Get the free Annual State and Local Sales & Use Tax Seminar Registration

Show details

This document is a registration form for the Louisiana Association of Tax Administrators' Annual State and Local Sales & Use Tax Seminar, detailing the event, presenters, registration fee, and accommodation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual state and local

Edit your annual state and local form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual state and local form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual state and local online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit annual state and local. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual state and local

How to fill out Annual State and Local Sales & Use Tax Seminar Registration

01

Visit the official website or registration portal for the Annual State and Local Sales & Use Tax Seminar.

02

Locate the registration form for the seminar, usually found under the 'Events' or 'Seminars' section.

03

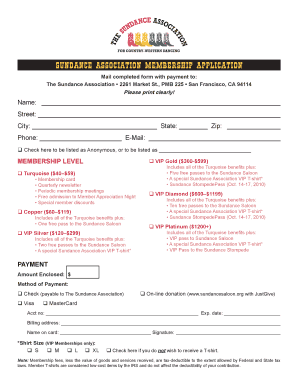

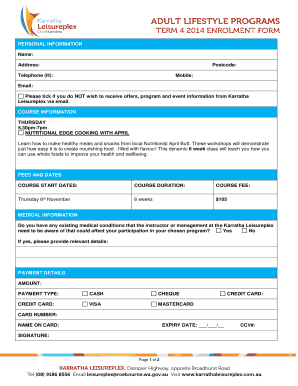

Fill in your personal details, including your name, email address, phone number, and job title.

04

Provide your organization or company name and mailing address.

05

Select the preferred payment method (credit card, check, etc.) and fill in any required billing information.

06

Review your information for accuracy.

07

Submit the registration form and note any confirmation number or email you receive.

Who needs Annual State and Local Sales & Use Tax Seminar Registration?

01

Businesses and organizations that engage in selling goods or providing taxable services.

02

Accounting professionals who need to stay updated on state and local tax regulations.

03

Sales and use tax compliance officers responsible for ensuring correct tax practices.

04

Anyone interested in learning about the changes and updates in sales and use tax legislation.

Fill

form

: Try Risk Free

People Also Ask about

What is a local sales and use tax?

In conclusion, both sales tax and use tax are types of taxes that are levied on different transactions. Sales tax is typically charged at the point of sale on goods and services, while use tax is usually charged on items that were purchased outside of the state but are used within the state.

Who has to collect sales tax in NC?

Businesses need to collect sales tax in North Carolina if they have either physical nexus or an economic nexus in the state.

How to find total state and local tax rate?

State Tax Amount = Price x (State Tax Percentage / 100) Use Tax Amount = Price x (Use Tax Percentage / 100) Local Tax Amount = Price x (Local Tax Percentage / 100) Total = Price + State Tax Amount + Use Tax Amount + Local Tax Amount.

What is a local option sales tax used for?

A local option sales tax is often used as a means of raising funds for specific local or area projects, such as improving area streets and roads, or refurbishing a community's downtown area. LOSTs are always appended onto a state's base sales tax rate, most commonly at a rate of 1%.

What is the meaning of local sales tax?

Key Takeaways. A sales tax is a consumption tax on the sale of goods and services. A sales tax is usually charged as a percentage of the retail cost at the point of purchase. Local and municipal governments may charge their own sales tax, which is added to the state sales tax.

How to get a sales tax ID in NC?

You can register online using the online business registration portal or submit a completed Form NC-BR or other appropriate registration application by mail. You may request a registration application online, by mail, or by contacting the Department at 1-877-252-3052 (toll free).

What is the difference between local use tax and local sales tax?

Sales tax is collected by the seller at the point of sale and is remitted to the state by the seller. Use tax, on the other hand, is the responsibility of the buyer. It is self-assessed and paid directly to the state by the consumer when sales tax was not collected at the time of purchase.

What is an example of a local tax?

Local taxes come in many forms, from property taxes and payroll taxes to sales taxes and licensing fees. They vary widely from one jurisdiction to the next. Taxes levied by cities and towns are also referred to as municipal taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual State and Local Sales & Use Tax Seminar Registration?

The Annual State and Local Sales & Use Tax Seminar Registration is a formal process that allows businesses and organizations to register for seminars focused on sales and use tax compliance, education, and updates on legal requirements.

Who is required to file Annual State and Local Sales & Use Tax Seminar Registration?

Typically, businesses engaged in the sale of goods or services in a specific jurisdiction are required to file for registration, especially those that are subject to state and local sales and use tax regulations.

How to fill out Annual State and Local Sales & Use Tax Seminar Registration?

To fill out the registration, applicants need to provide accurate business information, such as name, address, tax identification number, and contact details, along with selecting the seminars they wish to attend and any additional required documentation.

What is the purpose of Annual State and Local Sales & Use Tax Seminar Registration?

The purpose of the registration is to ensure that businesses stay informed on current sales and use tax laws, receive training on compliance, and navigate regulatory changes effectively.

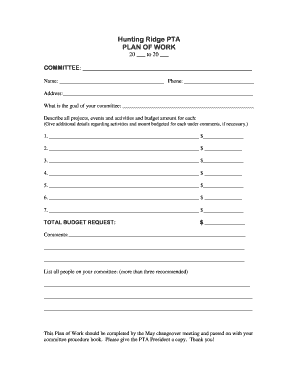

What information must be reported on Annual State and Local Sales & Use Tax Seminar Registration?

The registration must report the business's legal name, address, contact information, tax identification number, selected seminar dates, and any additional information as required by the seminar organizers or governing tax authorities.

Fill out your annual state and local online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual State And Local is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.