Get the free IRS Form 8821 - sba

Show details

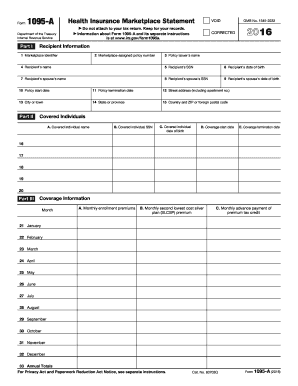

Have you filed all required Federal income tax returns If not have you filed for an approved IRS extension If the answer to both questions above is no SBA WILL NOT process your application for disaster assistance until this requirement has been met. INSTRUCTIONS FOR COMPLETING FORM 8821 Completing this document is as easy as A-B-C A. B. C. Write your name s and address in block 1. Next write your Social Security Number s. If you are a corporation or a partnership write the Employer...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irs form 8821

Edit your irs form 8821 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irs form 8821 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irs form 8821 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit irs form 8821. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 8821

How to fill out IRS Form 8821

01

Obtain IRS Form 8821 from the IRS website or a tax professional.

02

Fill in the name and social security number or employer identification number of the taxpayer.

03

Specify the designation of the representative by providing their name and contact information.

04

Indicate the specific tax matters and years or periods for which the authorization is valid.

05

Sign and date the form to validate it.

06

Mail or fax the completed form to the appropriate IRS office as indicated in the instructions.

Who needs IRS Form 8821?

01

Taxpayers who want to authorize someone to receive their confidential tax information from the IRS.

02

Individuals seeking to allow a tax preparer or representative to handle IRS matters on their behalf.

Fill

form

: Try Risk Free

People Also Ask about

Is form 8821 a power of attorney?

IRS Form 8821, Tax Information Authorization, allows you certain access to your client's information. In that way, it is similar to a power of attorney but grants less authority. The biggest difference between Form 2848 and Form 8821 is that the latter does not allow you to represent your client to the IRS.

Can you fill out IRS forms by hand?

The handwriting must be completely legible using black ink block letters to avoid processing errors. The IRS says, “Although handwritten forms are acceptable, they must be completely legible and accurate to avoid processing errors. Handwritten forms often result in name/TIN mismatches.”

Can a non-CPA represent you before the IRS?

Uncredentialed preparers currently have limited practice rights. They may only represent clients whose returns they prepared and signed, but only before IRS revenue agents, customer service representatives and similar IRS employees, including employees in the Taxpayer Advocate Service.

Who can certify documents for the IRS?

You can submit certified copies of original documents if you have: The original issuing agency certify the original document. Contact them for details. Officers at U.S. embassies and consulates overseas provide certification and authentication services.

What do you need to be a contact representative for the IRS?

The qualifications you need to begin a contact representative career with the IRS include a high school diploma and a mix of accounting and customer service skills. Candidates who have completed at least some college coursework or earned a degree in accounting, finance, or a similar field of study are highly desirable.

Who can be an authorized representative for the IRS?

The third party can be a family member or friend, a tax professional, attorney or business, depending on the authorization. There are different types of third party authorizations: Power of Attorney - Allow someone to represent you in tax matters before the IRS.

Who can be an authorized representative on 2848?

The individual you authorize must be a person eligible to practice before the IRS. You may authorize a student who works in a qualified Low Income Taxpayer Clinic (LITC) or Student Tax Clinic Program (STCP) to represent you under a special appearance authorization issued by the Taxpayer Advocate Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRS Form 8821?

IRS Form 8821 is a form used to authorize an individual or organization to receive confidential tax information from the IRS on behalf of the taxpayer.

Who is required to file IRS Form 8821?

Any taxpayer who wishes to designate a person or organization to receive their tax information from the IRS should file Form 8821.

How to fill out IRS Form 8821?

To fill out Form 8821, provide the taxpayer's information, details of the person or organization being authorized, specify the types of tax information requested, and sign the form.

What is the purpose of IRS Form 8821?

The purpose of IRS Form 8821 is to give authorization to another party to receive tax information from the IRS, helping streamline communication regarding tax matters.

What information must be reported on IRS Form 8821?

Form 8821 requires the taxpayer's name, address, Social Security number or Employer Identification Number, the name and address of the authorized person or organization, and the specific types of tax information requested.

Fill out your irs form 8821 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irs Form 8821 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.