Get the free SPECIAL REPORT OF LATE CONTRIBUTION

Show details

This document is a form used to report late contributions of $500 or more received after the closing date of the Pre-Primary or Pre-Election report and before the primary or election. It includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign special report of late

Edit your special report of late form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your special report of late form via URL. You can also download, print, or export forms to your preferred cloud storage service.

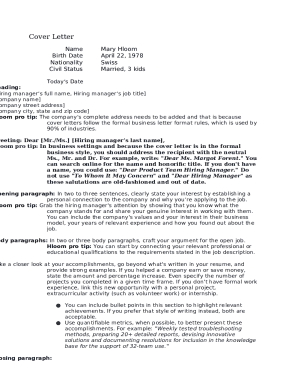

How to edit special report of late online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit special report of late. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out special report of late

How to fill out SPECIAL REPORT OF LATE CONTRIBUTION

01

Obtain the SPECIAL REPORT OF LATE CONTRIBUTION form from the relevant authority.

02

Fill out your personal information in the designated sections, including name, address, and contact details.

03

Specify the dates of the late contributions in the appropriate fields.

04

Provide a detailed explanation for each late contribution, including reasons and any mitigating circumstances.

05

Include any supporting documentation that may be required, such as bank statements or communications.

06

Review the completed form for accuracy before submission.

07

Submit the form to the designated authority by the specified deadline.

Who needs SPECIAL REPORT OF LATE CONTRIBUTION?

01

Individuals or organizations who have made late contributions to a program or fund.

02

Participants in retirement plans or benefits that require reporting of late contributions.

03

Employers who have not submitted contributions on time for employee benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the extended due date for Form 5500?

2024 Deadlines July 31, 2024: Form 5500 deadline for employers with calendar year plans that do not qualify for a filing exemption. October 15, 2024: Form 5500 extended deadline for calendar year plans.

What are the penalties for filing form 5500 late?

$250 per day, up to $150,000 for each late Form 5500 or 5500-EZ, plus interest (IRC Section 6652(e)) as amended by section 403 of the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act). $1,000 for each late actuarial report (IRC Section 6692)

What is self-correction of late contributions?

The self-correction feature is available when the total amount of “lost earnings” determined by using the VFCP online calculator is $1,000 or less and the delinquent contributions or loan repayments are remitted within 180 days after they were received or withheld by the employer.

How do you report late contributions on Form 5500?

The specific section of Form 5500 where late contributions are reported is Schedule H for large plans or Schedule I for small plans, which outline the plan's financial details, including the amount of late contributions, the corrective measures taken, and any lost earnings that were restored.

What is considered a late contribution?

Late deposits of employee contributions However, small plans with less than 100 participants have a 7 day safe harbor. This means deposits made within 7 business days after the pay date in which those amounts were withheld are not considered late. Guideline uses 5 business days for plans with 100 participants or more.

How do I fix a late 401k contribution?

Correcting Late Deposits Deposit the deferrals immediately. Make an additional contribution to compensate participants for lost investment gains. File Form 5330 with the IRS and pay an excise tax. Report the delinquency on Form 5500. Submit supporting documentation to the DOL for their review and approval.

What is the statute of limitations on Form 5500?

To reassess your taxes and disqualify your plan, the IRS has a 3 year statute of limitations. They will not assess income taxes for periods later than the limitations periods. Filing a Form 5500-EZ officially starts the 3 year statute of limitations.

How do I correct a late 401k contribution?

Correcting Late Deposits Deposit the deferrals immediately. Make an additional contribution to compensate participants for lost investment gains. File Form 5330 with the IRS and pay an excise tax. Report the delinquency on Form 5500. Submit supporting documentation to the DOL for their review and approval.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SPECIAL REPORT OF LATE CONTRIBUTION?

The SPECIAL REPORT OF LATE CONTRIBUTION is a document that is submitted to report contributions that have not been made on time according to the regulations or guidelines set by the governing body.

Who is required to file SPECIAL REPORT OF LATE CONTRIBUTION?

Entities or individuals who fail to make required contributions on time, such as employers contributing to retirement plans or employee benefit schemes, are typically required to file this report.

How to fill out SPECIAL REPORT OF LATE CONTRIBUTION?

To fill out the SPECIAL REPORT OF LATE CONTRIBUTION, one should gather relevant details including the names of contributors, the amounts due, the dates the contributions were due, and the reasons for the delayed contributions, then complete the designated sections of the form accurately.

What is the purpose of SPECIAL REPORT OF LATE CONTRIBUTION?

The purpose of the SPECIAL REPORT OF LATE CONTRIBUTION is to maintain compliance with contribution requirements, to provide transparency, and to ensure that late contributions are documented and rectified appropriately.

What information must be reported on SPECIAL REPORT OF LATE CONTRIBUTION?

The report must include details such as the names of the entities making late contributions, the specific amounts that were due, the dates they were supposed to be made, the actual dates of contribution, and any explanations or justifications for the delay.

Fill out your special report of late online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Special Report Of Late is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.