Get the free OCCUPATIONAL LICENSE TAX APPLICATION

Show details

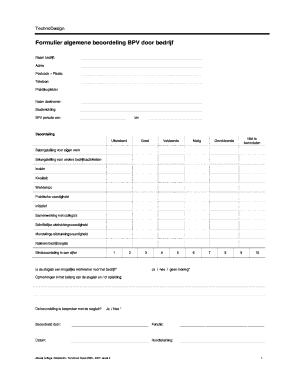

This document is used to apply for an occupational license tax, detailing information required from businesses including their operational details and tax calculations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign occupational license tax application

Edit your occupational license tax application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your occupational license tax application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit occupational license tax application online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit occupational license tax application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out occupational license tax application

How to fill out OCCUPATIONAL LICENSE TAX APPLICATION

01

Gather all necessary documents, including proof of identity and business structure.

02

Visit your local government office or website to obtain the Occupational License Tax Application form.

03

Fill out the application form with your business name, address, and type of business activities.

04

Provide information regarding the ownership of the business, including names and addresses of all owners.

05

Include details about the estimated gross receipts for the business.

06

Review the application for accuracy and completeness.

07

Submit the application along with any required fees to the appropriate local government office.

08

Keep a copy of the submitted application and any payment confirmation for your records.

Who needs OCCUPATIONAL LICENSE TAX APPLICATION?

01

Anyone who operates a business within a specified jurisdiction or city.

02

Individuals offering services or products for sale where a license is required by local law.

03

Businesses that are newly established or those that have changed their business structure or location.

Fill

form

: Try Risk Free

People Also Ask about

How much does a business license cost in Virginia?

Annual Registration Fees Type of businessWhen is my fee due?How much is the fee? Nonstock Corporations Your due date is the last day of the month your business was formed or registered. $25.00 Limited Liability Companies Your due date is the last day of the month your business was organized or registered. $50.003 more rows

How much is business tax in Virginia?

Virginia Tax Rates, Collections, and Burdens Virginia has a 6.0 percent corporate income tax rate. Virginia also has a 4.30 percent state sales tax rate, a 1 percent mandatory, statewide, local add-on sales tax rate, and an average combined state and local sales tax rate of 5.77 percent.

What is a GA occupational tax certificate?

An occupational tax certificate, commonly referred to as a business license, is a certificate issued by government agencies. The certificate is evidence that an individual or company has paid an occupational tax as required by the local ordinance.

How much does it cost to get an occupational license in Louisiana?

To obtain an Occupational License, your must complete the Business Registration Application Form for OLT/Sales Tax located under Tax Forms and submit it to the Revenue Division along with a check made payable to the City and Parish Treasurer for $50 for businesses that open between January 1-June 30 or $25 for

Are you required to have a business license in Virginia?

Virginia doesn't require businesses to obtain a general business license to operate within the state. But most cities and counties will require a business to obtain a local business license if it wants to operate within that city or county.

What is the business professional and occupational license tax in Virginia?

The Virginia Business Professional and Occupational License (BPOL) is a local level tax levied on businesses' gross receipts. Rates typically range from $0.03 to $0.58 per $100 of gross receipts, depending on the locality and industry classification.

What is a Louisiana occupational license?

Occupational licensing is a permit issued by the government that allows someone to work in a particular field. In Louisiana, nearly one in five workers must now get an occupational license before they can legally do their job.

Who is subject to Virginia BPOL tax?

All business owners, including owners of home-based businesses, are subject to the BPOL tax. Business owners are required to register their business with the Department of Tax Administration (DTA) within 75 days of beginning business operations in Fairfax County.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is OCCUPATIONAL LICENSE TAX APPLICATION?

The Occupational License Tax Application is a form that businesses must complete in order to obtain a license to legally operate within a specific municipality or jurisdiction. This application assesses the nature of the business and its compliance with local regulations.

Who is required to file OCCUPATIONAL LICENSE TAX APPLICATION?

Any individual or entity intending to conduct business activities within a jurisdiction is required to file an Occupational License Tax Application. This includes vendors, contractors, and any establishment providing services for profit.

How to fill out OCCUPATIONAL LICENSE TAX APPLICATION?

To fill out the Occupational License Tax Application, one must provide accurate business information, including the business name, owner details, nature of the business, location, and estimated revenues. Specific forms may vary by jurisdiction, so it is important to refer to local guidelines.

What is the purpose of OCCUPATIONAL LICENSE TAX APPLICATION?

The purpose of the Occupational License Tax Application is to ensure that businesses comply with local regulations, collect necessary taxes, and maintain a record of businesses operating within the jurisdiction for regulatory and safety purposes.

What information must be reported on OCCUPATIONAL LICENSE TAX APPLICATION?

Information that must be reported typically includes the business name, owner or responsible party's name, business address, type of business, anticipated revenue, and sometimes the number of employees. Specific requirements may vary by location.

Fill out your occupational license tax application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Occupational License Tax Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.