Get the free Pioneer Retirement Income Strategies Through MetLife

Show details

This document serves as a prospectus for the Pioneer PRISM XC Variable Annuity offered by First MetLife Investors Insurance Company. It outlines the features, benefits, and terms of the annuity, including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pioneer retirement income strategies

Edit your pioneer retirement income strategies form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pioneer retirement income strategies form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pioneer retirement income strategies online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit pioneer retirement income strategies. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pioneer retirement income strategies

How to fill out Pioneer Retirement Income Strategies Through MetLife

01

Gather necessary financial documents, including income statements and retirement savings account details.

02

Visit the MetLife website or contact a MetLife advisor for information on Pioneer Retirement Income Strategies.

03

Review the available funding options and retirement goals offered by the program.

04

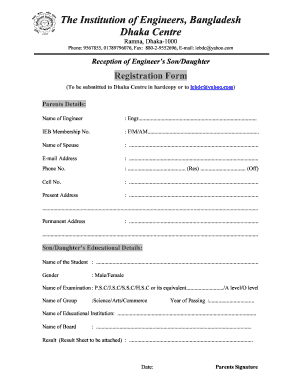

Fill out the application form by providing personal details and financial information.

05

Assess your risk tolerance and investment preferences through MedLife's tools.

06

Submit the completed application along with any required documentation.

07

Schedule a consultation with a MetLife advisor to finalize your retirement strategy.

Who needs Pioneer Retirement Income Strategies Through MetLife?

01

Individuals nearing retirement looking for structured income plans.

02

Those wishing to maximize their retirement savings and investment income.

03

People seeking professional advice on retirement income distribution.

04

Retirees looking for a reliable source of income to support their lifestyle.

Fill

form

: Try Risk Free

People Also Ask about

Is MetLife a good retirement company?

What Makes MetLife Unique — and Why It Matters. MetLife has superior financial ratings: A+ from A.M. Best, AA- from S&P, and Aa3 from Moody's. This means they're well-capitalized and reliable when it comes to paying claims. The company has more than 90 million customers in over 60 countries.

Is MetLife financially stable?

MetLife's strong balance sheet strength assessment is supported by AM Best's view of the consolidated holding company's capital adequacy that is enhanced by the financial flexibility and the liquidity of its ultimate parent (MetLife, Inc.), which historically has maintained significant and steady levels of excess

What is the MetLife growth and income annuity?

What is it? MetLife Growth and Guaranteed IncomeSM (MGGI) is a deferred variable annuity featuring a guaranteed1 withdrawal for life and a death benefit backed by MetLife. It features the Fidelity® VIP FundsManager® 60% Portfolio, a single, all-in-one investment solution1.

Is MetLife a good retirement plan?

MetLife's 401(k) Plan offers you one of the best ways to help you reach your financial goals in retirement. If you're not contributing to the 401(k) Plan, you are missing out on a great opportunity to save on your own for retirement, and you are not taking advantage of the Company Matching Contribution.

What is the secure income option in MetLife retirement portfolio?

The Secure Income Option provides a guaranteed level of income for life, even if the underlying fund value runs out of money, along with a guaranteed death benefit. The guaranteed level of income also has the potential to increase, through: lock-ins of positive investment performance above the existing guarantee level.

Which insurance company is best for retirement planning?

Mashreq Investment Plans. Metlife Investment Plans. ADIB Investment Plans. Orient Insurance Investment Plans. Zurich Investment Plans. HAYAH Investment Plans. Sukoon Takaful Investment Plans. LIC International Investment Plans.

Is MetLife good at paying claims?

This means they're well-capitalized and reliable when it comes to paying claims. The company has more than 90 million customers in over 60 countries. If you're looking for long-term stability, especially for group life insurance or annuity payouts, MetLife is one of the most financially sound carriers available.

Can I cash out my MetLife annuity?

Fixed and Variable Annuity Charges/Fees If you withdraw money from an annuity, there may be a surrender fee (or withdrawal charge). Usually surrender charges are applied to all purchase payments you make and reduce to zero over time. Therefore,if you save over the longer term, no surrender charges would apply.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pioneer Retirement Income Strategies Through MetLife?

Pioneer Retirement Income Strategies Through MetLife is a financial service designed to help individuals plan for retirement by providing structured income strategies to ensure a steady stream of income during retirement years.

Who is required to file Pioneer Retirement Income Strategies Through MetLife?

Individuals who are utilizing the retirement income strategies offered by MetLife and need to report their income plans for tax or regulatory purposes are required to file this information.

How to fill out Pioneer Retirement Income Strategies Through MetLife?

To fill out the Pioneer Retirement Income Strategies form, individuals should gather their personal financial information, including income sources, retirement accounts, and any other relevant financial data, and follow the specific instructions provided in the form for accurate reporting.

What is the purpose of Pioneer Retirement Income Strategies Through MetLife?

The purpose of Pioneer Retirement Income Strategies Through MetLife is to provide clients with tailored retirement income solutions that help them manage their funds efficiently and ensure financial stability throughout their retirement.

What information must be reported on Pioneer Retirement Income Strategies Through MetLife?

The information that must be reported includes personal identification details, income sources, anticipated retirement expenses, and any other financial assets relevant to the retirement income strategy.

Fill out your pioneer retirement income strategies online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pioneer Retirement Income Strategies is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.