Get the free Disaster Loan Fact Sheet - sba

Show details

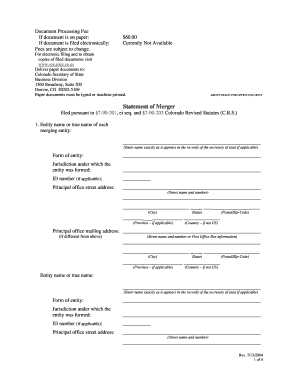

Date 07/08/2011 U* S* SMALL BUSINESS ADMINISTRATION FACT SHEET - DISASTER LOANS ARKANSAS Declaration 12678 / 12679 Disaster AR-00050 Incident Severe Storms Tornadoes Flooding occurring May 24 through May 26 2011 in the Arkansas counties of Franklin Johnson and for economic injury only in the contiguous Arkansas counties of Crawford Logan Madison Newton Pope Sebastian Application Filing Deadlines Physical Damage September 6 2011 Economic Injury April 9 2012 Whether you rent or own your own...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign disaster loan fact sheet

Edit your disaster loan fact sheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disaster loan fact sheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing disaster loan fact sheet online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit disaster loan fact sheet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out disaster loan fact sheet

How to fill out Disaster Loan Fact Sheet

01

Start by visiting the official Small Business Administration (SBA) website.

02

Locate the section related to Disaster Loans.

03

Download the Disaster Loan Fact Sheet document.

04

Read through the instructions provided on the Fact Sheet carefully.

05

Fill in your personal information, including your name, address, and contact details.

06

Provide information about your business, such as its name, type, and location.

07

Describe the nature of the disaster and how it has impacted your business.

08

Include financial information, like your business income and expenses.

09

Review your completed Fact Sheet for accuracy.

10

Submit the Fact Sheet as instructed by the SBA.

Who needs Disaster Loan Fact Sheet?

01

Businesses affected by natural disasters seeking financial assistance.

02

Individuals or sole proprietors whose operations have been disrupted by disasters.

03

Non-profit organizations that have sustained economic harm due to a disaster.

04

Farmers who have lost resources due to disasters and are looking for recovery options.

Fill

form

: Try Risk Free

People Also Ask about

What credit score is needed for an SBA disaster loan?

Generally, to qualify for any type of SBA loan—disaster loan or otherwise—you'll need to have a credit score between 640 and 670, or higher. This being said, for any of the four loans in the official SBA disaster loan program, it will be up to the SBA to verify your credit and determine your eligibility.

What is the approval rate for the SBA disaster loan?

The loans must help return damaged property to its pre-disaster condition through repairs or replacements. Type and Cost Share: Because this is a loan, there is no cost share. Application: SBA generally makes a decision on each application within seven to 21 days.

What is the interest rate on a FEMA disaster loan?

SBA can offer a loan that fits your personal budget. For applicants unable to obtain credit elsewhere, the interest rates are 2.5 % for home loans, 4.0% for business loans and 2.375% for nonprofit organizations.

Why would I get denied for an SBA disaster loan?

If your credit history is unimpressive, you will not receive a favorable credit rating. It's important to note that you need a credit score of at least 620 when applying for an SBA disaster loan. However, a higher credit score improves your chances of swift approval.

Why would I get denied for an SBA disaster loan?

If your credit history is unimpressive, you will not receive a favorable credit rating. It's important to note that you need a credit score of at least 620 when applying for an SBA disaster loan. However, a higher credit score improves your chances of swift approval.

Is it hard to get approved for an SBA disaster loan?

Qualifying for an SBA loan is generally easier than a traditional bank loan, but that doesn't mean it's a simple process. Applying for these loans takes a lot of effort, including loads of paperwork. Whether you'll qualify will depend on the type of SBA loan you pursue.

What can I spend my SBA disaster loan on?

Loan proceeds may be used for the repair or replacement of the following: Real property. Machinery. Equipment. Fixtures. Inventory. Leasehold improvements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Disaster Loan Fact Sheet?

The Disaster Loan Fact Sheet is a document that provides important information regarding the availability of loans for individuals and businesses affected by disasters. It outlines the terms, conditions, and eligibility requirements for disaster loans.

Who is required to file Disaster Loan Fact Sheet?

Individuals and businesses that are seeking financial assistance through disaster loans are required to file a Disaster Loan Fact Sheet as part of their application process.

How to fill out Disaster Loan Fact Sheet?

To fill out the Disaster Loan Fact Sheet, applicants should provide accurate and complete information regarding their financial status, the extent of disaster damage, and their needs for assistance. Detailed instructions are usually provided with the fact sheet.

What is the purpose of Disaster Loan Fact Sheet?

The purpose of the Disaster Loan Fact Sheet is to collect essential information from applicants to assess their eligibility for loans and to expedite the processing of their loan applications.

What information must be reported on Disaster Loan Fact Sheet?

The information that must be reported on the Disaster Loan Fact Sheet includes personal and business details, the extent of damage caused by the disaster, current financial status, and any other details relevant to the loan application.

Fill out your disaster loan fact sheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Disaster Loan Fact Sheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.