Get the free checking reconcilement form

Show details

This document serves as a form to help individuals reconcile their checking accounts by listing outstanding checks, subtracting charges, and calculating final balances.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign checking reconcilement form

Edit your checking reconcilement form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your checking reconcilement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing checking reconcilement form online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit checking reconcilement form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out checking reconcilement form

How to fill out checking reconcilement form

01

Gather all your bank statements and check registers for the period you are reconciling.

02

Start by entering the beginning balance from your bank statement on the reconcilement form.

03

Go through your check register and compare each transaction with the bank statement.

04

Mark off each transaction on the bank statement that matches your check register.

05

Take note of any outstanding checks or deposits that have not yet cleared the bank.

06

Calculate your ending balance by adjusting the beginning balance with the outstanding transactions.

07

Ensure that the adjusted bank balance matches the ending balance in your check register.

08

Document any discrepancies and investigate the reasons for the differences.

Who needs checking reconcilement form?

01

Individuals and businesses who maintain a checking account.

02

Accountants and financial officers responsible for managing company finances.

03

Anyone who wants to ensure accurate financial records and prevent errors.

Fill

form

: Try Risk Free

People Also Ask about

What is a reconciliation statement in English?

Meaning of reconciliation statement in English a document that compares different financial accounts, amounts, etc. in order to check that they add up to the same total or to explain any differences between them: The company must make available all its bank reconciliation statements.

How often should you reconcile your checking account?

As a general rule, you should reconcile your savings and checking account with your bank statements at least once every month. It's best to reconcile soon after receiving your statement to spot errors early on and prevent any harm to your account. Addressing errors can also be more challenging the more time passes.

What does it mean when a person says they are reconciling their checking account?

Account reconciliation is the process that makes sure financial records match external financial statements such as bank statements, invoices, or credit card bills. It helps verify that recorded financial transactions are accurate.

What is brs with an example?

A bank reconciliation statement is a summary document that shows the recorded bank account balance of the company matches the balance recorded by the bank. The statement covers all transactions of the company, including deposits and withdrawals.

What is an example of account reconciliation?

For example, if you spent money on a new book and the charge shows up on your receipt but not on your bank statement, an error has occurred. If the charge is shown on both your receipt and your bank statement, however, these two are balanced and the account is reconciled.

How to check reconciliation?

What should you look for on the Bank Reconciliation Statement? Check the dates. Check the cashbook balance. Check the bank statement balance. Check the structure of the reconciliation statement. Check the outstanding items listed on the reconciliation statement. Check some cashbook entries.

Who should not prepare a bank reconciliation?

The person preparing the reconciliation should not be the same person reviewing and approving it. This segregation of duties is a key internal control that prevents fraud. For instance, without this step, someone could potentially steal money and then adjust the reconciliation to cover their tracks.

What is a checking account reconcilement?

Reconciliation of bank statements is the process of comparing the transactions recorded in the company's accounting records with the transactions listed on the bank statement. This process involves matching the amounts and dates of each transaction to ensure that they are consistent across both sets of records.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

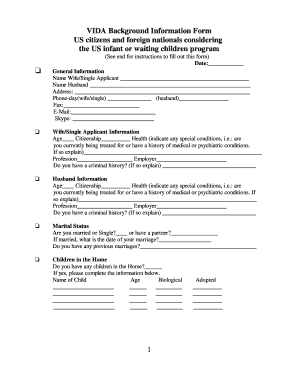

What is checking reconcilement form?

The checking reconcilement form is a document used to compare and reconcile the amounts in a business's checkbook with the bank statement to ensure that all transactions are accurately recorded.

Who is required to file checking reconcilement form?

Typically, any business or individual managing a checking account is required to file a checking reconcilement form to maintain accurate financial records and ensure proper cash flow management.

How to fill out checking reconcilement form?

To fill out a checking reconcilement form, start by listing the ending balance from your bank statement, then adjust this figure by adding any deposits that have not yet cleared and subtracting outstanding checks to reconcile with your checkbook balance.

What is the purpose of checking reconcilement form?

The purpose of the checking reconcilement form is to verify that the records of transactions in a checking account match those recorded by the bank, helping to identify discrepancies and prevent errors or fraud.

What information must be reported on checking reconcilement form?

The checking reconcilement form must report the bank statement balance, any outstanding checks, deposits in transit, and the adjusted balance to determine if it matches the checkbook balance.

Fill out your checking reconcilement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Checking Reconcilement Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.