Get the free Official Form 4

Show details

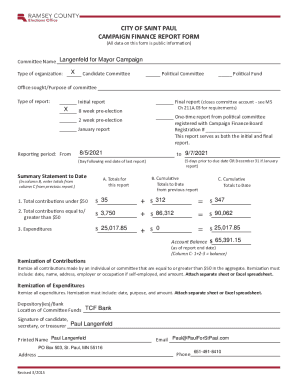

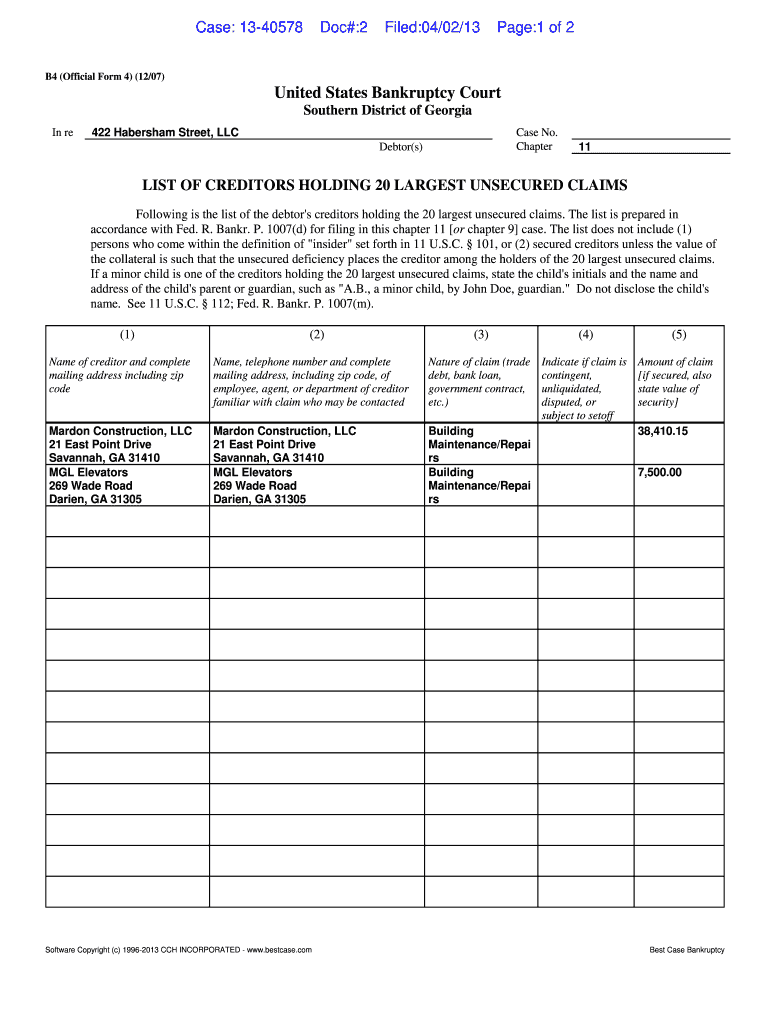

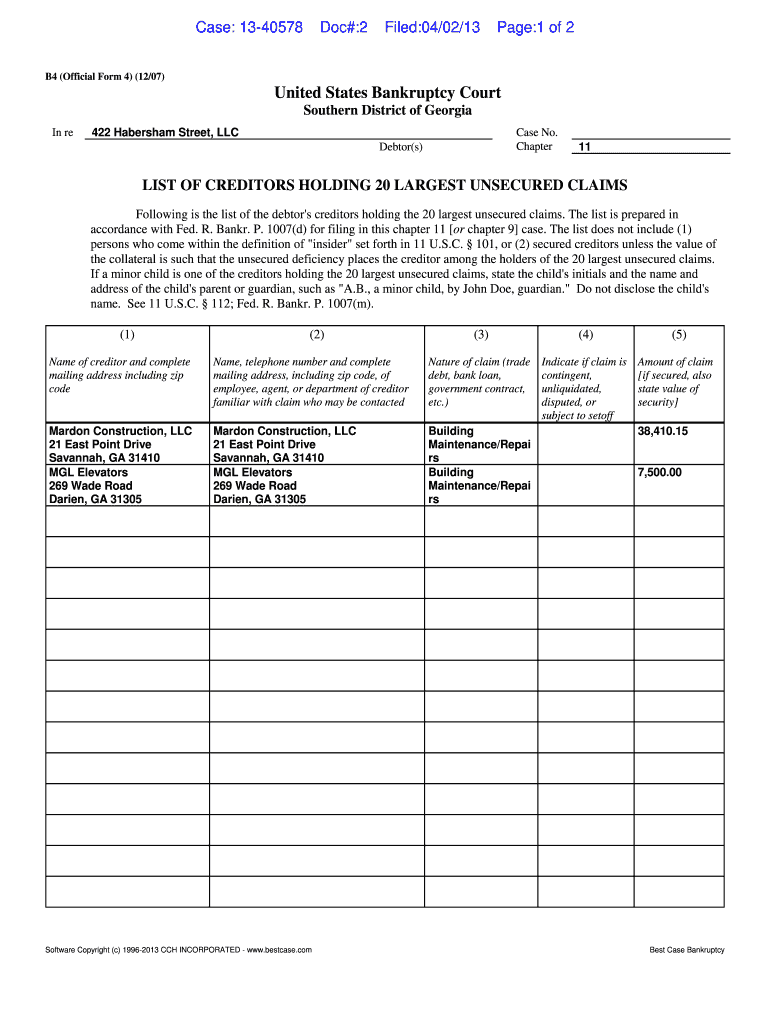

This document is a list prepared in accordance with bankruptcy rules for filing in a Chapter 11 case, detailing the creditors holding the largest unsecured claims against the debtor.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign official form 4

Edit your official form 4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your official form 4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit official form 4 online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit official form 4. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out official form 4

How to fill out Official Form 4

01

Download the Official Form 4 from the designated website.

02

Read the instructions carefully before filling out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact details.

04

Provide any necessary identification numbers or references as required by the form.

05

Fill out the sections that pertain to your specific situation or request.

06

Review all your entries to ensure accuracy and completeness.

07

Sign and date the form in the specified area.

08

Submit the completed form through the prescribed method (online, by mail, or in person).

Who needs Official Form 4?

01

Individuals applying for certain licenses or permits.

02

Organizations seeking official acknowledgment for specific purposes.

03

Professionals required to furnish legal documents.

04

Anyone fulfilling governmental or regulatory requirements.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to fill out ss4 form?

Use Form SS-4 to apply for an employer identification number (EIN). An EIN is a 9-digit number (for example, 12-3456789) assigned to employers, sole proprietors, corporations, partnerships, estates, trusts, certain individuals, and other entities for tax filing and reporting purposes.

What is a Form 4 for Section 16?

Anyone who is a Section 16 insider of a reporting company must file a Form 4 with the SEC under Section 16 of the Exchange Act to report any changes in the filer's beneficial ownership of any class of the company's equity securities after the filer executes a transaction.

Who is eligible for Form S-4?

This Form may be used for registration under the Securities Act of 1933 (“Securities Act”) of securities to be issued (1) in a transaction of the type specified in paragraph (a) of Rule 145 (§230.145 of this chapter); (2) in a merger in which the applicable state law would not require the solicitation of the votes or

