Get the free Sovereign Private Car Policy - mceinsurancecom

Show details

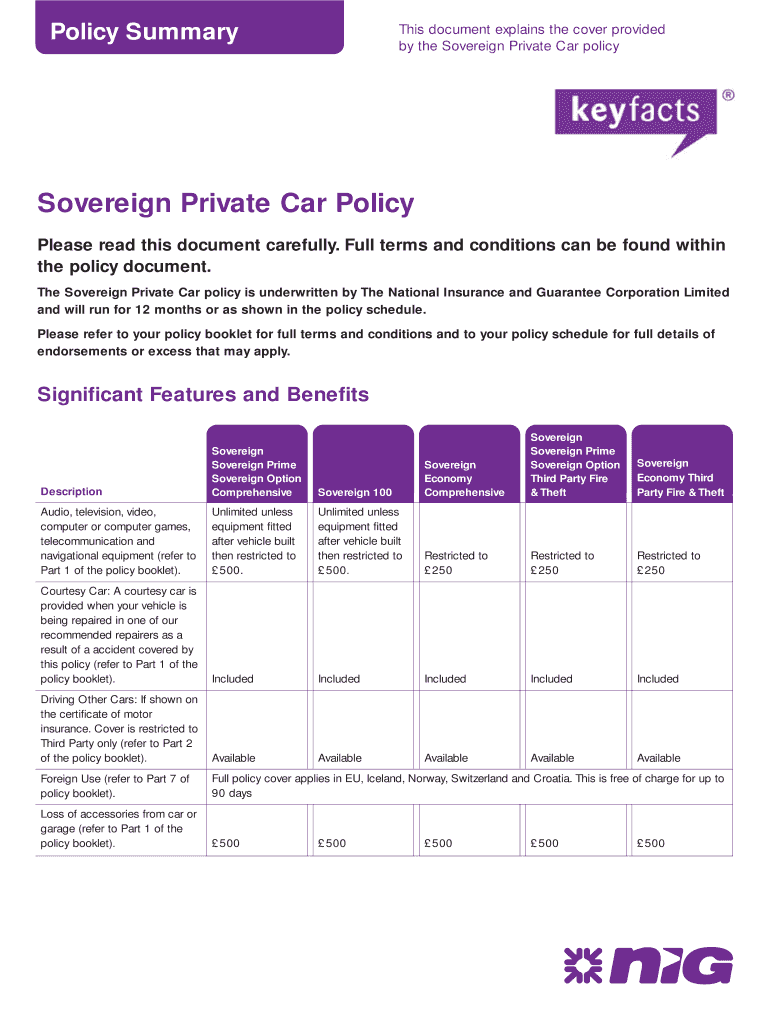

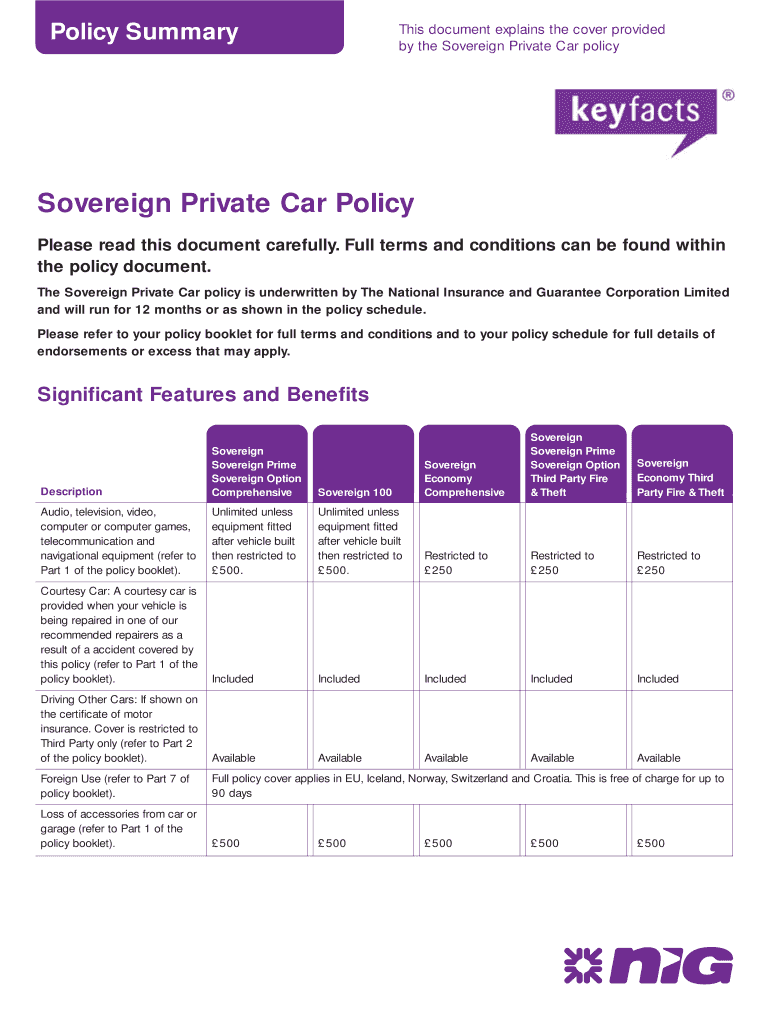

Policy Summary This document explains the cover provided by the Sovereign Private Car policy Sovereign Private Car Policy Please read this document carefully. Full terms and conditions can be found

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sovereign private car policy

Edit your sovereign private car policy form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sovereign private car policy form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sovereign private car policy online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sovereign private car policy. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sovereign private car policy

How to fill out a sovereign private car policy?

01

Start by gathering all the necessary information such as your personal details, vehicle information, and driving history. Include your full name, address, contact information, and driver's license number.

02

Provide detailed information about the car you wish to insure. This includes the make, model, year of manufacture, vehicle identification number (VIN), and any modifications or aftermarket accessories installed.

03

State the purpose of your car usage, such as personal or commercial use, and provide an estimated annual mileage.

04

Disclose your driving history, including any accidents, violations, or claims made in the past. Be honest and accurate while providing this information.

05

Determine the coverage options you require. Evaluate and select from options such as liability coverage, collision coverage, comprehensive coverage, personal injury protection, and uninsured/underinsured motorist coverage. Consider the value of your vehicle, your budget, and any specific insurance requirements in your region.

06

Decide on the policy limits and deductibles. Policy limits refer to the maximum amount the insurance company will pay for a claim, while deductibles are the amount you will have to pay out of pocket before the insurance coverage kicks in.

07

Add any additional coverage or endorsements that may be relevant to your situation. This could include roadside assistance, rental car coverage, or coverage for custom parts and equipment.

08

Review the policy details, terms, and conditions carefully before signing. Pay attention to exclusions, limitations, and any additional fees or charges.

09

