Get the free NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX

Show details

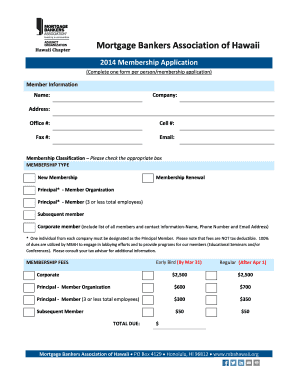

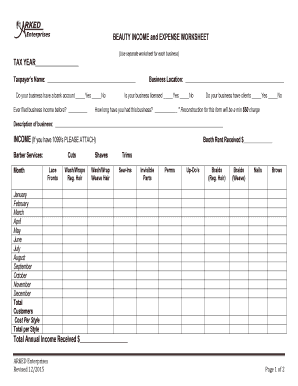

This document serves as a return form for the Nonproperty Sales Tax, detailing various sales categories and their respective tax rates, along with taxpayer information and declaration.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonproperty sales tax lot

Edit your nonproperty sales tax lot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonproperty sales tax lot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonproperty sales tax lot online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nonproperty sales tax lot. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonproperty sales tax lot

How to fill out NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX

01

Obtain the NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX form from your local tax office or online.

02

Fill in your business information including name, address, and tax identification number.

03

Indicate the reporting period for which you are filing the tax.

04

Calculate the total sales subject to tax for the reporting period.

05

Apply the appropriate local option tax rate to the total sales to compute the tax due.

06

Complete any additional required sections, such as deductions or exemptions.

07

Review the completed form for accuracy.

08

Submit the form along with any payment to the designated tax authority by the deadline.

Who needs NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX?

01

Businesses operating in jurisdictions that have imposed a local option sales tax.

02

Retailers and service providers that make sales subject to the local option tax.

03

Any individual or business that collects sales tax on behalf of the local government.

Fill

form

: Try Risk Free

People Also Ask about

What is the local option tax in Florida?

Local Option Fuel Taxes A tax of 1 to 5 cents on every net gallon of motor fuel sold within a county. Diesel fuel is not subject to this tax. Funds may also be used to meet the requirements of the capital improvements element of an adopted local government comprehensive plan.

What is the local option sales tax?

A local option sales tax is often used as a means of raising funds for specific local or area projects, such as improving area streets and roads, or refurbishing a community's downtown area. LOSTs are always appended onto a state's base sales tax rate, most commonly at a rate of 1%.

What is the local option tax in Idaho?

What is a Local Option Tax (LOT)? Under Idaho Code, cities can charge a local option tax (LOT) in three separate areas; sales tax on all items subject to Idaho Sales Tax, liquor by the drink and bed tax on hotel, motels and short term occupancy (VRBOs).

What is the meaning of local sales tax?

Key Takeaways. A sales tax is a consumption tax on the sale of goods and services. A sales tax is usually charged as a percentage of the retail cost at the point of purchase. Local and municipal governments may charge their own sales tax, which is added to the state sales tax.

What is the local option tax in South Carolina?

The Local Option Sales Tax (LOST) is authorized under S.C. Code Section 4-10-10. This tax is a general sales and use tax on retail sales that are taxable under the state sales and use tax. This tax is imposed to reduce the property tax burden on persons in the counties where this tax is imposed.

What is Iowa local option sales tax?

Local Option Sales Tax. In addition to the state sales tax, most local jurisdictions impose a local option sales tax. The rate is 1%. Within a county, some cities may have the local option tax and some may not.

What is the difference between local use tax and local sales tax?

Sales tax is collected by the seller at the point of sale and is remitted to the state by the seller. Use tax, on the other hand, is the responsibility of the buyer. It is self-assessed and paid directly to the state by the consumer when sales tax was not collected at the time of purchase.

What is an example of a local tax?

Local taxes come in many forms, from property taxes and payroll taxes to sales taxes and licensing fees. They vary widely from one jurisdiction to the next. Taxes levied by cities and towns are also referred to as municipal taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX?

NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX is a tax levied by local governments on specific sales transactions, excluding property. It is typically implemented to generate revenue for local projects and services.

Who is required to file NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX?

Businesses and vendors that make taxable sales within the jurisdiction that imposes the NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX are required to file this tax.

How to fill out NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX?

To fill out the NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX, one must complete the designated tax form, providing information such as total sales, taxable sales, exemptions, and the amount of tax collected.

What is the purpose of NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX?

The purpose of NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX is to raise funds for local government projects, services, and infrastructure improvements that benefit the community.

What information must be reported on NONPROPERTY SALES TAX (LOT) LOCAL OPTION TAX?

Information that must be reported includes the total sales amount, the amount subject to the tax, deductions for any exempt sales, and the total tax collected during the reporting period.

Fill out your nonproperty sales tax lot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonproperty Sales Tax Lot is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.