Who has to file form 4s?

In most cases, when an insider executes a transaction, he or she must file a Form 4. With this form filing, the public is made aware of the insider's various transactions in company securities, including the amount purchased or sold and the price per share.

What is Form 4 in the USA?

Form 4 is a United States SEC filing that relates to insider trading.

What triggers a Form 4 filing?

Form 4 must be filed with the Securities and Exchange Commission whenever there is a material change in the holdings of company insiders. If a party fails to disclose required information on a Form 4, civil or criminal actions could result.

Who is required to file Form 4S?

The SEC requires an S-4 filing from any publicly traded company undergoing a merger or an acquisition. This form must also be filed in bankruptcy situations when there is an exchange offer on the table, and during hostile takeovers. The form must be filed regardless of the underlying purpose of the merger.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Official Form 4?

Official Form 4 is a legal document used in bankruptcy proceedings, specifically for reporting information about the debtor's financial status and any related parties involved.

Who is required to file Official Form 4?

Individuals and entities that are filing for Chapter 7 or Chapter 13 bankruptcy are required to file Official Form 4 along with their bankruptcy petitions.

How to fill out Official Form 4?

To fill out Official Form 4, debtors must provide personal information, details about their financial affairs, including income, expenses, debts, and assets. The form must be filled out completely and accurately, and signed before submission.

What is the purpose of Official Form 4?

The purpose of Official Form 4 is to provide the bankruptcy court with a comprehensive overview of the debtor's financial situation, allowing the court to assess the debtor's eligibility for bankruptcy relief and to understand the extent of their financial obligations.

What information must be reported on Official Form 4?

The information that must be reported on Official Form 4 includes the debtor's personal details, income sources, monthly expenses, a list of creditors, the amount of debts owed, and details of any assets owned.

Fill out your official form 4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Official Form 4 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.