Get the free Payroll Conversion

Show details

This document serves as a payroll conversion form for the Diocese of St. Petersburg, collecting client information for payroll processing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payroll conversion

Edit your payroll conversion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payroll conversion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payroll conversion online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit payroll conversion. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payroll conversion

How to fill out Payroll Conversion

01

Gather all employee data including personal details, salary information, and banking details.

02

Obtain the historical payroll data for the past periods to ensure accurate calculations.

03

Choose a payroll conversion method, such as a direct transfer or phased approach.

04

Input employee data into the new payroll system, ensuring all fields are completed accurately.

05

Verify the configuration settings in the new payroll system to match the company’s payroll policies.

06

Run test payroll calculations to identify any discrepancies and correct them before going live.

07

Ensure proper documentation and training for staff on the new payroll system.

08

Launch the new payroll system and monitor the first few payroll cycles to resolve any issues.

Who needs Payroll Conversion?

01

Companies transitioning to a new payroll system.

02

Businesses acquiring another company and integrating payroll systems.

03

Organizations updating their payroll to comply with new legislation.

04

Employers looking to improve efficiency and functionality of payroll processes.

Fill

form

: Try Risk Free

People Also Ask about

How do you explain payroll?

It involves everything from tracking employee hours and factoring in overtime or bonus pay to deducting taxes, insurance, benefits, and other deductions as required by federal and state law. In addition, it covers required federal and state report filings.

What is the English conversion?

conversion noun (CHANGE) the process of converting something from one thing to another: conversion of something into something Solar power is the conversion of the sun's energy into heat and electricity. C2 [ C or U ]

What is HR or payroll?

The main function of human resources is to take care of employee relations, while the payroll function deals with the financial compensation of those employees and the process by which they get paid. These two departments have distinct responsibilities in an organization, however they do have areas where they overlap.

What do you mean by payroll?

Payroll is the total of all compensation a business must pay to its employees for a set period of time or on a given date. It is usually managed by the accounting or human resources department of a business. Small-business payroll is run by the owner or an associate.

What is the meaning of payroll in USA?

In a nutshell, payroll is the total recompense that a company is obliged to pay to its employees for their services. Companies can offer weekly pay, biweekly pay, or monthly pay depending on their business payroll policy. Payroll includes salaries, wages, deductions, bonuses and net pay.

How to use the word payroll?

How to Use payroll in a Sentence They cut him from their payroll. Businesses are keeping their payrolls low by embracing new technologies. He's the manager of a baseball team with a $50 million payroll. The Rays' payroll ranks 28th among the 30 major-league teams.

What is payroll in English?

Payroll is the total of all compensation a business must pay to its employees for a set period of time or on a given date. It is usually managed by the accounting or human resources department of a business.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

