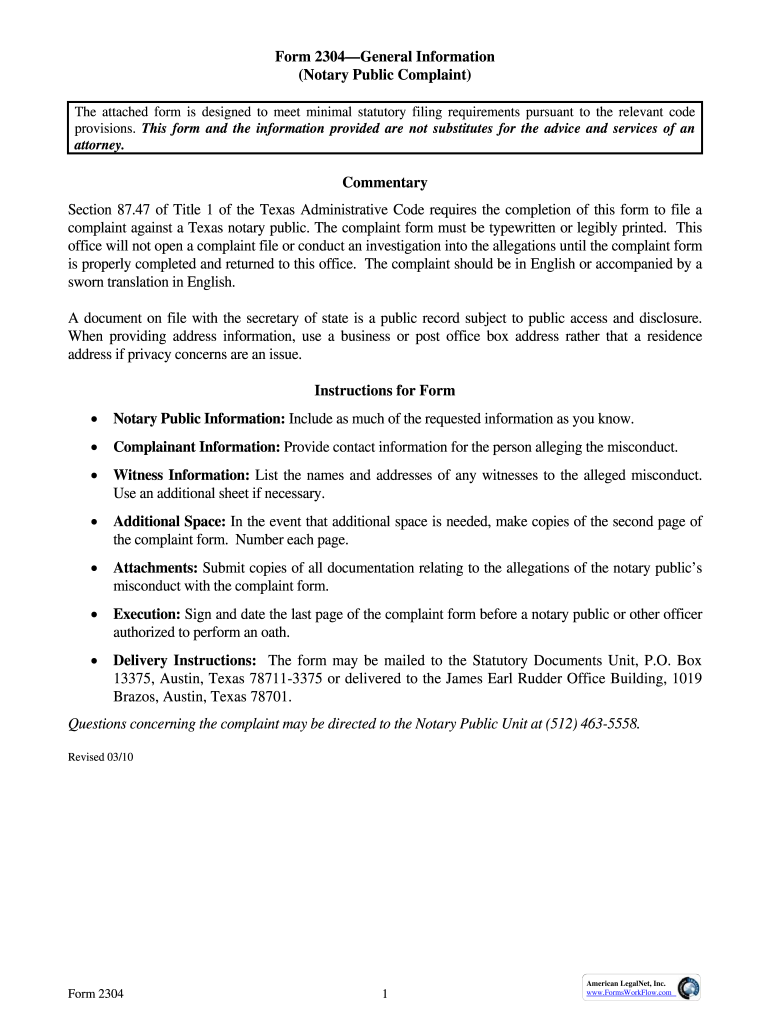

TX SOS 2304 2010 free printable template

Get, Create, Make and Sign TX SOS 2304

Editing TX SOS 2304 online

Uncompromising security for your PDF editing and eSignature needs

TX SOS 2304 Form Versions

How to fill out TX SOS 2304

How to fill out TX SOS 2304

Who needs TX SOS 2304?

Instructions and Help about TX SOS 2304

Dot is at your service just bought a used car truck you won't officially be its new owner until you complete a few simple steps required by state law especially when you're buying a vehicle from an individual the best way to protect yourself and make sure you do everything right is to go with the seller to the local county tax office and let the experts help you complete the sale now let's go over what you need to do when you buy a used vehicle or receive a vehicle as a gift step 1 get a properly signed title and make sure the seller signs the application for Texas certificate of title a vehicle's title identifies its official owner it's your responsibility to notify Dot within 20 business days of the sale date to let us know the vehicle now belongs to you and to request a new title in your name you'll need two things to apply for title the vehicles title and the application for Texas certificate of title form 1:30 you download the format with gov or get one at your county tax office the seller must sign and date the back of the vehicles title and enter the mileage from the odometer the seller also has to write in the sales price and sign your application for a new title if you procrastinate it'll cost you if you don't apply for a new title within 20 business days from the date of sale you'll automatically be charged a ×25 penalties plus another $25 for every month you're late if you are buying a car or truck from a car lot or a dealership they will apply for a new title in your name always ask for a copy of the paperwork for your records step 2 get the Texas registration receipt VIN number and seller information be sure to ask for the vehicles Texas registration receipt note the date you got the vehicle and write down the previous owners name address and phone number you'll also need the vehicle identification number or VIN which you can find on the title keep the records in a safe place in case there's ever a question about the vehicle step3 print a vehicle transit permit, so you can drive to the county tax office to title the vehicle if the seller kept the place owners can now keep a vehicle's license plates after they sell a car truck if the car truck you're buying in a private sale has had its plates and registration sticker removed you legally aren't allowed to drive it unless you have a temporary vehicle transit permit download one for free online at www.viki go to the County Tax Office with the seller when you're buying a vehicle in a private sale the best way to protect yourself and avoid potentially costly mistakes is for you to go with the seller to the local county tax office staff can check to make sure the vehicle has a clean title without any legal or salvage issues immediately completing the required paperwork also means you won't be facing any late filing fees always make sure you've obtained a properly signed title and the sellers signature and sales price on your application for Texas certificate of title, so you have what you...

People Also Ask about

What is the most common mistake made by a notary?

How do I check the status of my notary application in Texas?

How do I get a copy of my notary Commission certificate in Texas?

Can you sue a notary in Texas?

How do I become a traditional notary in Texas?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find TX SOS 2304?

How do I fill out the TX SOS 2304 form on my smartphone?

How do I edit TX SOS 2304 on an Android device?

What is TX SOS 2304?

Who is required to file TX SOS 2304?

How to fill out TX SOS 2304?

What is the purpose of TX SOS 2304?

What information must be reported on TX SOS 2304?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.