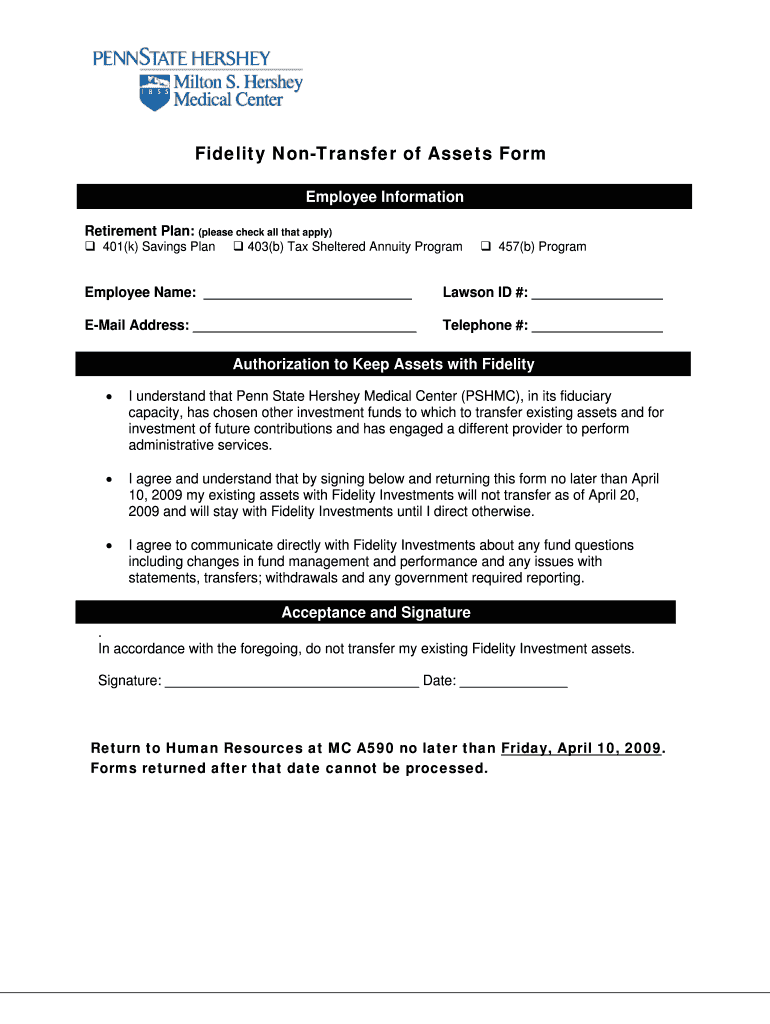

Get the free Fidelity Non-Transfer of Assets Form

Show details

This form is used by employees to authorize that their existing assets with Fidelity Investments will not be transferred and will remain with Fidelity until further instructions are given by the employee.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fidelity non-transfer of assets

Edit your fidelity non-transfer of assets form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fidelity non-transfer of assets form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit fidelity non-transfer of assets online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit fidelity non-transfer of assets. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fidelity non-transfer of assets

How to fill out Fidelity Non-Transfer of Assets Form

01

Obtain the Fidelity Non-Transfer of Assets Form from the Fidelity website or your financial advisor.

02

Read the instructions carefully provided on the form.

03

Fill out the account holder's personal information in the designated fields, including your name, address, and contact details.

04

Provide the details of the assets you are requesting not to be transferred, such as account numbers and types of assets.

05

Indicate the reason for the non-transfer request in the appropriate section.

06

Review the completed form for any errors or missing information.

07

Sign and date the form where required.

08

Submit the form to Fidelity via the specified method, such as mail or online submission.

Who needs Fidelity Non-Transfer of Assets Form?

01

Individuals or entities who wish to prevent the transfer of certain assets held within Fidelity accounts.

02

Account holders who are in the process of closing their accounts but want to retain specific assets.

03

Clients facing a financial situation requiring them to restrict asset transfers for safety or legal reasons.

Fill

form

: Try Risk Free

People Also Ask about

How do I cancel a transfer of assets on Fidelity?

There is no guarantee that a transfer can be canceled. For Electronic Funds Transfer requests for eligible mutual fund accounts, you can select Attempt to Cancel from the Orders page, or you may call a Fidelity representative at 800-544-6666 to attempt to cancel the request.

Why is my Fidelity account ineligible for EFT?

The most common reason why you'd see an ``ineligible'' error message for the Electronic Funds Transfer (EFT) feature is that the account is restricted. With that said, in order to confirm and provide appropriate instructions to correct the issue, we would need to review the account in a secure channel.

What is transfer of assets Fidelity?

A transfer of assets (TOA) is when you transfer all or part of an account from one financial firm to another without selling your holdings.

Why is my Fidelity account restricted for transfers?

The account is restricted to purchasing securities only when a client has sufficient settled cash in the account at the time of purchase. This restriction also prevents a client from transferring cash or shares between Fidelity accounts online.

Why is my bank account not eligible for transfer?

Insufficient funds. You have incorrect routing and/or account numbers listed. You may be doing an ACH transfer when the other financial institution only accepts wire transfers. You do not have the correct business or personal name, address information listed. Your account does not have online transfer capabilities.

What Fidelity accounts are not eligible for transfer?

All Fidelity brokerage and mutual fund accounts are eligible for electronic funds transfer (EFT), with the exception of self-employed 401(k) plans, self-directed brokerage accounts, SIMPLE IRAs, Fidelity Retirement plans (Keogh), and non-prototype accounts.

Why is my Fidelity account ineligible for linking to a bank?

Some common causes of an external bank account not linking are incorrect bank instructions (account and routing number), a name mismatch, the bank account being owned by an entity (like a business account, for example), or your financial institution is unable to link to Fidelity through the Real-Time Verification (RTV)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fidelity Non-Transfer of Assets Form?

The Fidelity Non-Transfer of Assets Form is a document used to indicate that certain assets held in an account at Fidelity cannot be transferred to another financial institution or account.

Who is required to file Fidelity Non-Transfer of Assets Form?

Typically, investors or account holders who wish to ensure that specific assets are not transferred or are only to remain with Fidelity must file this form.

How to fill out Fidelity Non-Transfer of Assets Form?

To fill out the form, provide your personal information, account details, and specify the assets that are non-transferable, then sign and date the document.

What is the purpose of Fidelity Non-Transfer of Assets Form?

The purpose of the form is to legally document the account holder's wishes regarding the handling and transferability of their assets within Fidelity.

What information must be reported on Fidelity Non-Transfer of Assets Form?

The information required includes personal identification details, account number, the specific assets to be restricted from transfer, and any necessary signatures.

Fill out your fidelity non-transfer of assets online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fidelity Non-Transfer Of Assets is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.