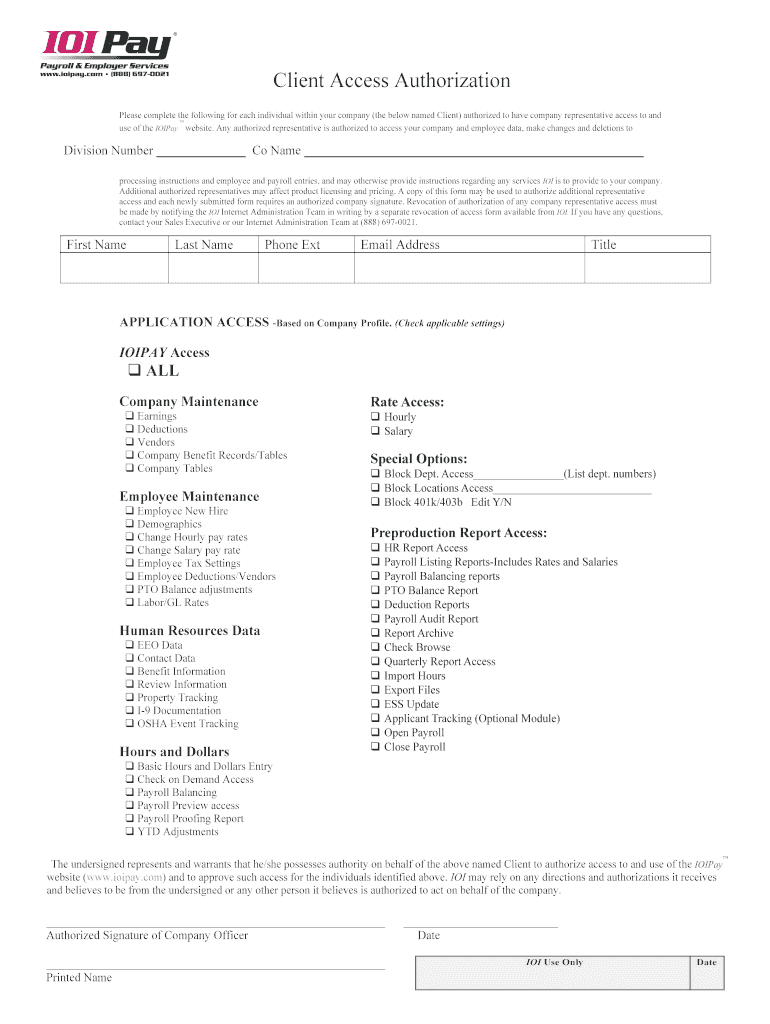

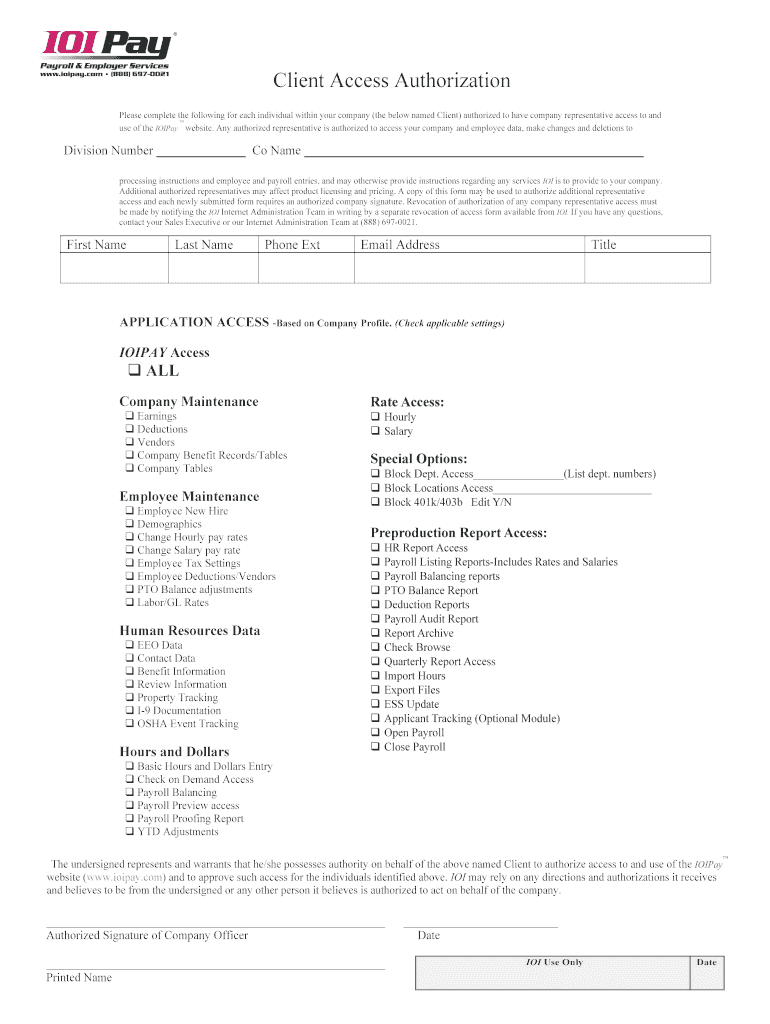

What is Payroll Conversion?

Payroll Conversion is the process of transitioning payroll data from one payroll system to another, ensuring that all employee compensation, tax information, and deductions are accurately transferred.

Who is required to file Payroll Conversion?

Employers or businesses that are switching payroll systems or making significant changes to their payroll processes are required to file Payroll Conversion to ensure compliance and accurate reporting.

How to fill out Payroll Conversion?

To fill out Payroll Conversion, you need to gather relevant employee payroll data, complete the necessary forms with accurate information, and provide details such as employee earnings, tax withholdings, and previously reported payroll data.

What is the purpose of Payroll Conversion?

The purpose of Payroll Conversion is to ensure a smooth and accurate transfer of payroll data between systems, minimize errors, and maintain compliance with tax regulations and reporting requirements.

What information must be reported on Payroll Conversion?

Payroll Conversion must report information such as employee names, Social Security numbers, earnings, tax withholdings, deductions, and any other relevant payroll data that ensures a complete transfer.

Fill out your payroll conversion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payroll Conversion is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.