Get the free COMMERCIAL REAL ESTATE LOAN APPLICATION ADDENDUM

Show details

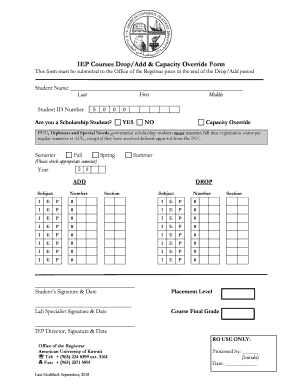

COMMERCIAL REAL ESTATE LOAN APPLICATION ADDENDUM ASSET & LIABILITY INFORMATION Amount Assets LIABILITIES Cash in Banks (list) Amount 1 2 3 Stocks & Bonds 4 Residential Real Estate 5 Real Estate Investments

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign commercial real estate loan

Edit your commercial real estate loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your commercial real estate loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing commercial real estate loan online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit commercial real estate loan. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out commercial real estate loan

How to fill out a commercial real estate loan:

01

Determine your loan needs and goals: Before filling out a commercial real estate loan application, you need to assess your needs and goals. Consider factors such as the amount of financing you require, the purpose of the loan (e.g., purchasing new property or refinancing existing debt), and your desired loan term.

02

Gather necessary documents: To complete a commercial real estate loan application, you'll need various documents, including:

2.1

Financial statements: Prepare detailed financial statements such as income statements, balance sheets, and cash flow statements.

2.2

Business plan: Provide a comprehensive business plan outlining your proposed use of the loan proceeds, market analysis, and financial projections.

2.3

Property information: Gather information about the property, including its address, type of property (e.g., office building, retail space), and current market value.

2.4

Personal financial information: Prepare personal financial statements and information about your assets, liabilities, and credit history.

2.5

Legal and organizational documents: Include documentation on your business's legal structure, such as articles of incorporation or partnership agreements.

03

Research lenders: Identify potential lenders that offer commercial real estate loans. Consider factors such as their interest rates, loan terms, fees, and reputation. It's advisable to compare multiple lenders to find the best fit for your needs.

04

Complete the loan application: Fill out the commercial real estate loan application accurately and thoroughly. Provide all requested information, including personal and business details, loan purpose, desired loan amount, and collateral information.

05

Submit supporting documentation: Attach all the necessary documents requested by the lender to support your loan application. Ensure all documents are complete, organized, and legible.

06

Review loan terms and negotiate if necessary: Once the lender receives your application, they will review it and may provide you with a loan proposal. Carefully review the terms, including interest rates, repayment schedule, and any fees. If you have concerns or want to negotiate certain terms, discuss them with the lender.

07

Await approval and underwriting process: After submitting your application and supporting documents, the lender will assess your creditworthiness, property value, and other factors. This typically involves an underwriting process where the lender verifies information, conducts property appraisals, and evaluates your financial strength.

08

Obtain loan approval and closing: If your application is approved, the lender will provide you with a loan commitment letter detailing the approved loan terms. Review the commitment letter thoroughly and sign it if you agree with the terms. The lender will then arrange for the loan closing, where legal documents are signed, and funds are disbursed.

Who needs commercial real estate loan?

01

Businesses looking to purchase property: Companies that need their own office space, manufacturing facilities, retail locations, or warehouse space often seek commercial real estate loans to finance the purchase.

02

Real estate investors: Investors interested in generating rental income or property appreciation may require commercial real estate loans to acquire income-producing properties such as apartment complexes, shopping centers, or office buildings.

03

Property developers: Developers who want to undertake new construction, renovation, or expansion projects may rely on commercial real estate loans to finance land acquisition, construction costs, or property improvements.

04

Business owners seeking refinancing options: Existing property owners may opt for commercial real estate loans to refinance existing debt, lower interest rates, or access equity for other purposes.

Note: It's essential to consult with financial professionals or lenders specializing in commercial real estate loans to determine if it's the right option for your specific situation. Each borrower's circumstances may vary, and professional advice can help guide you through the process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my commercial real estate loan in Gmail?

commercial real estate loan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Can I create an eSignature for the commercial real estate loan in Gmail?

Create your eSignature using pdfFiller and then eSign your commercial real estate loan immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Can I edit commercial real estate loan on an iOS device?

Create, edit, and share commercial real estate loan from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is commercial real estate loan?

A commercial real estate loan is a financing option for businesses looking to purchase or refinance properties used for business purposes, such as office buildings, retail spaces, or industrial facilities.

Who is required to file commercial real estate loan?

Businesses or individuals seeking financing for commercial properties are required to file a commercial real estate loan application with a lender.

How to fill out commercial real estate loan?

To fill out a commercial real estate loan application, borrowers typically need to provide information about the property, their finances, and business plan.

What is the purpose of commercial real estate loan?

The purpose of a commercial real estate loan is to provide funding for the purchase, refinancing, or development of commercial properties.

What information must be reported on commercial real estate loan?

Information such as property details, borrower's financial history, business plan, and loan terms must be reported on a commercial real estate loan application.

Fill out your commercial real estate loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Commercial Real Estate Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.