Get the free ST-120

Show details

This document serves as a sales tax exemption certificate for registered New York State vendors and certain other purchasers to buy tangible personal property or services for resale without paying

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-120

Edit your st-120 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-120 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

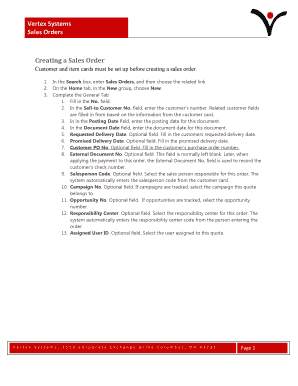

How to edit st-120 online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit st-120. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-120

How to fill out ST-120

01

Obtain the ST-120 form from the New York State Department of Taxation and Finance website or your local office.

02

Fill in your name and contact information in the designated areas at the top of the form.

03

Provide the name and address of the seller from whom you are purchasing goods.

04

Indicate the date of purchase and the type of goods purchased in the appropriate sections.

05

Sign and date the form at the bottom to certify that the information is accurate.

Who needs ST-120?

01

Businesses or individuals purchasing goods in New York State who wish to claim a sales tax exemption.

02

Non-profit organizations that qualify for tax-exempt purchases.

03

Certain government agencies engaging in exempt transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a single purchase exemption request and a blanket purchase exemption request?

In contrast with a single purchase certificate, a blanket sales tax exemption allows a purchaser to give a seller one certificate that covers all similar purchases rather than separate certificates for each purchase.

Why would someone have a tax exemption?

Tax-exempt status may provide complete relief from taxes, reduced rates, or tax on only a portion of items. Examples include exemption of charitable organizations from property taxes and income taxes, veterans, and certain cross-border or multi-jurisdictional scenarios.

What is a blanket certification?

Blanket Certification or "Blanket" means an exemption from the requirement to obtain an individual Water Quality Certification for certain activities deemed insignificant effect on water quality and may be issued to Section 404 nationwide or regional general permits.

What is a single purchase certificate?

Create a single use exemption certificate when a customer provides you with a certificate that applies only to a specific transaction, job, or contract. Use these certificates for temporary relief from taxes or regulations for a specific purpose, such as a special event, trade show, or brief project.

What is the difference between a single purchase certificate and a blanket certificate?

Purchasers apply for exemption certificates and provide them to sellers at checkout. In the case of a blanket certificate, it's not necessary to use a new certificate for each purchase, as long as the qualifying factors are the same and the certificate is valid.

How to fill out st-120 form pdf?

How to fill out Form ST-120? Open Form ST-120 in the PDF editor. Fill in your name, address, and sales tax registration number in the appropriate fields. Complete the seller's information if applicable. List the items being purchased for resale. Sign the form electronically. Download the completed form to your device.

What is NY ST-120 form?

Form ST-120, Resale Certificate, is a sales tax exemption certificate. This certificate is only for use by a purchaser who: A – is registered as a New York State sales tax vendor and has a valid.

Who needs a tax-exempt certificate?

Anyone who qualifies under state guidelines, which typically include nonprofit organizations, educational institutions, government agencies, and businesses intending to resell the purchased goods. Specific qualifications can vary significantly from one state to another.

What is a blanket certificate?

Under a blanket certificate issued pursuant to section 7(c) of the Natural Gas Act, a natural gas company may undertake a restricted array of routine activities without the need to obtain a case-specific certificate for each individual project.

Why do I need a tax exemption certificate?

A sales tax exemption certificate is a valuable tool for eligible businesses and organizations. It helps reduce costs by avoiding unnecessary tax payments, thus providing more resources for business growth.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-120?

ST-120 is a sales tax exemption certificate used in New York State to allow certain purchases to be made exempt from sales tax.

Who is required to file ST-120?

Businesses and individuals making tax-exempt purchases in New York State are required to file ST-120.

How to fill out ST-120?

To fill out ST-120, provide your name, address, type of business, reason for exemption, and include a description of the purchased items.

What is the purpose of ST-120?

The purpose of ST-120 is to verify the tax-exempt status of purchases and to ensure that sellers do not charge sales tax on qualified items.

What information must be reported on ST-120?

The information that must be reported on ST-120 includes the purchaser's name, address, type of exemption, detailed description of the property or services purchased, and the certificate's purpose.

Fill out your st-120 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-120 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.