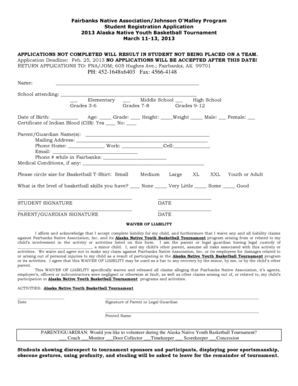

Get the free York County Hospitality Tax Program

Show details

This document outlines the guidelines and criteria for the distribution of hospitality tax funds intended for tourism-related purposes in York County. It includes information about the Advisory Committee,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign york county hospitality tax

Edit your york county hospitality tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your york county hospitality tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing york county hospitality tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit york county hospitality tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out york county hospitality tax

How to fill out York County Hospitality Tax Program

01

Obtain the York County Hospitality Tax Program application form from the official York County website.

02

Review the eligibility criteria to ensure your organization qualifies for the program.

03

Gather all necessary documentation, including proof of expenses related to hospitality services.

04

Complete the application form accurately, providing all requested information, including contact details and project descriptions.

05

Attach any required supporting documents, such as financial statements and receipts.

06

Submit the completed application form and supporting documents by the specified deadline.

07

Follow up with the York County office to confirm receipt of your application and inquire about the review process.

Who needs York County Hospitality Tax Program?

01

Local businesses and organizations involved in hospitality services in York County.

02

Non-profit organizations hosting tourism-related events and activities.

03

Community groups looking to enhance local tourism experiences.

04

Any entity that requires funding to support programs that attract visitors to York County.

Fill

form

: Try Risk Free

People Also Ask about

What services are taxable in SC?

What sales, transactions, services, or intangibles are subject to the Sales Tax? Telephone Services. Automated answering services. Fax transmission services. Database access transmission services. Streaming services. Cloud based services.

What is the Hilton Head hospitality tax?

What is the Hospitality Tax? A tax equal to two percent of the total gross sales price received for prepared foods, meals and beverages sold.

What is local hospitality tax?

A Local Hospitality Tax is a tax, not to exceed two percent, on the sale of prepared meals. and beverages sold in establishments. The tax is authorized in Article 7 of Chapter 1 of. Title 6 of the Code of Laws of South Carolina, 1976, as amended, generally referred to as. the “Local Hospitality Tax Act”.

What is the sales tax in York County?

Total sales and use tax in York County is 7%.

What is a hospitality tax in South Carolina?

The hospitality tax is a uniform tax of 2% on the gross proceeds derived from the sales of prepared meals, food, and beverages sold in or by establishments, or those licensed for on-premises consumption of alcoholic beverages, , or wine.

What can SC hospitality tax be used for?

(A) The revenue generated by the hospitality tax must be used exclusively for the following purposes: (1) tourism-related buildings including, but not limited to, civic centers, coliseums, and aquariums; (2) tourism-related cultural, recreational, or historic facilities; (3) beach access and renourishment; (4) highways

What is the hospitality tax rate in Charleston SC?

The hospitality tax in Charleston, SC, is a 2% tax on the sales of prepared meals, food, and beverages sold in establishments, including those licensed for on- premises alcohol consumption.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is York County Hospitality Tax Program?

The York County Hospitality Tax Program is a local tax initiative aimed at generating funds to support tourism-related projects and services in York County, South Carolina.

Who is required to file York County Hospitality Tax Program?

Businesses that sell or provide accommodations, food, or drinks intended for consumption are required to file the York County Hospitality Tax Program.

How to fill out York County Hospitality Tax Program?

To fill out the York County Hospitality Tax Program, businesses must complete the official form provided by the county, reporting the total hospitality tax collected during the specified period along with any required supporting documentation.

What is the purpose of York County Hospitality Tax Program?

The purpose of the York County Hospitality Tax Program is to fund projects that enhance tourism, such as infrastructure improvements, marketing initiatives, and special events that attract visitors to the area.

What information must be reported on York County Hospitality Tax Program?

Businesses must report total hospitality tax collected, any exemptions, and the details of the taxable sales during the reporting period in the York County Hospitality Tax Program.

Fill out your york county hospitality tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

York County Hospitality Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.