Finally, submit your completed application, along with any required supporting documents, to the insurance provider. You may submit the application online, through mail, or in person at their office.

Who needs a sovereign private car policy?

01

Individuals who own a private car and want protection against financial losses due to accidents, theft, or damage.

02

People who live in regions where car insurance is mandatory by law.

03

Individuals who want peace of mind and security while driving, knowing they have coverage for potential liabilities, medical expenses, or vehicle repairs.

04

Owners of high-value or luxury cars that require specialized coverage and protection.

05

Businesses or professionals who use private cars for commercial purposes, such as ridesharing, delivery services, or transportation of goods.

Remember, always consult with an insurance professional or the specific insurance provider for detailed guidance tailored to your unique circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send sovereign private car policy for eSignature?

Once your sovereign private car policy is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

Can I sign the sovereign private car policy electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your sovereign private car policy in seconds.

Can I edit sovereign private car policy on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as sovereign private car policy. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is sovereign private car policy?

Sovereign private car policy is an insurance policy that provides coverage for private vehicles owned by individuals.

Who is required to file sovereign private car policy?

All vehicle owners are required to file sovereign private car policy.

How to fill out sovereign private car policy?

You can fill out sovereign private car policy by providing information about the vehicle, driver, coverage options, and making the required payments.

What is the purpose of sovereign private car policy?

The purpose of sovereign private car policy is to provide financial protection in case of accidents, theft, or other damages involving the insured vehicle.

What information must be reported on sovereign private car policy?

Information such as vehicle details, driver details, coverage options, and payment details must be reported on sovereign private car policy.

Fill out your sovereign private car policy online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sovereign Private Car Policy is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.