Get the free Eturn form no later than due date lease check each box - reachleadershipacademy

Show details

November 2015 Name: Teacher: Bringing Sack Lunch only (circle) Online (circle) All students (paid/ free×reduced lunch must) submit a meal request for month. M every m Please fill out the form (checks

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eturn form no later

Edit your eturn form no later form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eturn form no later form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing eturn form no later online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit eturn form no later. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out eturn form no later

How to fill out eturn form no later:

01

Gather all the necessary information: Before starting to fill out the eturn form, make sure you have all the required information at hand. This includes your personal details, income details, tax documents, and any other supporting documents that may be needed.

02

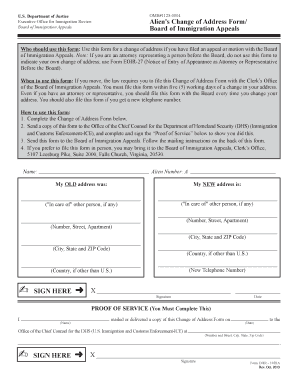

Start with personal information: Begin by filling out the personal information section of the eturn form. This typically includes your name, address, Social Security number, and any other information requested.

03

Report your income: The next step is to report your income accurately. This may include wages, salary, self-employed income, investment income, and any other sources of income. Be sure to provide accurate and complete information to avoid any discrepancies or audits.

04

Deductions and credits: Take the time to review the deductions and credits available and determine if you qualify for any. This could include deductions for medical expenses, student loan interest, and child tax credits, among others. Make sure to properly document and provide any supporting documentation required for these deductions or credits.

05

Double-check for accuracy: Before submitting your eturn form, take a moment to review all the information you have entered. Check for any errors, inconsistencies, or missing information. It's crucial to ensure everything is accurate to avoid any potential penalties or issues with the tax authorities.

Who needs eturn form no later?

01

Individuals with taxable income: The eturn form is typically required for individuals who have taxable income. This includes salaries, wages, investment income, and self-employment income that meets the necessary thresholds set by the tax authorities.

02

Self-employed individuals: If you are self-employed or run your own business, you will likely need to fill out an eturn form. This is necessary to report your business income, deductible expenses, and other related information.

03

Individuals with complex financial situations: Some individuals may have complex financial situations that require them to fill out an eturn form. This could include individuals with multiple sources of income, investment properties, rental income, or significant deductions and credits.

04

Individuals who want to claim deductions and credits: The eturn form allows individuals to claim deductions and credits that may help reduce their tax liability. If you are eligible for any deductions or credits and want to take advantage of them, you will need to fill out the eturn form.

05

Individuals who want to comply with tax regulations: Filing the eturn form is a legal requirement in many jurisdictions. By filling out and submitting the form, individuals ensure they are compliant with tax regulations and avoid potential penalties or legal issues.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify eturn form no later without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your eturn form no later into a dynamic fillable form that you can manage and eSign from anywhere.

How do I make changes in eturn form no later?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your eturn form no later to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my eturn form no later in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your eturn form no later directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

What is eturn form no later?

Eturn form no later is a document used to report financial information to the authorities.

Who is required to file eturn form no later?

Individuals and businesses are required to file eturn form no later if they meet certain financial criteria.

How to fill out eturn form no later?

Eturn form no later can be filled out online or by mail, following the instructions provided by the relevant authorities.

What is the purpose of eturn form no later?

The purpose of eturn form no later is to ensure that individuals and businesses accurately report their financial information.

What information must be reported on eturn form no later?

Eturn form no later requires information such as income, expenses, assets, and liabilities to be reported.

Fill out your eturn form no later online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eturn Form No Later is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.