Get the free Business Overdraft

Show details

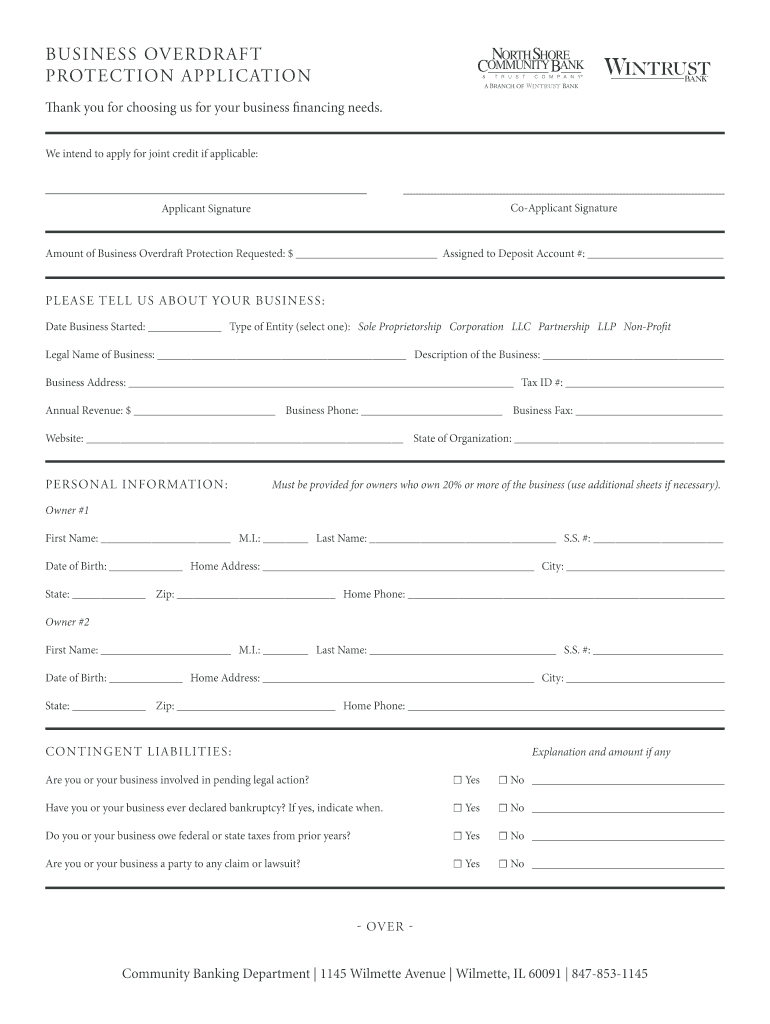

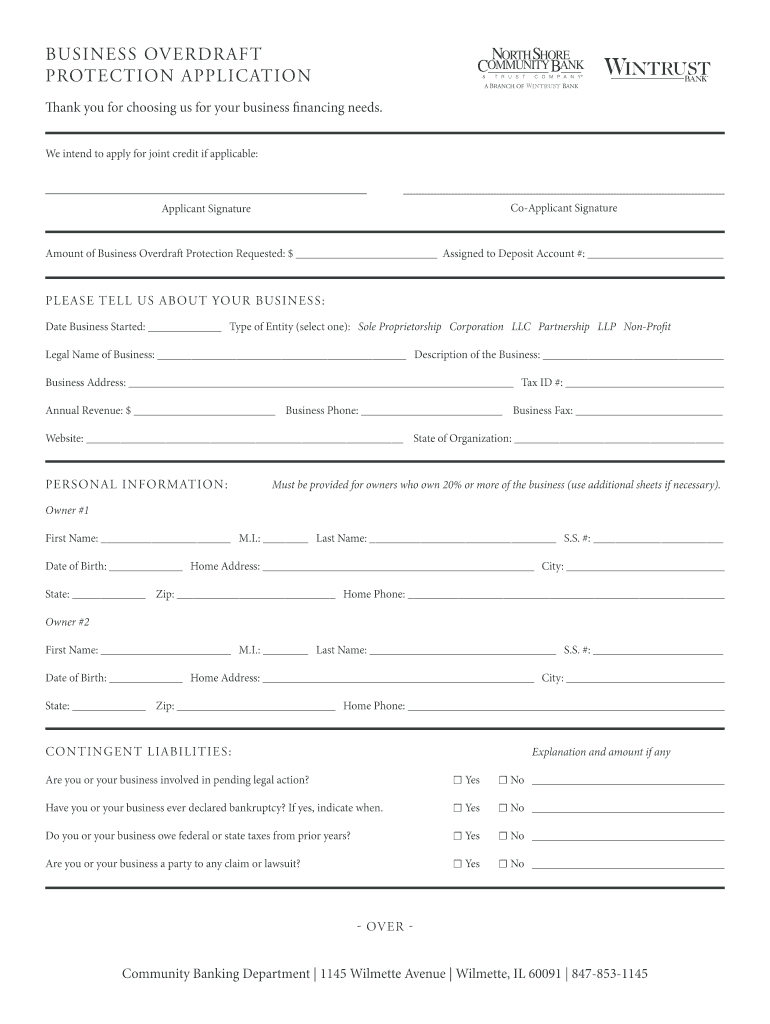

Business Overdraft Protection Application Thank you for choosing us for your business financing needs. We intend to apply for joint credit if applicable: Applicant Signature Amount of Business Overdraft

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business overdraft

Edit your business overdraft form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business overdraft form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business overdraft online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit business overdraft. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business overdraft

How to fill out a business overdraft:

01

Start by researching different banks and financial institutions that offer business overdrafts. Look for ones that have reasonable interest rates and fees.

02

Once you have identified a suitable institution, gather all the necessary documents required for the application process. This typically includes financial statements, tax returns, and proof of identity.

03

Schedule a meeting with a representative from the bank or financial institution to discuss your business and the specific requirements for obtaining a business overdraft.

04

Prepare a comprehensive business plan that outlines your company's goals, financial projections, and how the business overdraft will be used to support your operations.

05

Complete the application forms provided by the bank or financial institution accurately and thoroughly. Ensure that you provide all the requested information and double-check for any errors or omissions.

06

Before submitting your application, take the time to review all the terms and conditions associated with the business overdraft. Pay close attention to the interest rates, repayment terms, and any potential penalties.

07

Submit your application along with all the necessary supporting documents as required by the bank or financial institution.

08

After submitting your application, wait for the bank or financial institution to review and process it. This can take some time, so be patient.

09

If your application is approved, carefully review the terms of the business overdraft agreement before accepting it. Make sure you fully understand the terms and conditions and ask any questions you may have.

10

