily available can make the process smoother and expedite potential agreements.

In summary, filling out a business credit application involves gathering necessary documentation, providing accurate business and personal information, and being thorough in disclosing financial details. Both startups and established businesses may need a business credit application to establish creditworthiness, access funding opportunities, and facilitate partnerships or vendor relationships.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I fill out business credit application on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your business credit application. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Can I edit business credit application on an Android device?

You can edit, sign, and distribute business credit application on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

How do I complete business credit application on an Android device?

Complete business credit application and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

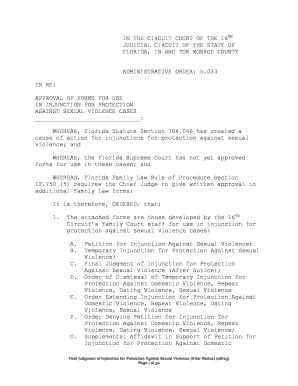

What is business credit application?

A business credit application is a form that businesses fill out to apply for credit or financing from vendors or financial institutions.

Who is required to file business credit application?

Businesses that are looking to obtain credit or financing are required to file a business credit application.

How to fill out business credit application?

To fill out a business credit application, businesses typically need to provide information about their company, financial history, and credit references.

What is the purpose of business credit application?

The purpose of a business credit application is to help lenders assess the creditworthiness of a business and make a decision on whether to extend credit.

What information must be reported on business credit application?

Information that must be reported on a business credit application may include company details, financial statements, tax ID numbers, credit references, and banking information.

Fill out your business credit application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Credit Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.