MN Form 90.1.3 2011 free printable template

Show details

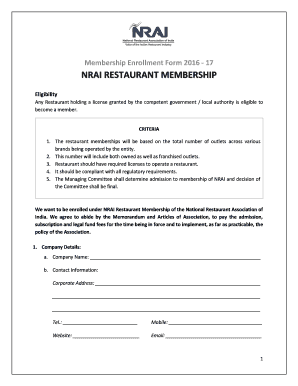

(Top 3 inches reserved for recording data) AFFIDAVIT OF TRUSTEE Regarding Certificate of Trust or Trust Instrument Minn. Stat. 501B.57 Minnesota Uniform Conveyancing Blanks Form 90.1.3 (2011) State

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MN Form 9013

Edit your MN Form 9013 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN Form 9013 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN Form 9013 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MN Form 9013. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN Form 90.1.3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN Form 9013

How to fill out MN Form 90.1.3

01

Obtain a copy of MN Form 90.1.3 from the official website or local office.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information, including name, address, and contact details in the designated sections.

04

Provide the relevant details about the asset or income that the form is pertaining to.

05

Ensure all the required documentation is attached as specified in the instructions.

06

Review the completed form to ensure accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form to the appropriate office via mail or in person.

Who needs MN Form 90.1.3?

01

Individuals or businesses seeking to report specific assets or income in Minnesota.

02

Those applying for certain financial benefits that require disclosure of income/assets.

03

People involved in legal or financial proceedings that necessitate this form.

Fill

form

: Try Risk Free

People Also Ask about

What is a certificate holder of a trust?

Trust Certificateholder means the Person in whose name a Trust Certificate is registered on the Certificate Register. Trust Certificates means the asset backed certificates issued pursuant to the Trust Agreement, substantially in the form of Exhibit A to the Trust Agreement.

Does a trust have to be recorded in Minnesota?

An estate or trust with $600 or more of gross income assignable to Minnesota must file Form M2, Income Tax Return for Estates and Trusts.

What is a trust certificate on Iphone?

Trusted certificates establish a chain of trust that verifies other certificates signed by the trusted roots — for example, to establish a secure connection to a web server. When IT administrators create Configuration Profiles, these trusted root certificates don't need to be included.

How do I get proof of trust?

The bank, brokerage, escrow company or other financial institution likely has a trust certificate form you can fill out and use. An estate lawyer or other attorney can help draft a certificate of trust. This includes online legal and estate planning services.

What is the statute 501c1013 in Minnesota?

Amendment or revocation of a certificate of trust may be made only by a written instrument executed by the settlor or a trustee of a trust. Amendment or revocation of a certificate of trust is not effective as to a party unless that party has actual notice of the amendment or revocation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify MN Form 9013 without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like MN Form 9013, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out the MN Form 9013 form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign MN Form 9013 and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit MN Form 9013 on an Android device?

You can make any changes to PDF files, like MN Form 9013, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is MN Form 90.1.3?

MN Form 90.1.3 is a specific form used for reporting certain financial or operational information to the Minnesota Department of Revenue.

Who is required to file MN Form 90.1.3?

Organizations or entities that meet specific criteria set by the Minnesota Department of Revenue, typically involving the receipt of certain types of income or funding, are required to file MN Form 90.1.3.

How to fill out MN Form 90.1.3?

To fill out MN Form 90.1.3, individuals or organizations must gather the required financial information, accurately complete each section of the form as instructed, and ensure that all necessary documentation is attached before submission.

What is the purpose of MN Form 90.1.3?

The purpose of MN Form 90.1.3 is to collect necessary data for the Minnesota Department of Revenue to ensure compliance with state financial regulations and to assess tax liabilities.

What information must be reported on MN Form 90.1.3?

The information that must be reported on MN Form 90.1.3 typically includes details about income, expenses, assets, liabilities, and any other relevant financial data as mandated by the state.

Fill out your MN Form 9013 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN Form 9013 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.