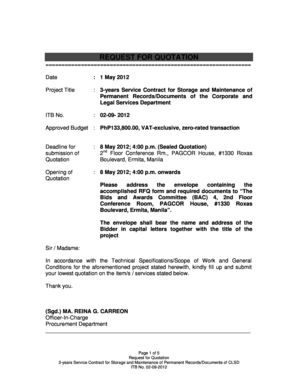

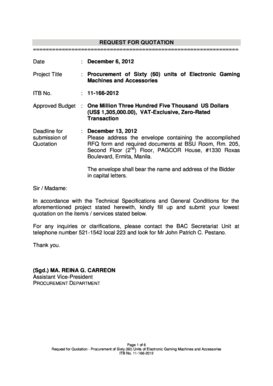

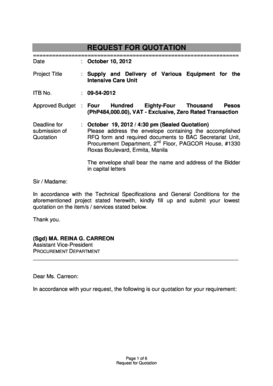

Get the free IRA Beneficiary Designation Form

Show details

Complete this form to add or change beneficiary information on your existing IRA account(s).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira beneficiary designation form

Edit your ira beneficiary designation form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira beneficiary designation form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira beneficiary designation form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ira beneficiary designation form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira beneficiary designation form

How to fill out IRA Beneficiary Designation Form

01

Obtain the IRA Beneficiary Designation Form from your financial institution or download it from their website.

02

Read the instructions on the form carefully to understand the requirements.

03

Provide your personal information, including your name, address, and Social Security number.

04

List the primary beneficiaries you wish to designate, including their names, addresses, and Social Security numbers.

05

Specify the percentage of the IRA you want each beneficiary to receive, ensuring the total equals 100%.

06

If desired, list contingent beneficiaries who will inherit the IRA if primary beneficiaries are unavailable.

07

Sign and date the form to confirm your selections.

08

Submit the completed form to your financial institution according to their submission guidelines.

Who needs IRA Beneficiary Designation Form?

01

Anyone who has an Individual Retirement Account (IRA) should complete a Beneficiary Designation Form.

02

Individuals who want to ensure their IRA assets are distributed according to their wishes upon their death.

03

Those who have experienced life events (e.g., marriage, divorce, birth of a child) and need to update their beneficiary designations.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I don't designate a beneficiary on my IRA?

If you don't designate beneficiaries for your IRA, your assets will pass to your spouse (if you're married at the time of your death) or your estate (if you're not married at the time of your death). A beneficiary receives your assets after your death.

What does it mean to be an IRA beneficiary?

Beneficiaries of retirement plan and IRA accounts after the death of the account owner are subject to required minimum distribution (RMD) rules. A beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an IRA after they die.

How to claim an IRA as a beneficiary?

Inheriting an IRA 1: Notify us of a death. Start the inheritance process by notifying us of a death, including the option to upload a death certificate if you have one. 2: Open an inherited IRA. Open the same type of IRA account you're inheriting (Roth or traditional). 3: Inherit the money.

Do I need to fill out a beneficiary form?

Forms for Designations We recommend that you designate beneficiaries to receive your life insurance benefits. However, if you are happy with the order of precedence(PDF file), you don't have to do anything.

What is the correct way to title an inherited IRA?

Inherited IRA Account Title If John Doe passes away, leaving his IRA to his daughter Jane Doe, the account should be titled something like, “John Doe (deceased June 2019) Inherited IRA FBO of Jane Doe, Beneficiary.” The deceased owner's name and the words “inherited IRA” or “beneficiary” must be in there.

How do I fill out a beneficiary designation form?

Provide the following information on the beneficiary designation: The full name of the trust as it shows on the trust document. The date the trust was created. The name of the trustee, followed by the word “trustee”, or if you cannot provide a trustee, ETF may accept another contact person. The trustee's address.

What is an IRA beneficiary form?

This form may be used to designate one or more beneficiaries for an IRA or a 403(b)(7) account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA Beneficiary Designation Form?

The IRA Beneficiary Designation Form is a document that allows an individual to specify who will receive the assets in their Individual Retirement Account (IRA) upon their death.

Who is required to file IRA Beneficiary Designation Form?

The account holder of the IRA is required to file the IRA Beneficiary Designation Form to ensure their chosen beneficiaries are recognized.

How to fill out IRA Beneficiary Designation Form?

To fill out the IRA Beneficiary Designation Form, the account holder must provide their personal information, list the names and details of the beneficiaries, specify the percentage of the IRA to be distributed to each beneficiary, and sign the form.

What is the purpose of IRA Beneficiary Designation Form?

The purpose of the IRA Beneficiary Designation Form is to clearly document the account holder's wishes regarding who will inherit their IRA assets, avoiding potential disputes among heirs.

What information must be reported on IRA Beneficiary Designation Form?

The information reported on the IRA Beneficiary Designation Form includes the account holder's details, beneficiary names, contact information, relationship to the account holder, and the allocation of assets among beneficiaries.

Fill out your ira beneficiary designation form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Beneficiary Designation Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.