Once you have accepted the business overdraft agreement, you can start using the funds to support your business operations as needed. Remember to use the funds responsibly and ensure timely repayment to avoid any penalties or unnecessary interest charges.

Who needs a business overdraft:

01

Small and medium-sized businesses that may need flexible access to funds for various purposes such as managing cash flow, purchasing inventory, or covering unexpected expenses.

02

Startups and new businesses that may experience fluctuations in cash flow during their early stages and require a safety net to handle temporary financial challenges.

03

Businesses in industries with seasonal demand or cyclical sales patterns that may benefit from having extra funds available during slow periods.

04

Companies that want to take advantage of growth opportunities quickly without going through lengthy application processes for other types of financing.

05

Entrepreneurs who prefer to have a line of credit readily available as a safety net, even if they don't currently need it, as a measure of financial security.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit business overdraft online?

With pdfFiller, the editing process is straightforward. Open your business overdraft in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the business overdraft form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign business overdraft. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out business overdraft on an Android device?

Use the pdfFiller Android app to finish your business overdraft and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is business overdraft?

Business overdraft is a financial facility that allows a business to withdraw more money than is available in their account.

Who is required to file business overdraft?

Businesses that have accessed an overdraft facility from a financial institution are required to file business overdraft.

How to fill out business overdraft?

To fill out a business overdraft, businesses need to provide details about the amount withdrawn, interest rates, and repayment terms.

What is the purpose of business overdraft?

The purpose of business overdraft is to provide businesses with a short-term source of funding to cover expenses or cash flow gaps.

What information must be reported on business overdraft?

Businesses must report the amount of overdraft taken, interest charged, repayment terms, and any fees associated with the facility.

Fill out your business overdraft online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Overdraft is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.